Jun 14, 2024

This is an archive of our post on Aave governance forum. Read the full thread here.

Recommendation

LlamaRisk supports the assets and parameters recommended by @ChaosLabs for deploying Aave V3 on zkSync Era: USDC (native), USDT, WETH, and wstETH.

zkSync Era shows promising trends in user adoption and developer activity. However, DEX liquidity remains relatively low and concentrated primarily on SyncSwap. The presence of official and third-party bridges is a positive factor, but the 24-hour withdrawal delay from zkSync to Ethereum mainnet could pose challenges for liquidators in volatile market conditions.

While liquidity for the newly launched native USDC is very early, we believe listing it over the bridged USDC.e token is advantageous. Native USDC avoids the inherent risks associated with bridged assets and will likely see improved liquidity as Circle and its partners continue incentivizing integrations and usage across the zkSync ecosystem.

Liquidity provisions are expected to improve rapidly over the next period, and we are likely to support increased caps and onboarding of additional assets as the ecosystem matures.

About zkSync Era

zkSync Era is a Layer 2 scaling solution for Ethereum that utilizes zk-rollups to batch multiple transactions off-chain and submit a single proof to the Ethereum mainnet.

Launched in April 2024, zkSync Era currently has a Total Value Locked (TVL) of over $750m (≈$130m excluding bridged ETH) as of June 12th, 2024.

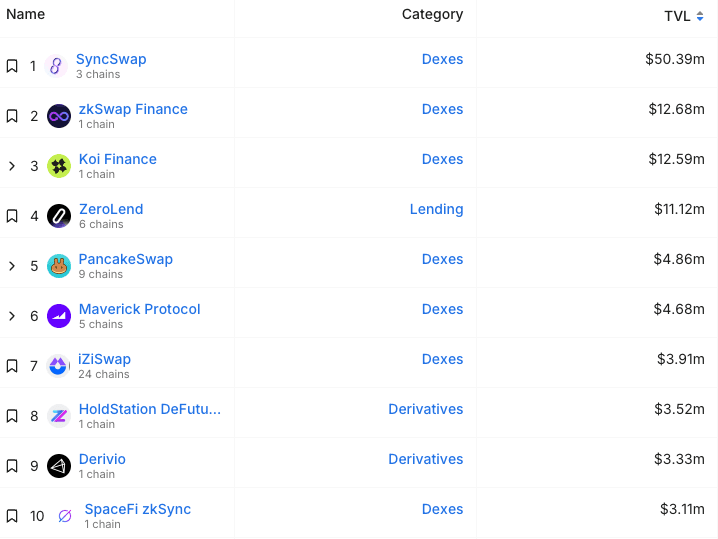

The network hosts a small number of Dapps, including DEXes (SyncSwap, zkSwap, Koi, Maverick, PancakeSwap, and IziSwap) and ZeroLend, an Aave V3 fork.

Source: DefiLlama, June 11th, 2024

Main Tokens

The main tokens on zkSync Era and their supply as of June 12th, 2024 (source: zkSync Era Explorer):

0x3355df6D4c9C3035724Fd0e3914dE96A5a83aaf4 85,921,544 86,179,309 WETH 0x5AEa5775959fBC2557Cc8789bC1bf90A239D9a91 13,166 47,665,197 USDT 0x493257fD37EDB34451f62EDf8D2a0C418852bA4C 14,675,886 14,690,562 WBTC 0xBBeB516fb02a01611cBBE0453Fe3c580D7281011 201 13,979,599 wstETH 0x703b52F2b28fEbcB60E1372858AF5b18849FE867 991 3,587,737 DAI 0x4B9eb6c0b6ea15176BBF62841C6B2A8a398cb656 1,162,825 1,166,313 [1] Native USDC launched on zkSync (April 9th), bridged USDC is USDC.e, which remains the more widely used token.

Oracle Providers

We recommend using Chainlink price feeds for zkSync, namely:

ETH/USD (0.5% deviation threshold, 24h heartbeat)

USDC/USD (0.3% deviation threshold, 24h heartbeat)

USDT/USD (0.3% deviation threshold, 24h heartbeat)

Pyth Network also offers price feeds on zkSync using its “On-Demand Price Update” model. However, the methodology and data provider sources used by Pyth Network are not readily accessible.

Bridging Assets

Asset transfers are achieved through the Official zkSync Bridge and third-party bridging solutions.

Official zkSync Bridge

The Official zkSync Bridge enables asset transfers between Ethereum and zkSync Era. Its key components are:

Bridgehub Contract on L1: Central hub for bridges, locking L1 assets for all ZK chains. Implements registry, ETH deposits/withdrawals, and message routing.

State Transition Contract: Manages proof verification and data availability for ZK chains. Uses StateTransitionRegistry and deploys DiamondProxy with facets for each chain.

Upgrade Mechanism: Ensures all chains are updated to the latest implementation. Non-compliant chains are frozen until updated.

WETH Contract: Deployed from L1 WETH bridge for seamless wrapped ETH transfers.

Source: zkSync documentation

Bridging Process

Deposit (Ethereum to zkSync Era):

Users lock tokens on Ethereum via L1 bridge contract

deposit, specifying destination chain.Bridgehub mints tokens on destination L2.

Withdraw (zkSync Era to Ethereum):

Users burn tokens on source L2 via L2 bridge contract

withdraw.L2 bridge sends withdrawal info to Bridgehub.

After processing (24-hour delay), Bridgehub releases funds on Ethereum.

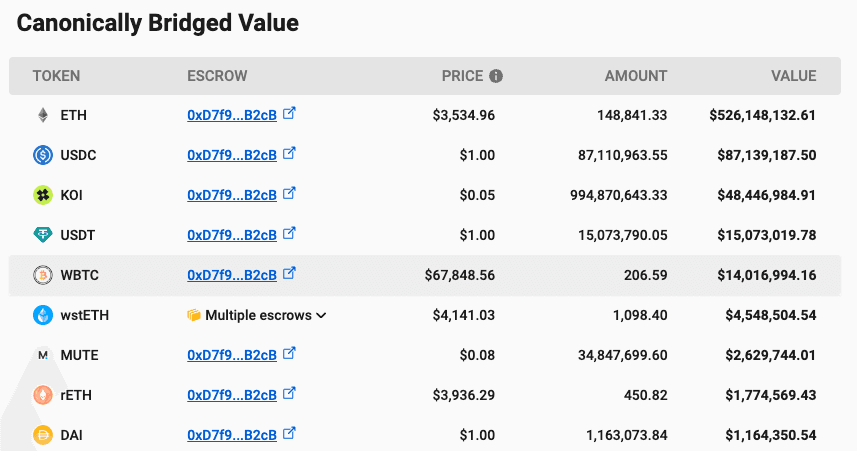

The bridge contract (0xD7f9f54194C633F36CCD5F3da84ad4a1c38cB2cB) was recently migrated and now holds the canonically bridged assets.

Source: L2Beat, June 12th, 2024

Third-party Bridges

Third-party bridges, such as Orbiter Finance, Bungee Exchange, LayerSwap & Symbiosis, expand zkSync interoperability with other L1 and L2 networks.

Liquidity

SyncSwap dominates the DEX liquidity landscape on zkSync Era. Its multiple pool types (Classic, Stable, Aqua) aim to optimize for different trading pairs and use cases. It is also worth noting that Uniswap just launched on zkSync, with other mainnet DEXs likely to follow suit.

Source: DeFillama, June 14th, 2024

Overall liquidity remains relatively low, especially for the newly launched native USDC. DEX liquidity is mainly concentrated around the USDC.e/ETH ($30m), WBTC-ETH ($5.1m), and USDC.e/USDT ($5.7m) pairs as of June 12th, 2024. This does not preclude liquidators from bridging assets off zkSync to complete an arbitrage loop. However, the native bridge process currently takes 24 hours, with faster options using third-party bridges, substantially increasing the risk the liquidator assumes and the complexity involved with managing hedged positions across networks or exchanges.