An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

As GHO continues scaling after successful deployments on L2s, it is rational to expand the GHO availability further. Our analysis indicates that GHO is ready for further cross-chain deployments, and Sonic is considered a suitable candidate.

We support the proposed GHO risk parameters, including CCIP and GhoDirectMinter configurations. Launching stataUSDC.e GSM is also a welcomed and rational decision to help GHO sustain stability. It is notable that GSMs will now provide an alternative way for users to enter Aave’s GHO ecosystem since GSMs transition to zero fee setup and are prepared to support the sGHO roll-out.

#Current GHO Scale

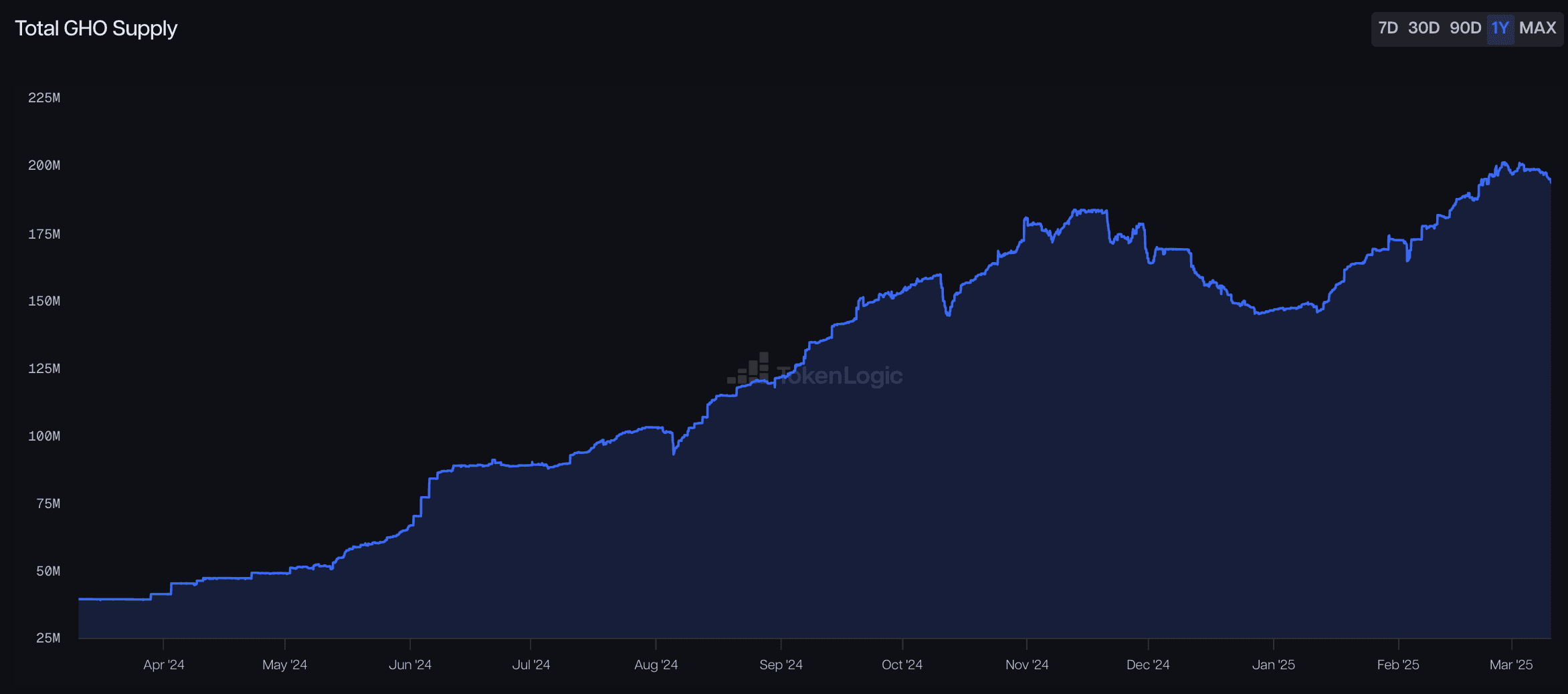

Arbitrum and Base were selected as the first blockchains for GHO expansion beyond Ethereum, with GHO already operational on these networks. The stablecoin’s total supply is now fluctuating around 200M after a period of a temporary supply slump back in January 2025. Shortly after sGHO is adopted, an additional boost in growth is anticipated.

Source: TokenLogic GHO Analytics, March 10th, 2025

#Liquidity

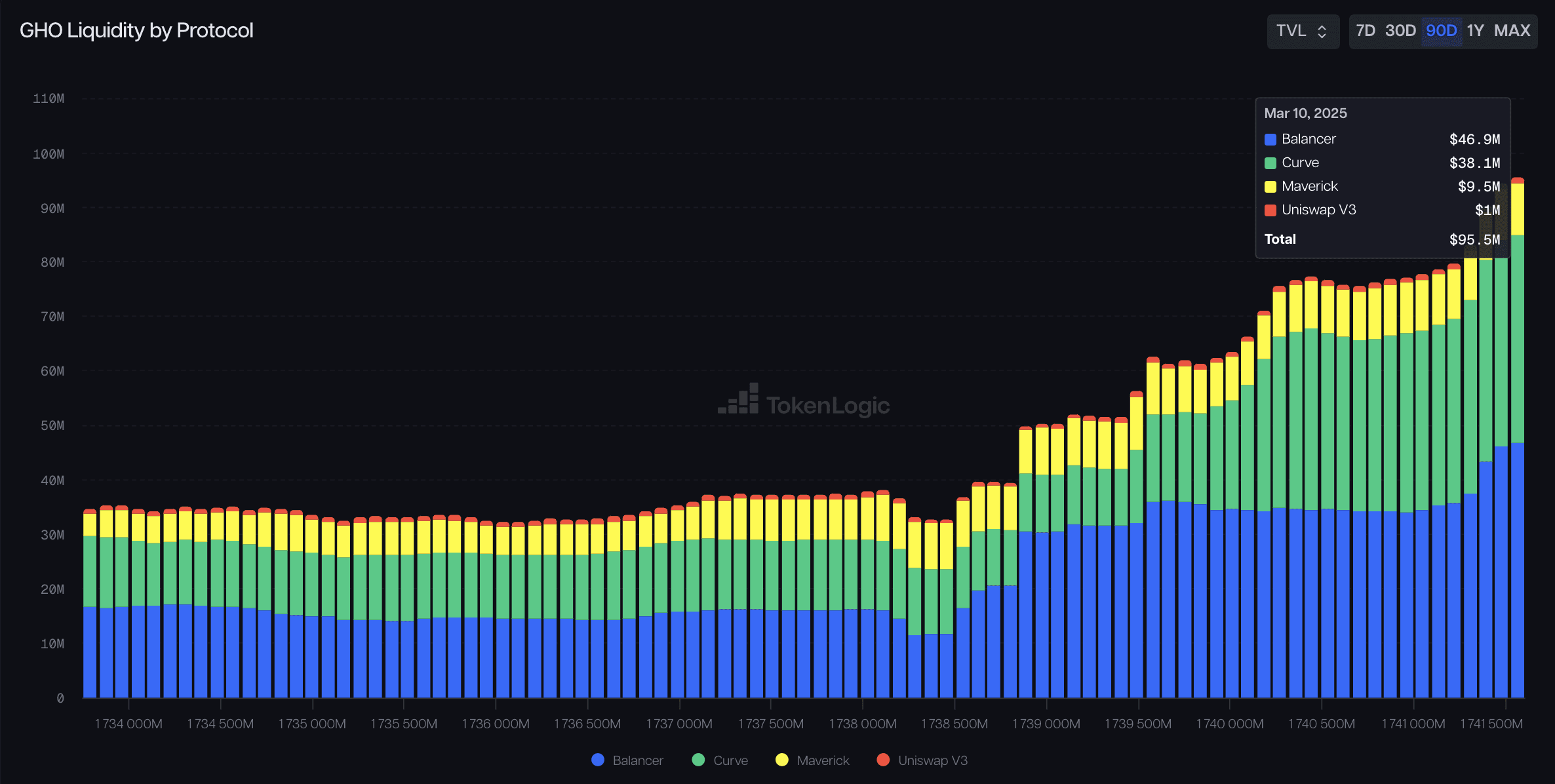

Over the past 90 days, GHO’s liquidity has grown significantly. Currently, the total liquidity TVL stands at $95.5M with 44.6M GHO available in the liquidity pools paired with other stablecoins, mainly USDC, USDT, and USR. The largest pools are deployed on Balancer and Curve.

Source: TokenLogic GHO Analytics, March 10th, 2025

Improved liquidity levels have resulted in 18M GHO being available to be sold within a 1% price impact on Ethereum Mainnet. This is a significant improvement over the last 90 days and indicates a large stability buffer regenerated after the temporary secondary market de-peg that happened in November 2024.

#Borrowing Trends

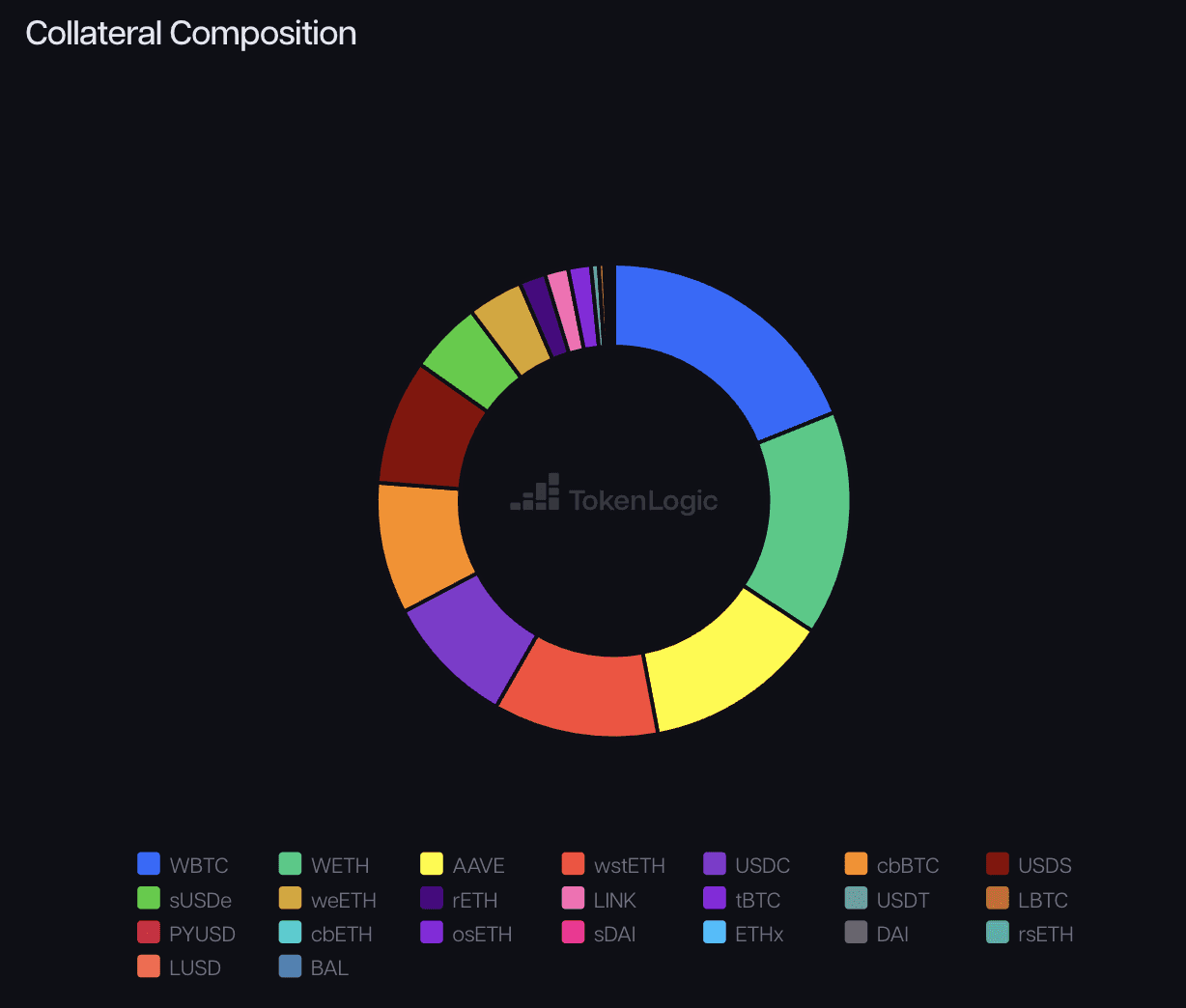

GHO borrowing remains healthy, with a current collateral ratio of 2.08 in the face of stressful broader market conditions. The main collateral type for GHO borrows is now WBTC (18.9%), with the WETH proportion (15.3%) falling slightly lower.

Source: TokenLogic GHO Analytics, March 10th, 2025

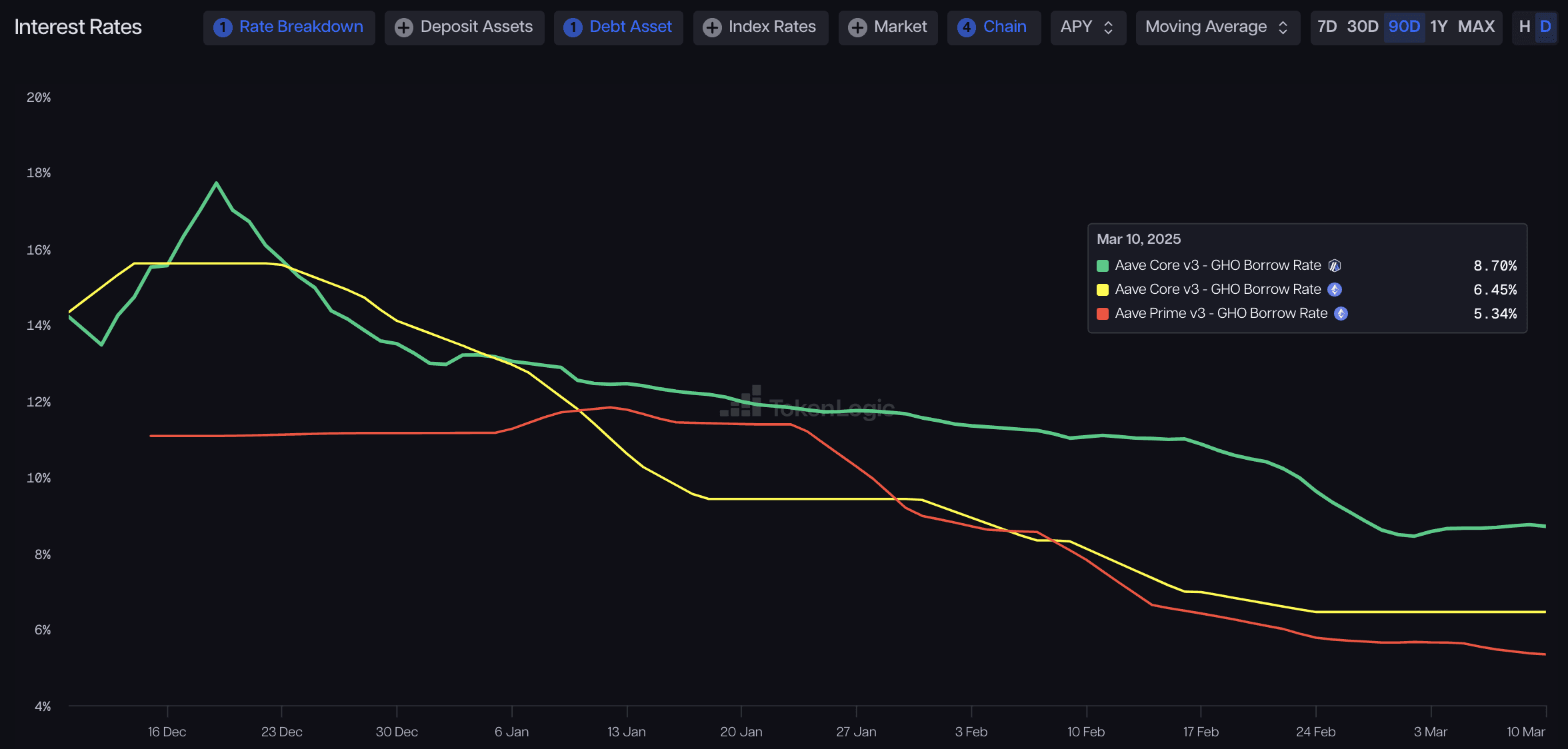

GHO’s borrow rate on Aave Core has now been lowered to 4.5-6.45%, which aligns with the current borrow rates of other stablecoins on Aave’s markets. Similar GHO borrow rates are also observed on Aave’s Prime and Base markets. Nonetheless, Arbitrum GHO’s borrow rate has remained elevated, currently at 8.7%.

Source: TokenLogic GHO Analytics, March 10th, 2025

#Network-Specific Considerations

Sonic is experiencing rapid DeFi sector growth, driven by the anticipation of an upcoming airdrop. Users earn points while protocols accumulate gems based on activity. The current chain TVL is at $690m, with Aave being one of the largest protocols shortly after its Sonic chain debut. This rapidly growing market can be considered for GHO introduction. Deploying GHO would also enable potential GHO integrations into Sonic’s yield venues.

#Liquidity Venues

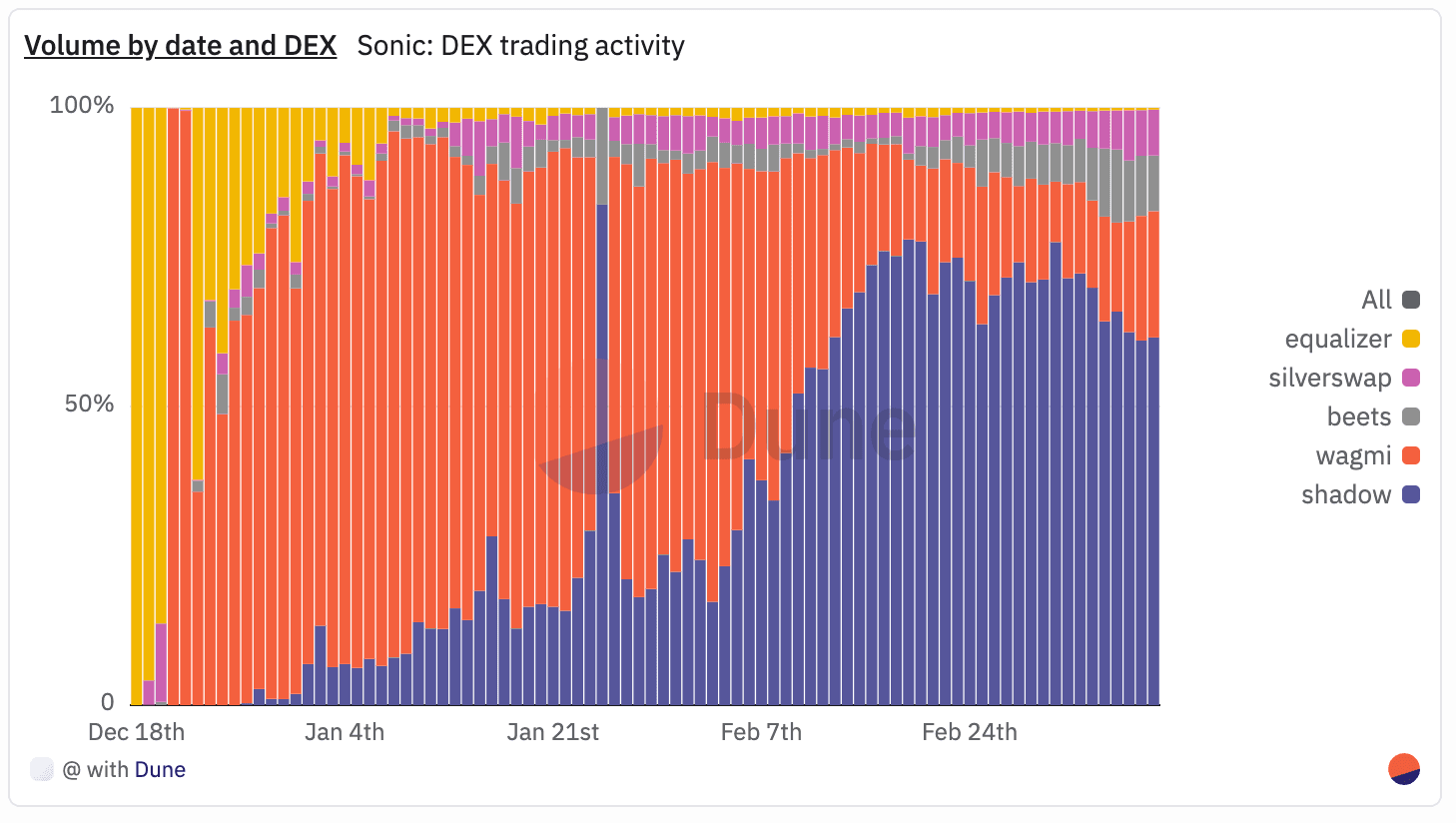

Currently, Beets protocol is the largest DEX on the Sonic chain with a TVL of ~$82m. Other DEXs, such as Shadow, Wagmi, Silverswap, and Equalizer, are also available. The high DEX availability is also motivated by the point program incentives. Particularly, this results in large volumes generated by Shadow concentrated liquidity pools.

Source: Dune Analytics, March 10th, 2025

A key part of early GHO growth on Sonic will be securing initial liquidity that would later become a supportive factor for further GHO supply and borrow cap increases.

#Stablecoin Yield Venues

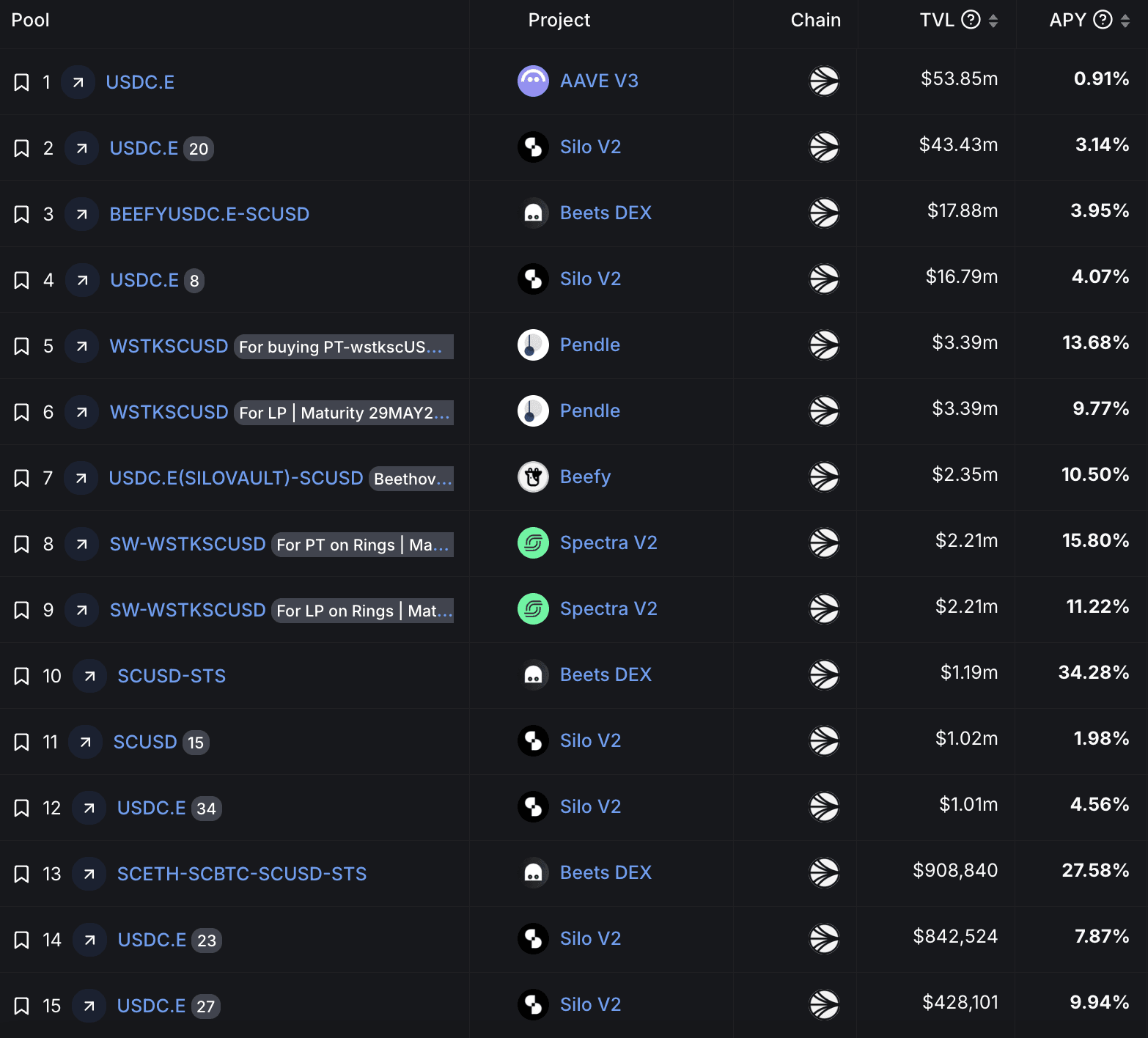

There is a vast availability for stablecoin yield opportunities on the Sonic chain, accounting for more than $98M of TVL (excluding Aave) in venues such as Silo V2, Beets, Pendle, Spectra V2, and Beefy. GHO deployment on this chain could also enable new GHO yield opportunities in some of these venues, consequently increasing utility for GHO borrowing on Aave’s Sonic market.

Source: DefiLlama, March 10th, 2025

#Aave’s Market

Since Aave’s deployment on Sonic, the market has grown rapidly to $130.7M, with only 3 initial assets: USDC.e, S, and WETH. The further growth potential is yet to be explored as Risk Stewards continue to increase the supply caps. Introducing GHO to this market would diversify the market’s asset distribution and enable the potential for GHO to become one of the main stablecoins early on.

#Facilitators

Unlike Mainnet, GHO would not be minted on-demand in the Aave Sonic market; it must be directly supplied to the lending pool. GHO is first minted on Mainnet and then bridged to Sonic using the CCIP Bridge Facilitator. The initial configuration for the Sonic GhoDirectMinter facilitator will have a mint cap of 10M GHO.

#Price Feed

GHO oracles on all markets use a fixed 1:1 price ratio, and Sonic will follow this standard.

#stataGSM

Deploying GSM modules and new chain deployments is a robust and welcomed stability measure. stataUSDC.e choice is motivated by the vast availability of USDC.e reserves on Aave’s Sonic market. 80M USDC.e has been supplied to this market, with the total USDC.e supply on Sonic reaching 204M. Therefore, an initial limit of 5M USDC.e in the GSM is rational, with maximal potential supply yield dilution being insignificant. However, if the USDC.e availability on Aave’s Sonic market diminishes, downward adjustments to stataGSM’s exposure cap would be advised.

#Recommended Parameters

The full parameter specification has already been provided by @ACI. LlamaRisk is in full accordance with these parameters and will continue monitoring the Sonic market after the deployment of GHO.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] Launch GHO on Sonic & set ACI as Emissions Manager for Rewards](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/4ee4d134-73c1-4d80-9a63-c717c399a53b.png)