An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

LlamaRisk supports this change in LT & LTV for the emode rsETH/wstETH market on Prime and Core instances. The proposed adjustment increases maximum leverage from 13.33x to 14.29x, providing a more competitive setup than other venues.

On Aave, rsETH is priced using Kelp’s internal exchange rate, Chainlink’s ETH/USD market feed, and a CAPO adapter that protects against rate inflation. This design favors the internal rate over the market rate to avoid liquidation cascades during temporary secondary market depegs. The underlying assets of rsETH are stETH, ETHx, and ETH. Notably, Kelp prices stETH at a 1:1 ratio with ETH.

Our analysis shows that the only significant edge case leading to a price dislocation between rsETH and wstETH would occur if ETHx—comprising roughly 14% of rsETH—experiences extreme depreciation relative to ETH. For instance, our model indicates that a 1% depeg in rsETH would require approximately a 7.14% drop in ETHx, while a meaningful dislocation would necessitate a 35–40% decline. Importantly, any rate depeg scenario would be driven by slashing of ETHx, as slashing of stETH would result in correlated price movements between rsETH and wstETH under emode.

Given the unlikelihood of severe ETHx slashing events—and since heavy liquidations would only occur under such unlikely events—the resulting liquidation volumes are expected to remain well contained within the market liquidity of rsETH/wstETH. Furthermore, the risk from leverage looping is marginal in the worst-case scenario, with the expected increase in exposure remaining below 2.116%.

#Analysis

Analysis timestamp: 1741566100

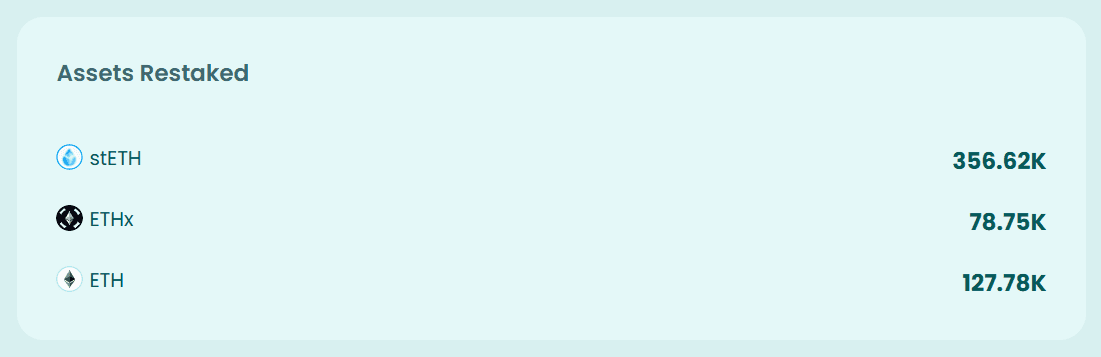

Kelp DAO’s rsETH comprises ETHx, stETH, and native ETH. The composition at the time of analysis is as follows:

Source: Kelp, March 11th, 2025

For the rsETH e-mode category, rsETH is allowed as collateral to back the wstETH borrowings. With more than 60% of stETH, the exchange rate between rsETH/wstETH is inherently strong, which is important for the users under this e-mode category.

#Liquidation Risk Analysis: rsETH/wstETH Market Dynamics

The primary liquidation risk vector exists through potential rsETH depegging from wstETH, which fundamentally requires ETHx depreciation (stETH is hardcoded 1:1 ETH peg via Oracle). Given that ETHx comprises ~14% of rsETH’s composition:

-

1% rsETH depeg ➔ ~7.14% ETHx depreciation required

-

5% rsETH depeg ➔ ~35.7% ETHx depreciation required

These thresholds imply substantial network slashing events would be needed to trigger meaningful depegging - a historically unprecedented scenario in liquid staking markets.

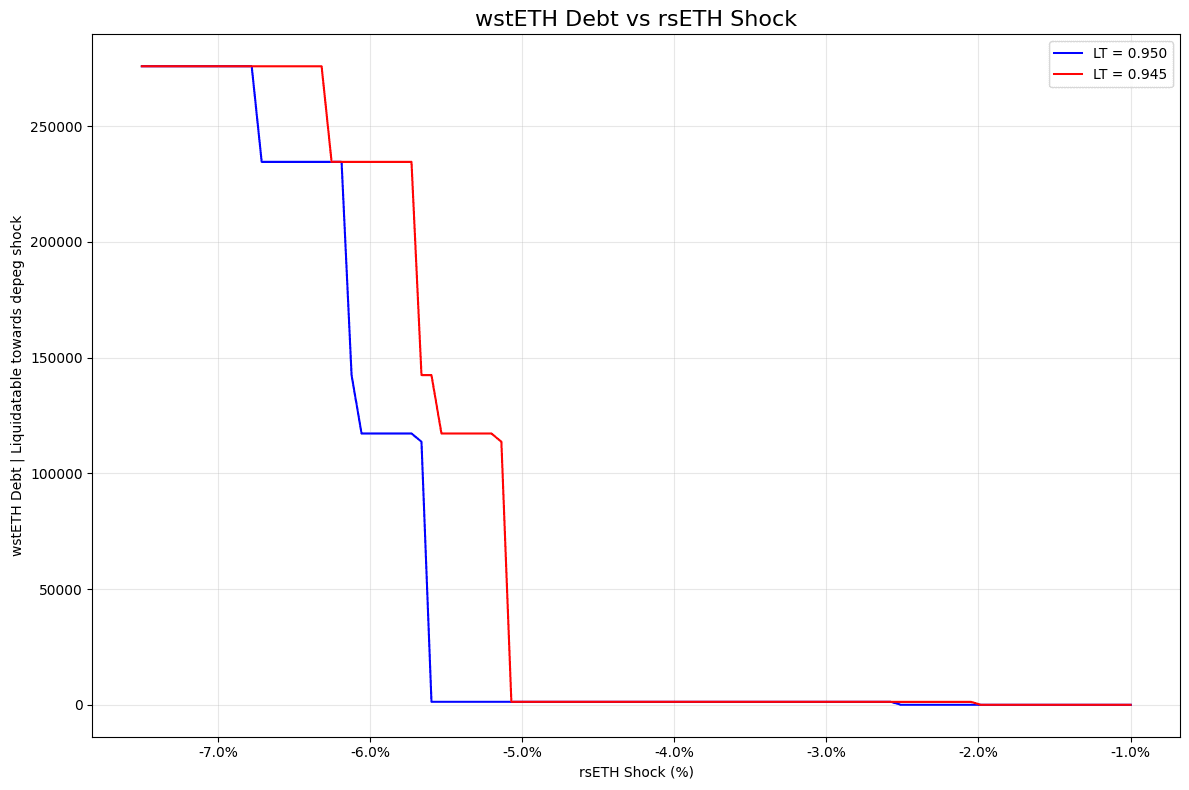

#Price Shock Analysis

Source: LlamaRisk, March 12th, 2025

LT Adjustment Impact (0.945 ➔ 0.95)

-

Requires additional 0.5% rsETH depeg compared to the previous configuration to reach critical collateralization and liquidation levels (~2% and ~5%, respectively)

-

Shifts liquidation threshold from ~36% to 40% ETHx price depreciation

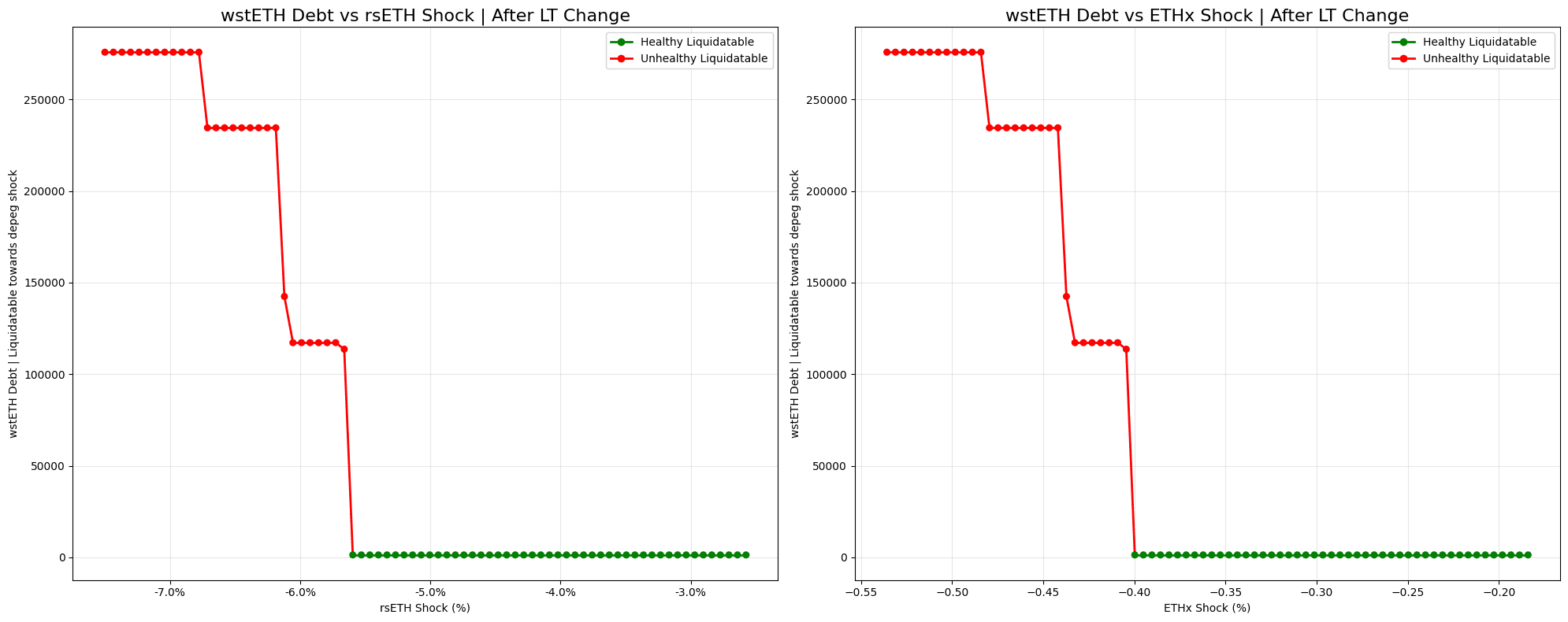

#Simulated Liquidation Process

Arbitrage Workflow:

-

ETH flash loan acquisition

-

ETH ➔ stETH conversion

-

stETH ➔ wstETH wrapping

-

Debt repayment

-

Collateral seizure (rsETH)

-

rsETH ➔ ETH swap (critical path)

-

Flash loan repayment

-

Profitability verification

Key Bottleneck:

Step 6 (rsETH liquidity) constrains maximum profitable liquidation amounts due to:

-

Rising slippage with larger positions

-

Pool depth limitations

#Liquidation Capacity Limits

Source: LlamaRisk, March 12th, 2025

Practical Boundaries:

| Metric | Threshold |

|---|---|

| wstETH Debt | 1,350-1,400 |

| rsETH Collateral | 1,730-1,800 |

| Slippage Tolerance | ≤5% |

Beyond these limits, price impact erodes liquidation profitability.

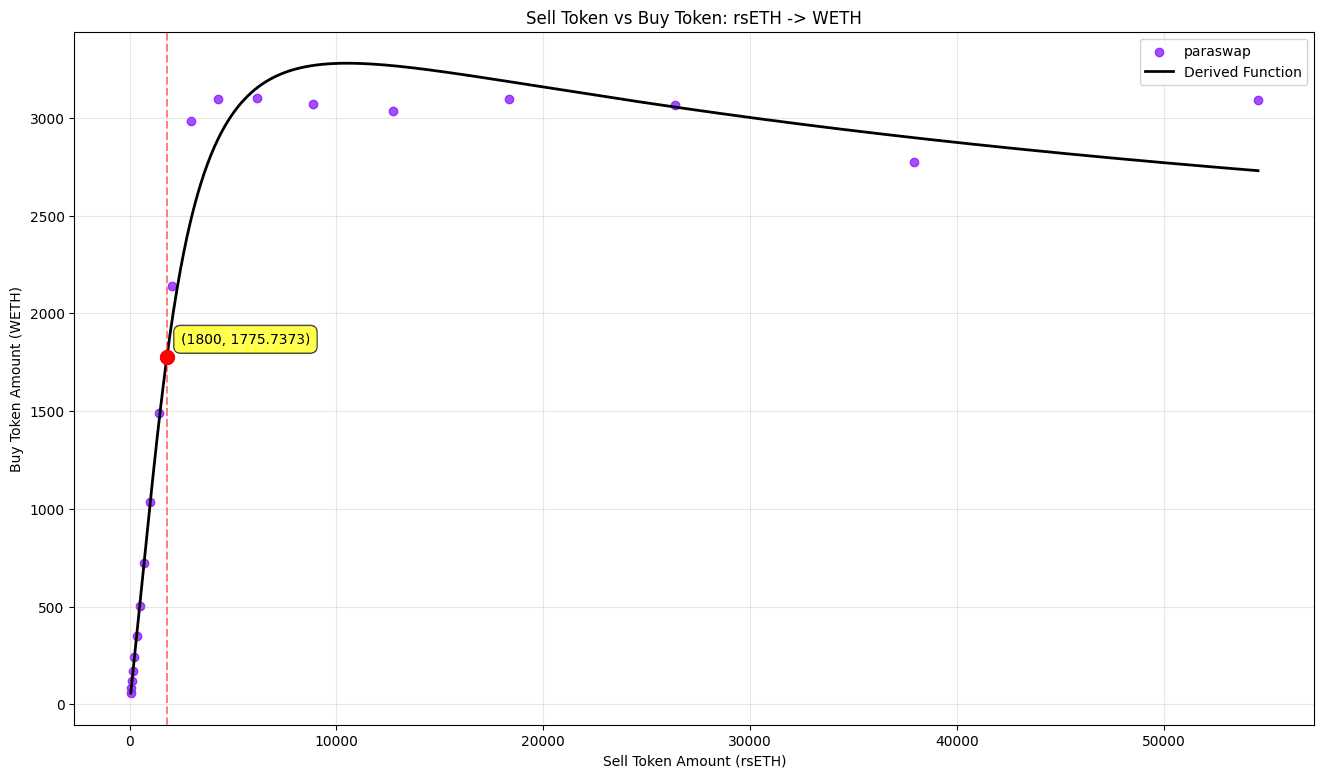

#Quantitative Validation

Source: LlamaRisk, March 12th, 2025

Sample Swap Impact:

-

Input: 1,800 rsETH ($3,870,000 @ $2,150)

-

Output: ~1,775 ETH ($3,672,750 @ $2,070)

-

Price Impact: 5.058%

#Key Findings

Critical liquidations require extreme ETHx depreciation (35-40%), which is unlikely outside catastrophic network failure. The proposed changes introduce modest improvements that do not pose a huge risk surface. Market liquidity inherently constrains maximum liquidation sizes through swap economics and is a bottleneck for high liquidation volumes.

#Leverage Loop Risk Analysis: rsETH Collateralization Impact

We analyze the systemic risk of maximum leverage utilization under different Loan-to-Value (LTV) ratios, considering a supply cap of 400,000 rsETH ($860M at $2,150/rsETH). The strategy involves:

-

Using rsETH as collateral to borrow wstETH

-

Converting borrowed wstETH back to rsETH

-

Repeating this process until reaching supply cap limits

1. Base Case Calculation (Original LTV)

Objective: Determine initial collateral required to reach the supply cap through 10x leverage loops

Solving for initial collateral:

2. Proposed LTV Impact Analysis

Using same initial collateral ($119,135,574) with new LTV:

Result:

-

Potential exposure increases to ~$878,200,000

-

Demonstrates protocol’s increased vulnerability surface

3. Risk Exposure Delta

#Key Findings

The proposed LTV configuration introduces a 2.12% increase in maximum potential exposure under stressed conditions.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] rsETH LTV & LT Update](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/08faad39-82e8-442d-adb2-8b790ef00dc3.png)