An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

LlamaRisk supports Phase 2 of SVR Activation. We support BGD’s recommendation of allowing BTC-correlated assets on the Core instance and ETH-correlated assets on the Prime instance as ideal candidates for the continued rollout of SVR.

Additionally, we propose including USDC as a new SVR asset on Prime. Under normal conditions, most liquidations result from volatile asset price changes. However, a stablecoin price update may occur simultaneously with a volatile asset price update in less frequent instances. In such cases, searchers can participate in both auctions, thereby increasing the number of liquidation paths and potential recapture. We propose testing this scenario in a pilot market over an extended period to understand its likelihood and overall impact better. This change would not add additional constraints to the system and is considered a risk-measured approach.

Based on SVR’s overall performance, it is necessary to fully expand its coverage to harness its potential. Initially, a limited number of searchers acted as a bottleneck, but significant efforts are underway to onboard more searchers. Another important point is the interaction between different assets in a loan. For example, a change in a non-SVR asset’s price can trigger a liquidation of an asset that uses an SVR feed. This highlights the need to scale the SVR deployment before we can truly observe and measure its full impact.

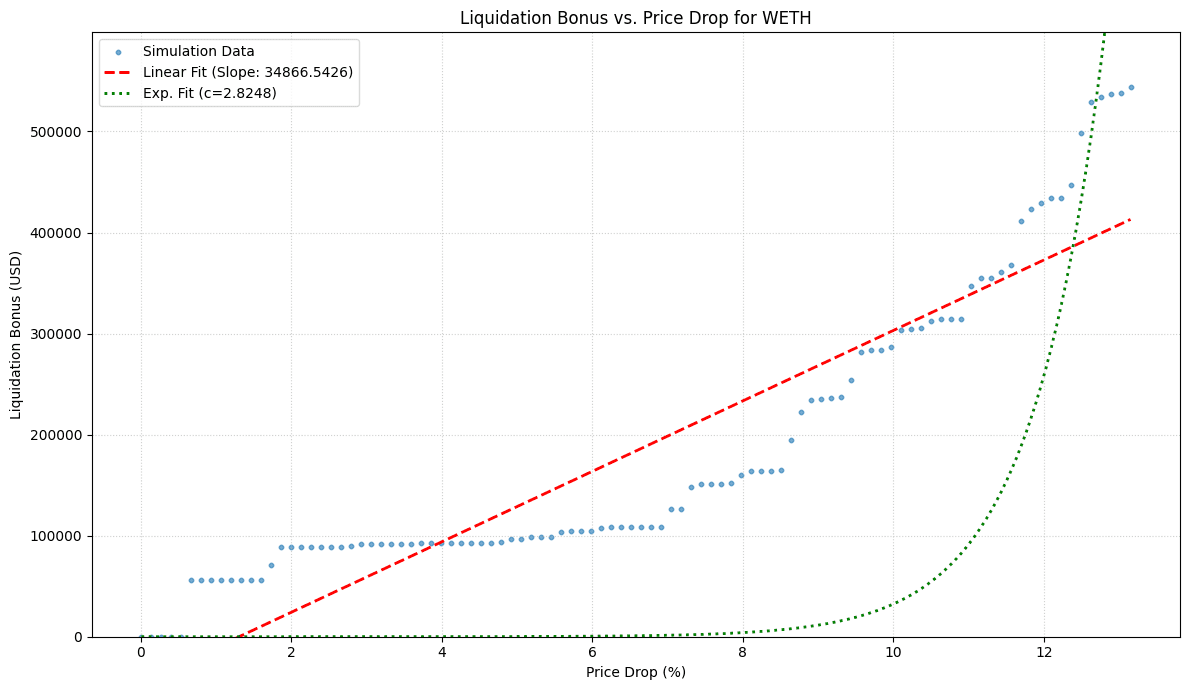

Regarding specific asset insights, our analysis indicates that for WETH, the borrows are primarily LST looping, which results in minimal liquidation risk. On the collateral side, most assets are stablecoins, implying a one-sided liquidation risk if WETH declines in value. For WBTC, a similar risk assessment applies—only a portion of the borrows are in BTC-correlated E-Mode, while a large share of the borrows is collateralized by wstETH and WETH.

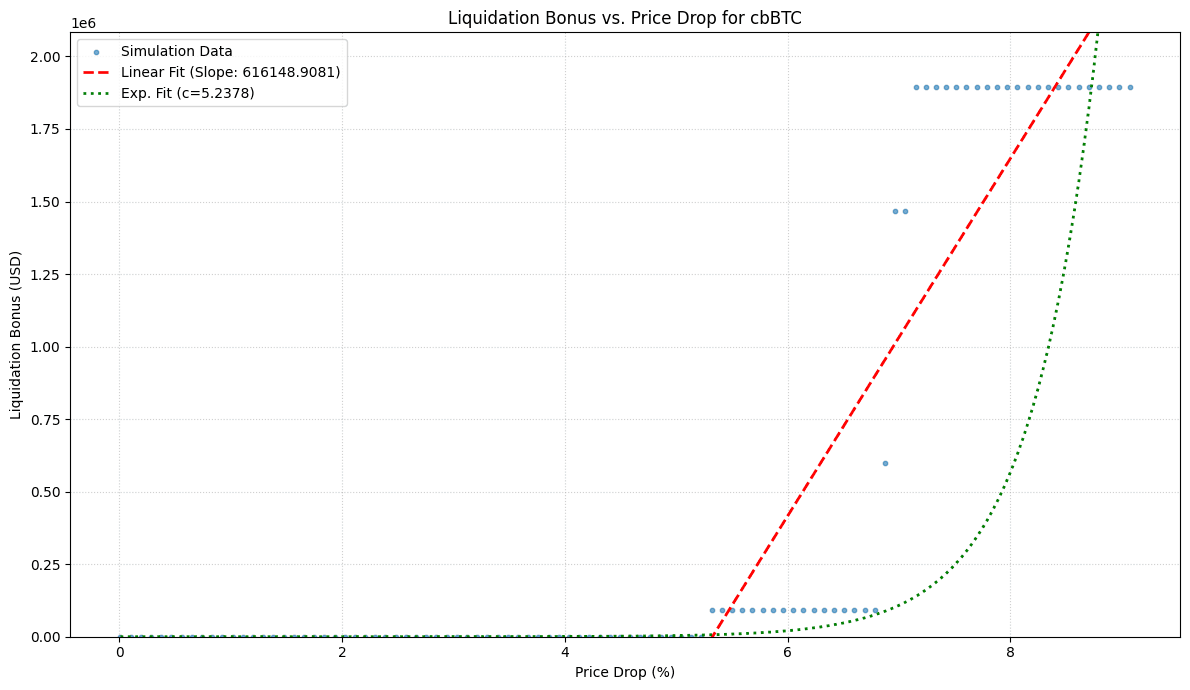

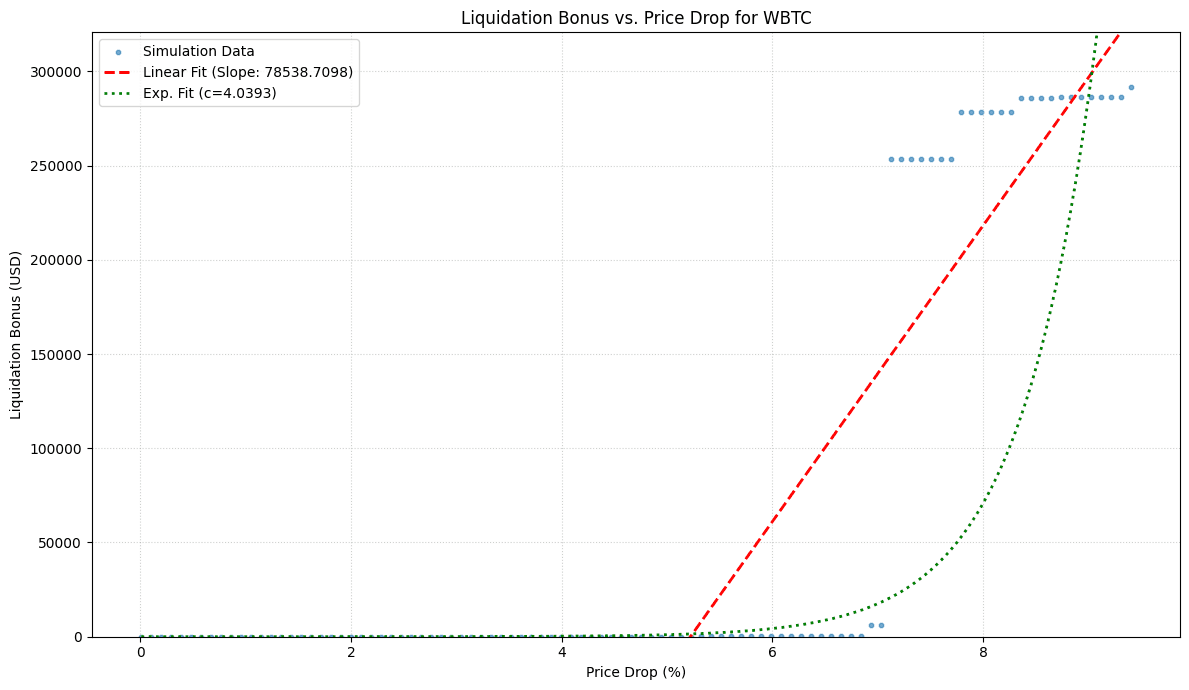

Additionally, we have analyzed Aave V3 assets with the highest Oracle-Extractable-Value (OEV) potential—tokens whose price declines are most likely to generate significant liquidation bonuses using Chainlink’s SVR Oracle. This analysis, which accounts for liquidation sensitivity and historical price volatility, is based on two years of high-frequency Chainlink price data for 38 assets. The detailed findings of our research are provided below.

#Oracle-Extractable-Value (OEV) Potential in Aave V3 Assets

We calculated each asset’s 99% daily Value-at-Risk (VaR99) to determine the worst expected loss under normal market conditions over a single day, with 99% confidence. Building on this, we developed two composite risk scores—lin_res and exp_res—to further assess each asset’s exposure to liquidation events. These scores are derived by simulating progressive downside price shocks and measuring the resulting liquidation values. In simple terms:

-

lin_res captures the liquidity risk using a linear model, estimating how much liquidation value builds up proportionally as the asset price declines.

-

exp_res uses an exponential model, which accounts for scenarios where the liquidation risk increases at an accelerating rate as the asset price falls further.

Both scores integrate the asset’s liquidation sensitivity (i.e., how quickly it triggers liquidations as prices drop) and historical price volatility, helping us prioritize assets likely to generate significant liquidation events in stressful market conditions.****

Key Findings

-

cbBTC dominates with a significantly higher score than any other asset.

-

WBTC ranks second, followed by WETH.

-

Liquid-staking derivatives (weETH and wstETH) occupy the next tier.

-

Mid-cap governance tokens (LINK, AAVE, UNI, LDO) show lower but still notable scores.

Bitcoin and Ethereum-backed collateral represent the richest OEV opportunity, with cbBTC alone accounting for most extractable value under stress scenarios.

We recommend prioritizing assets with high lin_res and exp_res scores for further SVR development, as these assets exhibit both strong liquidation sensitivity (with substantial liquidations triggered per percentage price drop) and high historical volatility. Each asset’s VaR99 values (called shock) provide valuable context for understanding its potential to generate liquidation value.

#Detailed Results

The table below summarizes the computed metrics for assets where the simulation resulted in non-zero liquidatable values, with assets ranked by lin_res (in descending order).

| asset | lin_slope | exp_slope | shock | volatility | lin_res | exp_res |

|---|---|---|---|---|---|---|

| cbBTC | 616,148.91 | 5.24 | 6.05 | 0.027036 | 16,657.9384 | 0.1416 |

| WBTC | 78,538.71 | 4.04 | 6.27 | 0.025373 | 1,992.7982 | 0.1025 |

| WETH | 34,866.54 | 2.82 | 8.77 | 0.032608 | 1,136.9296 | 0.0921 |

| weETH | 21,077.91 | 2.43 | 9.75 | 0.037394 | 788.1815 | 0.0908 |

| wstETH | 18,668.95 | 2.62 | 8.76 | 0.032591 | 608.4372 | 0.0855 |

| LINK | 2,932.60 | 1.78 | 12.14 | 0.046228 | 135.5693 | 0.0823 |

| AAVE | 2,479.86 | 1.82 | 12.39 | 0.049288 | 122.2261 | 0.0897 |

| UNI | 821.14 | 1.56 | 13.39 | 0.050823 | 41.7329 | 0.0792 |

| LDO | 420.56 | 1.34 | 16.23 | 0.059093 | 24.8519 | 0.0793 |

| rETH | 109.65 | 2.06 | 8.75 | 0.032606 | 3.5754 | 0.0673 |

| rsETH | 32.88 | 2.07 | 12.40 | 0.042708 | 1.4042 | 0.0886 |

| 1INCH | 14.06 | 1.29 | 11.90 | 0.046512 | 0.6540 | 0.0600 |

#Recommendation

Assets with high scores on lin_res and exp_res are recommended for further SVR adoption since they demonstrate significant sensitivity (with substantial liquidations triggered per percentage price drop) and high historical volatility. The shock values (VaR99) offer an important context for the sensitivity analysis.

#Examples

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[Direct-to-AIP] Aave <> Chainlink SVR v1 activation. Phase 2](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/9bda6483-0b5b-4a1b-9f18-2226fb877b4d.png)