An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

LlamaRisk supports onboarding sUSDS to Aave V3 Base Instance. The unstaked version of the asset has demonstrated good product-market fit on mainnet, meaning the arrival it has staked counterpart on Base is a natural extension—both this proposal’s recommended E-modes and the asset itself present limited incremental risk to the protocol. We align with @ChaosLabs’ proposed parameters and E-modes.

The unstaked version asset has been reviewed by LlamaRisk previously, who found key risks to include an upcoming freeze function, jurisdictional exclusions and counterparty risk stemming from governance processes. This was brought to light in late February, to which Risk Stewards responded. In the interest of clarity, LlamaRisk has focused on Base-specific considerations while explaining this recommendation. Given that this asset may be unstaked at a fixed ratio instantly into USDS or USDC, they are essentially analogous (unlike, say, sUSDe, which has a 7-day unstake period).

Thanks to careful cross-chain dependency implementation, Base’s sUSDS market risk is low, and incremental dependency risk is limited.

#Base Asset Risk

sUSDS on Base presents few incremental risks to Aave.

sUSDS is accessed on Base after the Spark Peg Stability Module was deployed on the network. sUSDS may be converted to USDC/USDS as priced by a fixed-rate, crosschain Savings Rate Oracle. This introduces a Chainlink-based dependency. This oracle may also use a chain’s canonical bridge, reducing additional dependency risk.

Something traders looking to leverage long this asset and short a non-yield-bearing stable will want to pay attention to is how sUSDS APY is modified frequently based on market dynamics. While this may not affect the Aave protocol, it will affect user profitability and should be priced in by users looking to take advantage of this use case.

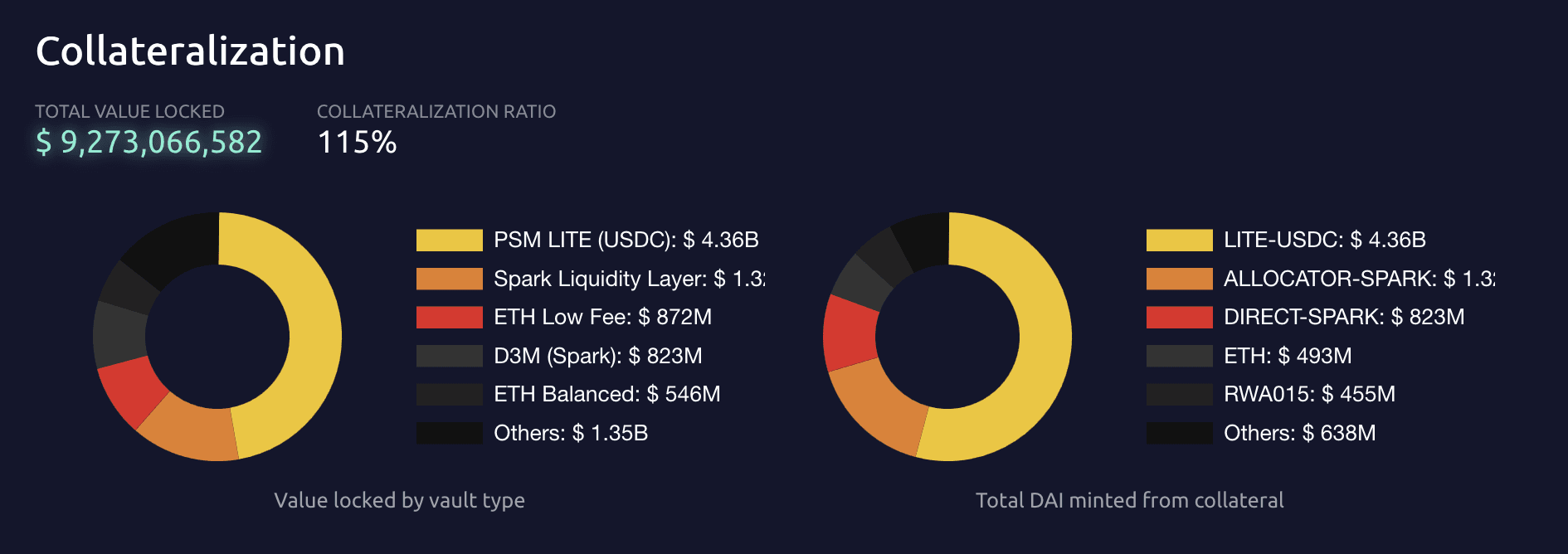

Source: USDS collateral, MakerBurn, April 10th, 2025

While this asset is already onboarded to the mainnet core, it is worth noting that the following (s)USDS’s backing is complex. Users may access backing at MakerBurn, where collateral and debt ceilings are listed. Significant intraday changes are detailed in supply moving from PSM-LITE-USDC (down 225M, 5% 24H) to Spark Liquidity Layer (up 155M, 13% 24H). While transparency on the Spark Liquidity Layer and RWA allocations are detailed in the forum, even sophisticated users may struggle to follow the application of methodology. This presents some degree of risk.

Significant differences in Base versus Mainnet contract are utilized. These newer contracts are heavily audited and have an impressive $10M bug bounty covering them.

#Base Market Risk

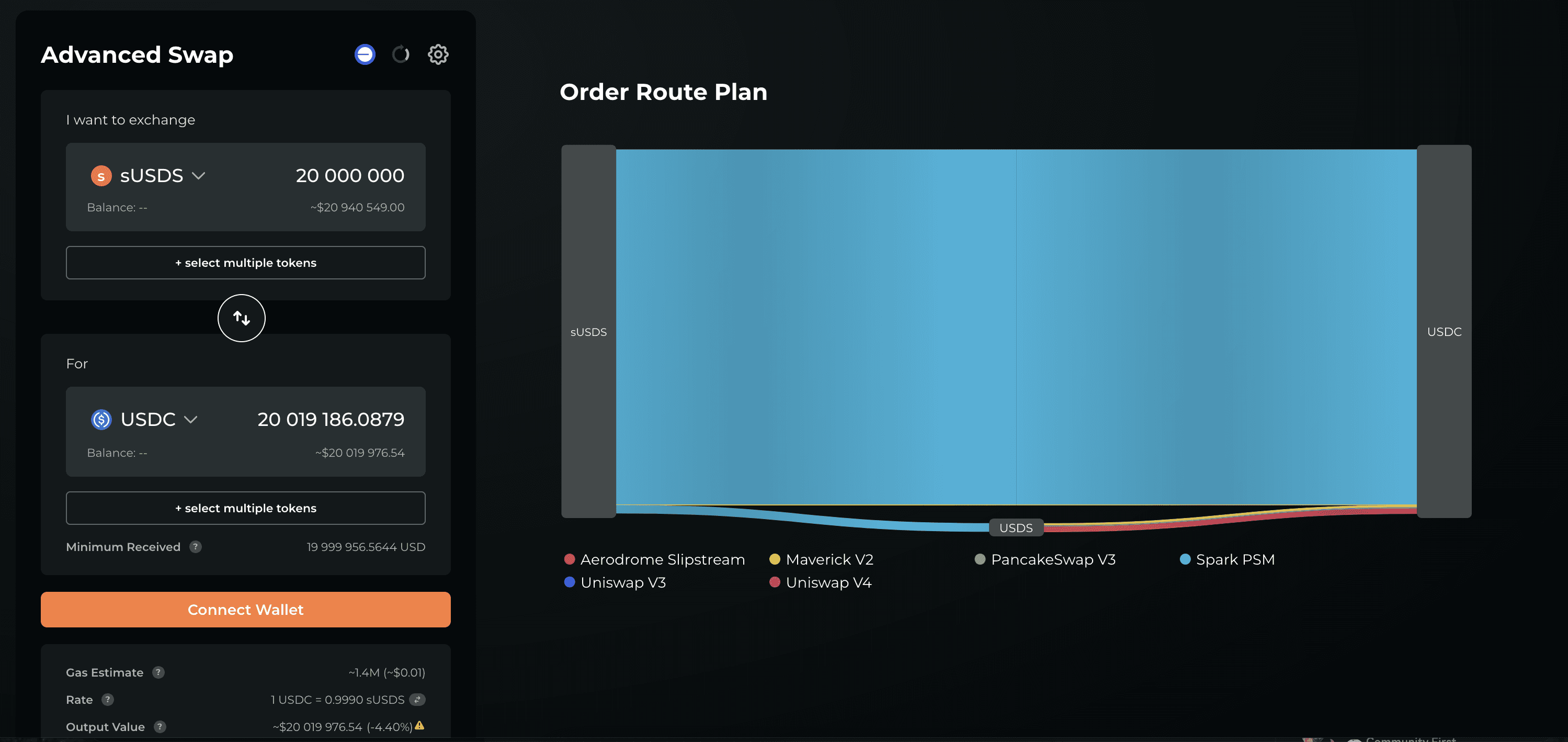

Source: sUSDS to USDC, Odos Router, April 9th, 2025

This asset is liquid, with over a $20M trade resulting in less than 5% price impact. This is mostly routed through Spark’s PSM, which is highly reliable liquidity. This means that exit liquidity risk is low.

The Spark PSM may be refilled at any point from the mainnet PSM should reach a threshold of $15M. An upcoming PSM change will programmatically direct liquidity from other sources across the Sky ecosystem, resulting in even deeper liquidity. This liquidity refill currently operates through CCTP, which takes roughly 20 minutes. This will further reduce liquidity risk.

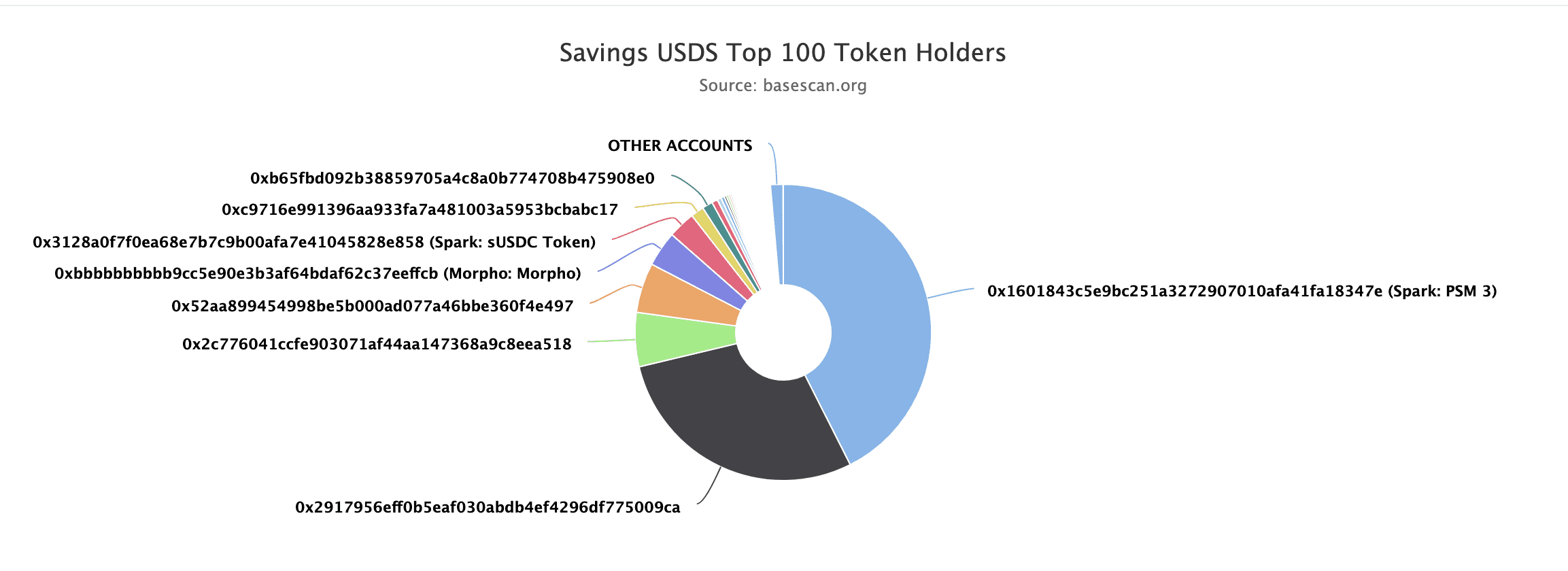

Source: Token Holder Distribution, Basescan, April 9th, 2025

This asset is held more than 75% of this network by 3 addresses. This indicates some concentration risk, which could result in liquidity instability. However, the largest holding address is the Spark PSM, with the second, third, and fourth linked to Fluid, Compound Spark, or Morpho. This means that these addresses are controlled by a far more fragmented set of entities than appears to be the case, reducing risk. The methodology for allocating PSM liquidity is publicly discussed by their risk provider, Block Analitica. This helps monitor liquidity, further reducing risk.

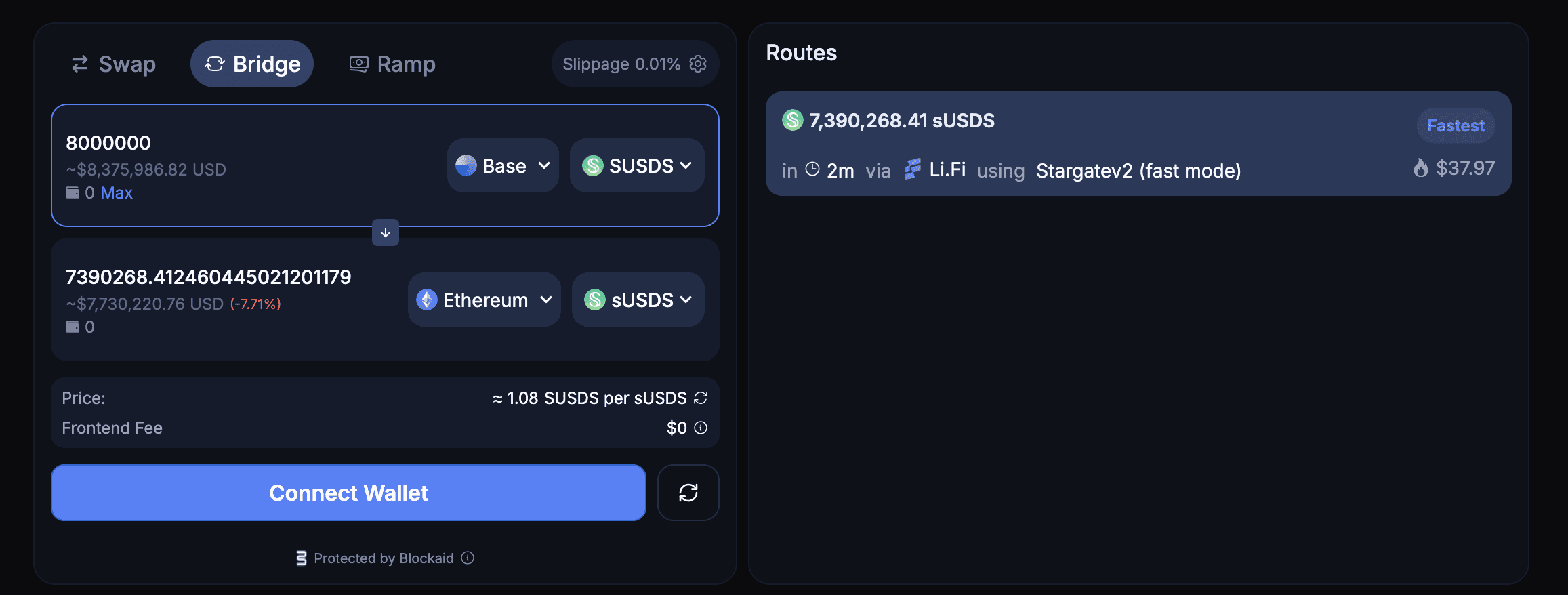

Source: sUSDS bridge liquidity, Oku, April 9th, 2025

Bridge liquidity is limited to just 7.3M sUSDS and concentrated to just one provider. This may result in large users being unable to access (should the PSM be exhausted) additional liquidity outside of Base instantly. Fortunately, up to 15M sUSDS may be bridged in under 5 minutes at 0% lost to add additional liquidity. This will increase arbitrage incentives and help reduce bridge liquidity risk.

#Parameter recommendations

LlamaRisk aligns with @ChaosLabs’ recommendations for onboarding both to the Base instance and specific E-modes. Of note is the lower LTV on the sUSDS-EURC E-mode, which price in potential currency deviation related to global macroeconomic events.

#Price feed Recommendation

LlamaRisk suggests using the Chainlink aggregator feed, which calls this Sky Savings Rate Oracle. This oracle is audited, well documented and used by other large markets. CAPO should also be used to protect against potential rate inflation.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] Onboard sUSDS to Aave V3 Base Instance](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/be19b756-911c-43c2-afc7-aaee7ffc6a3c.png)