An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

LlamaRisk concludes that PEPE can be onboarded with conservative parameterization but underscores crucial optics and strategic implications.

Onboarding a memecoin like PEPE establishes a significant precedent, likely encouraging further memecoin onboarding requests. This will inevitably shape Aave’s DeFi industry perception and introduce reputational risk. Aave’s architecture was not initially envisioned for such assets. Even with carefully managed risk parameters, this nuance may be lost on casual observers, potentially diminishing Aave’s perceived creditworthiness. The DAO must factor this reputational cost into its decision-making process. Therefore, to mitigate the reputational impact, we believe that PEPE should not be onboarded to the Aave Core instance or be approved as collateral for GHO minting.

We endorse the “emergence instance” concept proposed by ACI, having independently developed an onboarding/off-boarding framework for this use case. PEPE necessitates a distinct risk premium, which must be actualized through its interest rate model; a separate instance is the most suitable environment to implement this specific requirement. We propose PEPE as the inaugural asset for such an instance. This approach circumvents complexities tied to wGHO and risk tranching proposed for stkGHO. We reiterate our position against using PEPE for GHO minting.

Beyond these strategic points, PEPE’s technical onboarding is manageable. The principal conventional risk is its pronounced volatility, with the asset’s price capable of significant short-term fluctuations. This presents a potential risk to profitable liquidations, necessitating conservative supply and borrow caps, a low debt ceiling, cautious Loan-to-Value ratios (LTVs), and an interest rate model designed for appropriate revenue generation relative to risk.

Fundamentally, PEPE is a relatively uncomplicated asset. It possesses strong liquidity, both on-chain and off-chain and its developers have renounced all ownership. It introduces no new dependencies, and its architecture is simple. This inherent simplicity curtails risk. Given these immutable characteristics, the primary risk exposure for Aave, should it be onboarded, is market volatility.

#1. Asset Fundamental Characteristics

#1.1 Asset

PEPE is a memecoin deployed on Ethereum on April 14, 2023. It is ERC20 compliant and has a total supply of 420,690,000,000,000. It is loosely associated with Pepe the Frog, a cartoon character first drawn in 2005.

As a “memecoin”, this is a novel asset class to bring to Aave. This asset is conceptually straightforward and has no attached revenue source or staking ability. Multiple derivative PEPE tokens exist, but they have yet to see the same level of product-market fit as PEPE itself.

There are a variety of major use cases for onboarding this asset.

A user already holding this asset may wish to increase their exposure and borrow stablecoins against it, which may be swapped for more PEPE and redeposited to Aave. This is a form of leverage trading, a use case for which lending protocols offer a compelling alternative to perpetual exchanges for traders looking to pay less in funding in exchange for more conservative LTVs. Users may also use stablecoins for any other purpose, such as to access value without incurring a taxable event or sale of PEPE.

Alternatively, users may look to short PEPE by borrowing the asset, selling it for an asset they believe will appreciate relative to PEPE then resupplying it to Aave. Users already holding PEPE looking to hedge against price depreciation may short the asset and reduce price delta exposure.

#1.2 Architecture

PEPE’s architecture is straightforward. It is a token that self-describes in the following way:

$PEPE is a meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. The coin is completely useless and for entertainment purposes only.

Source: Pepe Roadmap, Pepe.VIP

To achieve this aim, their team has outlined a roadmap. Its clarity and simplicity are notable in an ever-increasing complexity and integration environment.

This architecture presents a limited risk to Aave.

#1.3 Tokenomics

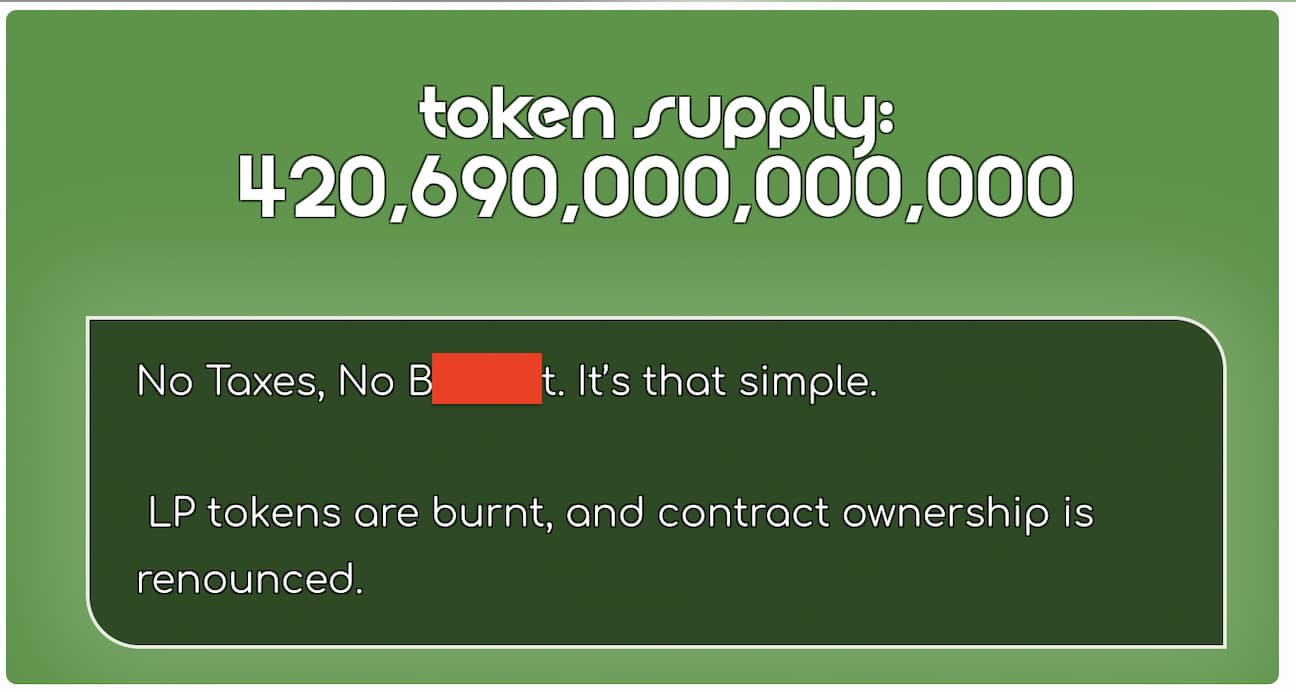

Source: Tokenomics, Pepe.VIP

PEPE’s tokenomics are similarly straightforward, with a 420,690,000,000,000 total supply. The team reported that an amount was locked into initial liquidity pools on launch. The incredibly high number of tokens results in a result confusing for non-sophisticated actors, adding risk. It is likely set that high to take advantage of unit bias, where speculators see a low unit price and decide it is a good investment (irrespective of market capitalization).

For reference, the “No Taxes” comment refers to trading taxes that some memecoins use to burn an amount of the memecoin in the trade. This is designed to increase the token’s price by reducing the overall supply.

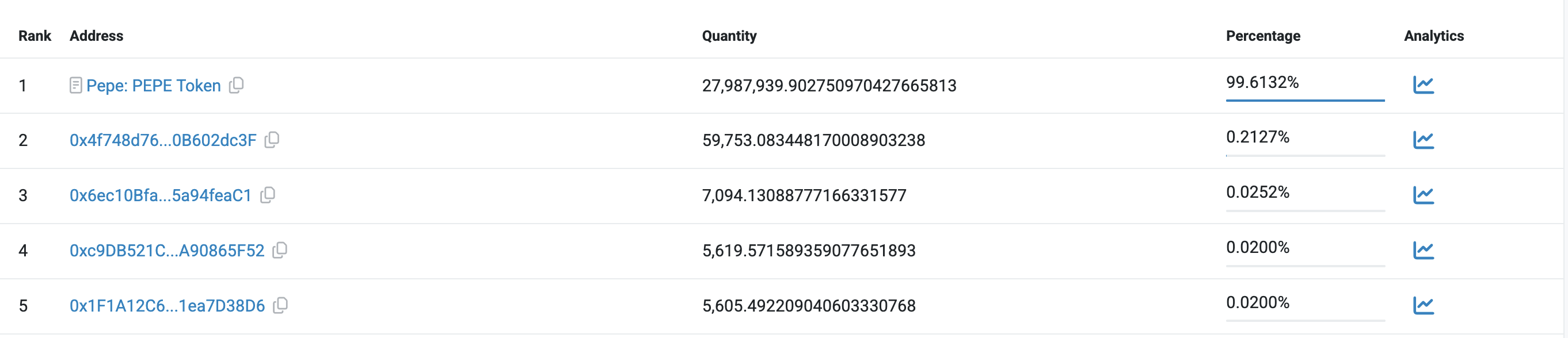

#1.3.1 Token Holder Concentration

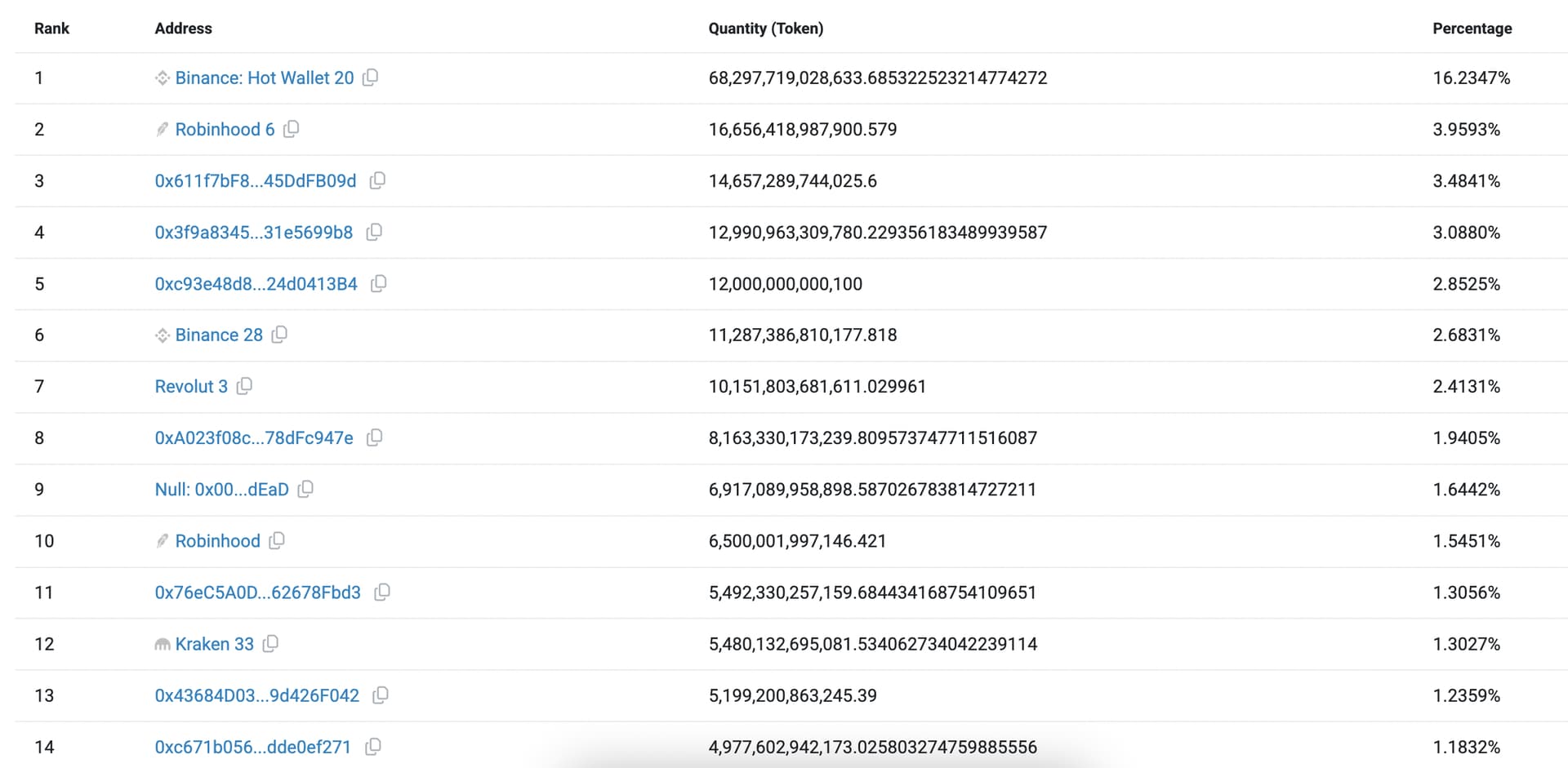

Source: Pepe Token Holder Distribution, Etherscan,, May 14th, 2025

Pepe is well distributed amongst CEXes and other venues. Its distribution is comparable to other leading ETH-centric memecoins.

#2. Market Risk

#2.1 Liquidity

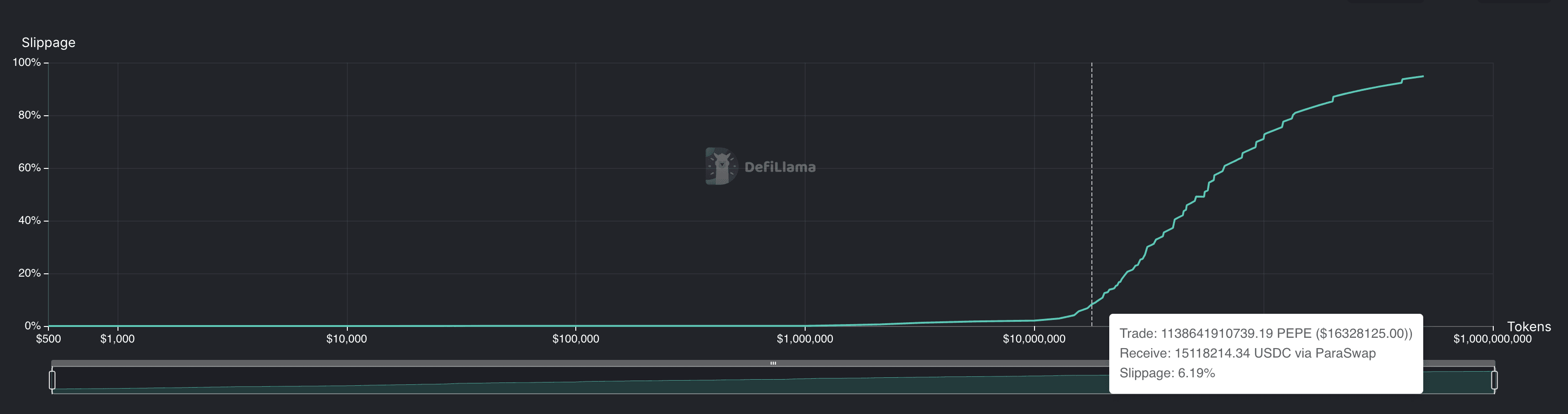

Source: Pepe Liquidity, DeFiLlama Liquidity, May 12, 2025

Pepe is sufficiently liquid on Mainnet, with a $11M trade resulting in ±7.5% price impact.

#2.1.1 Liquidity Venue Concentration

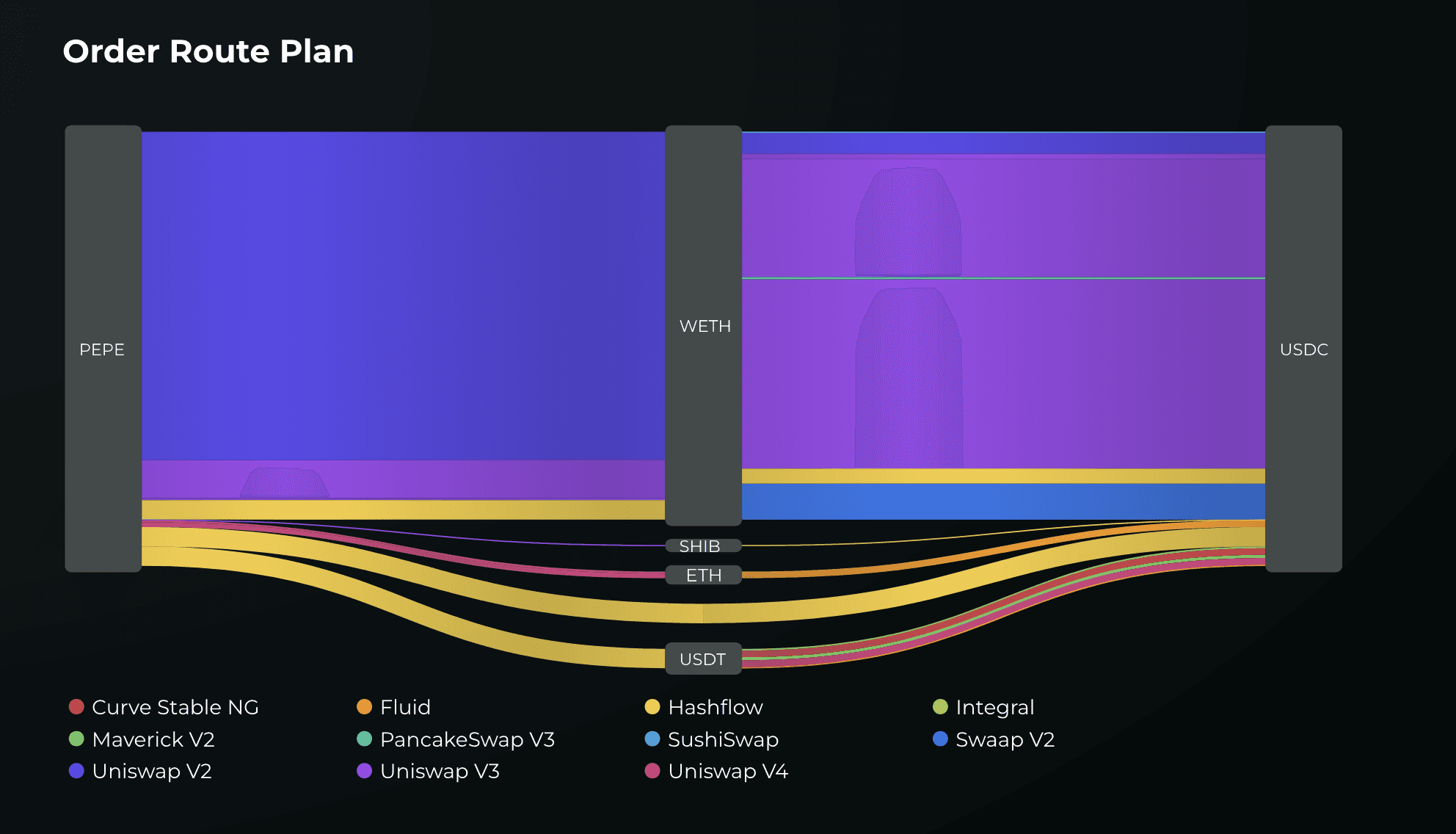

Source: Pepe Liquidity, Odos, May 12, 2025

The vast majority of PEPE liquidity is concentrated into a Uniswap V2 pool(~$52M), which is supported by a Uniswap V3 pool, a Hashflow pool and a selection of others.

#2.1.2 DEX LP Concentration

Source: Top 100 Uniswap V2 Pepe-WETH LP token holders, Etherscan, May 12th, 2025

The PEPE contract address holds nearly 100% of onchain liquidity in this pool. This amount was added at launch and has not been touched since. While nearly all this liquidity being held in one address presents risk, the fact that it is “locked” (see section 4) means that this liquidity cannot be pulled. Given that it is a Uniswap V2 position, this liquidity is full range and indiscriminate (as opposed to the more discriminate V3 positions that may pull liquidity should the price move out of range).

#2.2 Volatility

Source: PEPE/USD, GeckoTerminal, May 14th 2025

PEPE is highly volatile, with its token price doubling (and halving) in under 10 days in May 2024. This level of volatility could present a risk to profitable liquidation should liquidity not be locked in the token contract itself.

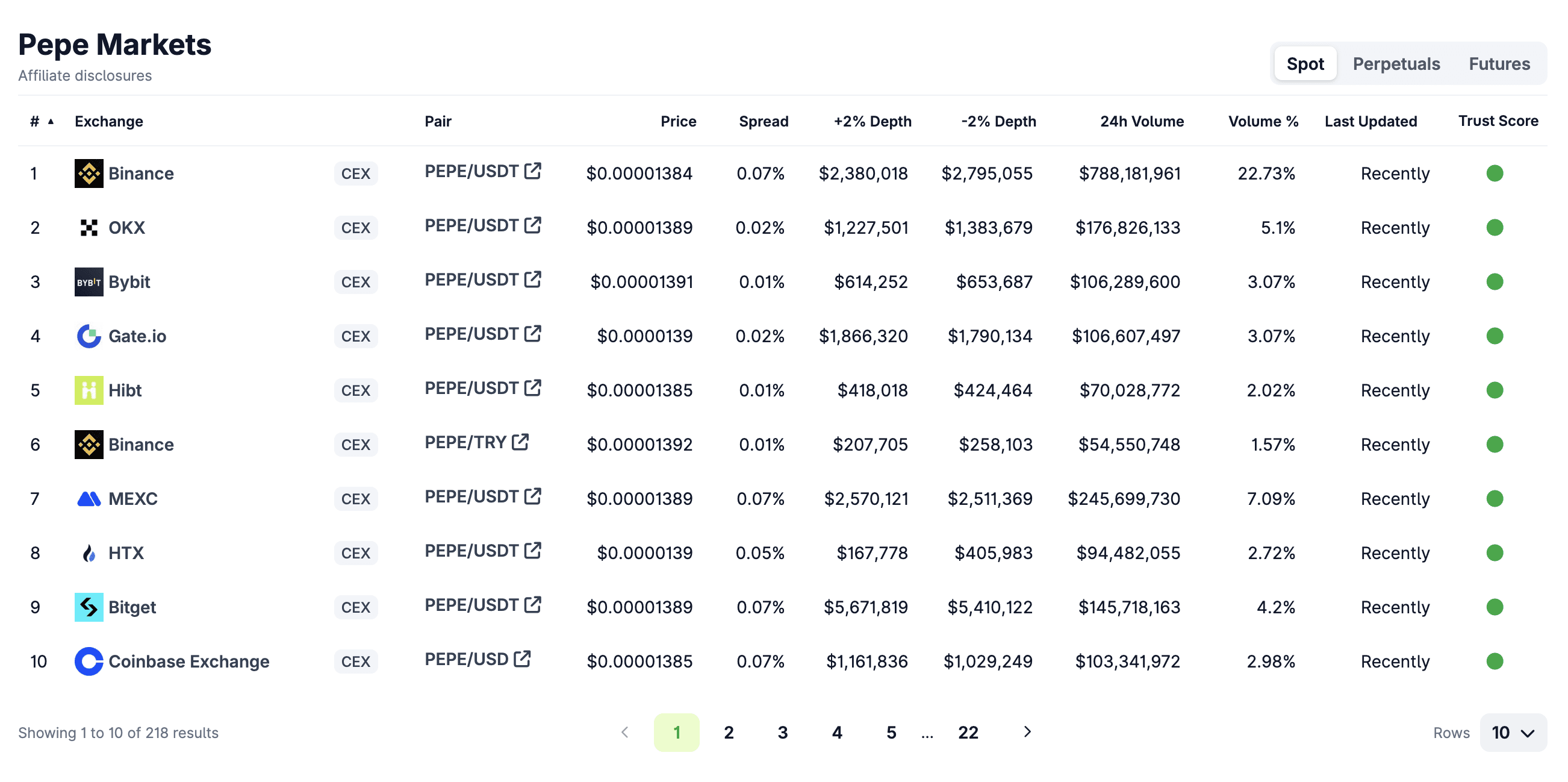

#2.3 Exchanges

Source: Pepe Exchanges, Coingecko, 12 May 2025

Pepe is traded on many centralized exchanges and is very liquid. Volumes on this token are extremely high (>$1B / daily). This indicates a strong demand to speculate on this token. 2% price impact is cumulative ~$30M, indicating good liquidity.

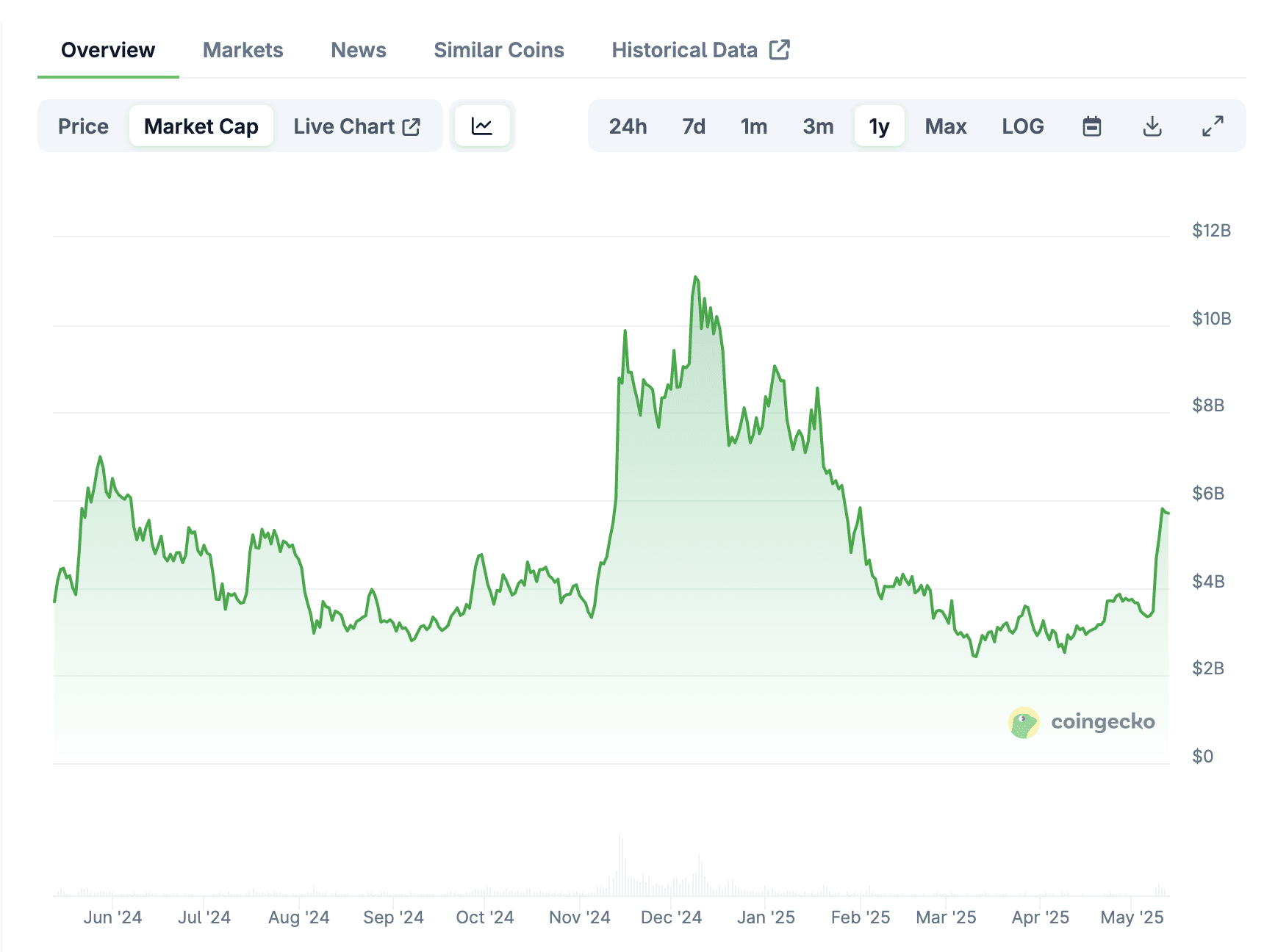

#2.4 Growth

Source: Pepe Market Capitalization, Coingecko, 12 May 2025

Pepe’s market capitalization has grown in lockstep with its token price. It has grown modestly over the past year ($4B to $5.8B), with significant upwards growth in between (up to $11B).

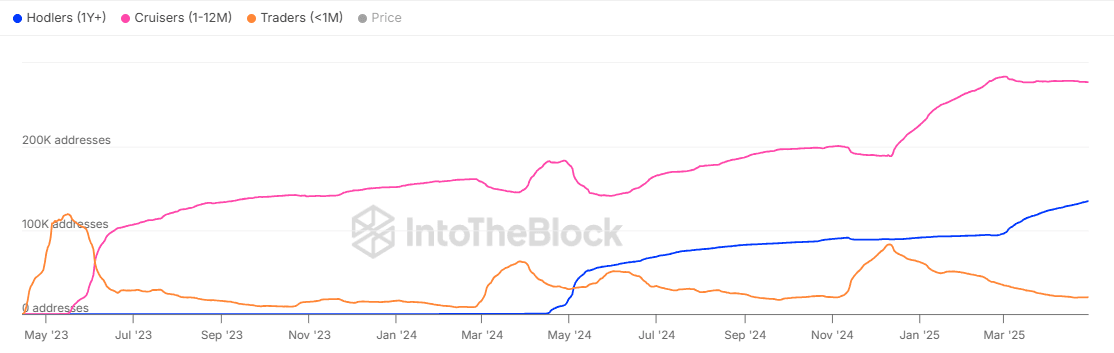

Source: Addresses by Time Held, IntoTheBlock, May 13th, 2025

#3. Technological Risk

#3.1 Smart Contract Risk

One audit by CertiK for this token is documented, though this audit was post-deployment. It found one issue, which was resolved by renouncing ownership of the contract.

#3.2 Bug Bounty Program

No bug bounty program is documented.

#3.3 Price Feed Risk

Pepe does not have a mainnet Chainlink price feed. Feeds on Arbitrum, Optimism, and zkSync are available. This would need to be streamed to the mainnet for Aave to facilitate the asset’s onboarding. This is a market price feed.

#3.4 Dependency Risk

As a memecoin, this token introduces no dependencies that Aave has not already exposed to.

#4. Counterparty Risk

#4.1 Governance and Regulatory Risk

Pepe has no governance or ownership. All contract control was renounced in April 2023. No aspect of the contract may be modified.

The recent Staff Statement issued by the U.S. Securities and Exchange Commission concerning so‑called “meme coins” bears directly on the legal characterization of these tokens, even though any effort to tether their issuers to a single domestic legal regime is likely to prove impracticable.

In that statement, the Division of Corporation Finance signals that, in most fact patterns, meme‑coin tokens such as PEPE—do not meet the definitional threshold of a “security.” Where a token is marketed chiefly for entertainment or speculative purposes, carries no expectation of profit derived from managerial or entrepreneurial efforts, confers no right to income, dividends, or business assets, and offers little functional utility beyond its exchange value and cultural cachet, the Division would generally not expect the offer or sale of the token to require registration under the Securities Act. The SEC likewise reserves the right to revisit that position should the “economic reality” shift—for example, if proceeds are pooled for a commercial venture or if token holders begin to share in profits generated by a promoter’s efforts—thereby bringing the asset within the ambit of the Howey test.

By contrast, the Commodity Futures Trading Commission adopts a broader lens: virtual currencies are presumptively treated as “commodities” under Section 1a(9) of the Commodity Exchange Act. Judicial precedent and CFTC enforcement activity—spanning Bitcoin, Ether, Litecoin, Tether, and other digital assets—confirm that meme‑coin tokens such as PEPE likewise fall within the statute’s commodity definition so long as they function primarily as a medium of exchange or store of value. In its submission to list an event contract referencing PEPE, Crypto.com cited previous CFTC proceedings, including CFTC v. Binance, to underscore that no federal regulator has reclassified PEPE as anything other than a commodity. Consequently, derivative instruments referencing PEPE—futures, swaps, or event contracts—remain subject to the CFTC’s supervisory jurisdiction.

#4.2 Access Control Risk

#4.2.1 Contract Modification Options

This contract may not be modified in any way, given that ownership was renounced. Should it not have been, key functions include a token blacklist function, a burn function, a transfer ownership function and a renounce ownership function, which was called at 0x91c9a6caf8e7b5419a7e597982a0cf9b4fc01413279ab840bb57a2e9c528f252.

#4.2.2 Timelock Duration and Function

N/A

#4.2.3 Multisig Threshold / Signer identity

N/A

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and available here.

#Aave V3 Specific Parameters

To be provided in collaboration with @ChaosLabs.

#Price feed Recommendation

LlamaRisk recommends that the PEPE/USD Chainlink feed be posted to Ethereum and used to support this Ethereum market.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] Add PEPE to Aave V3](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/1bf2dab4-d3e5-44ff-becb-28e783d74c15.png)