An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

LlamaRisk supports the proposed initial parameters and asset selection for the launch of Umbrella. Based on our Umbrella methodology simulations, these asset choices and the allocated budget are well-suited to provide optimized risk coverage for Aave’s Core market. The gradual deprecation of the legacy Safety Module, alongside Umbrella’s activation, will ensure that protocol coverage remains sufficient until Umbrella’s scope is expanded.

Additionally, we recommend a minor optimization to the Target Liquidity parameters for USDC and USDT. Our methodology indicates that loans backed by these two stablecoins exhibit different levels of market shock resilience. As such, there is an opportunity to maximize the marginal utility of each dollar within the Umbrella module by allocating more resources to USDT, which has a lower intrinsic liquidity capacity relative to its market size. The proposed adjustments are as follows:

-

Decrease USDC Target Liquidity from $85M to $66M.

-

Increase USDT Target Liquidity from $85M to $104M.

-

Adjust reward emissions proportionally, keeping the same total maximal emission rate.

These changes would improve risk-adjusted coverage without increasing overall costs for the DAO. As market conditions and loan compositions on Aave evolve and Umbrella coverage expands, we will continue to recommend further adjustments as needed.

#Evaluation of Risk Coverage

To evaluate the proposed parameters for the initial Umbrella activation, we applied our Umbrella-specific methodology based on the price shock simulations and market liquidity capacity estimations. The output measures bad debt coverage needs and helps us guide the risk-adjusted parameter recommendations on a per-asset basis.

The specific simulation run was executed on May 15th, 2025. A snapshot of asset prices and loan compositions on Aave was taken and historical price observations were taken into account for further synthetical price shock generation. Overall asset metrics were as follows:

| Asset | Price | Supply | Borrowed | Borrow Cap |

|---|---|---|---|---|

| WETH | $2,590 | 2,473,578 WETH | 2,139,972 WETH | 2,700,000 WETH |

| USDC | $1 | 2,463,512,109 USDC | 2,032,575,656 USDC | 4,320,000,000 USDC |

| USDT | $1 | 3,464,547,040 USDT | 3,178,590,933 USDT | 4,720,000,000 USDT |

| GHO | $1 | - | 180,000,000 GHO | 180,000,000 GHO |

#Liquidity Capacity and Debt Coverage

A core measure in this analysis is Liquidity Capacity, defined as the maximum amount of debt that can be liquidated profitably before price impact losses render further liquidations unfeasible. This capacity is crucial because the total liquidations a borrow asset can sustain with an active Umbrella coverage is conceptualized as the sum of the Target Liquidity and Liquidity Capacity.

The simulations employed Value at Risk (VaR) based shock scenarios to estimate Liquidity Capacity. These simulations estimated liquidatable debt and collateral under various stress conditions, scaling them to the point where liquidations cease to be profitable. The scaled liquidatable debt at this point is the Liquidity Capacity metric. The simulation run for the initial Umbrella asset on Core market provided the following measures:

| Asset | Borrow Cap | Liquidation Capacity | Liquidation Capacity ($) | Mean Liquidatable Debt ($) |

|---|---|---|---|---|

| USDC | 4,320,000,000 USDC | 50,400,000 USDC | $50,400,000 | $1,115,000 |

| USDT | 4,720,000,000 USDT | 12,200,000 USDT | $12,200,000 | $192,000 |

| WETH | 2,700,000 WETH | 6,900 WETH | $17,870,000 | $1,508,663 |

| GHO | 180,000,000 GHO | 5,000,000 GHO | $5,000,000 | $250,000 |

#Market Shock Resilience

To evaluate the robustness of the Target Liquidity in Umbrella’s module adjusted for Liquidity Capacity, market price shock simulations were applied, and the Shock Intensity multiplier metric was acquired. The Shock Intensity metric represents a multiple of a VaR99 based price shock paths such that the Liquidatable Debt would equate to the sum of the Target Liquidity and Liquidity Capacity.

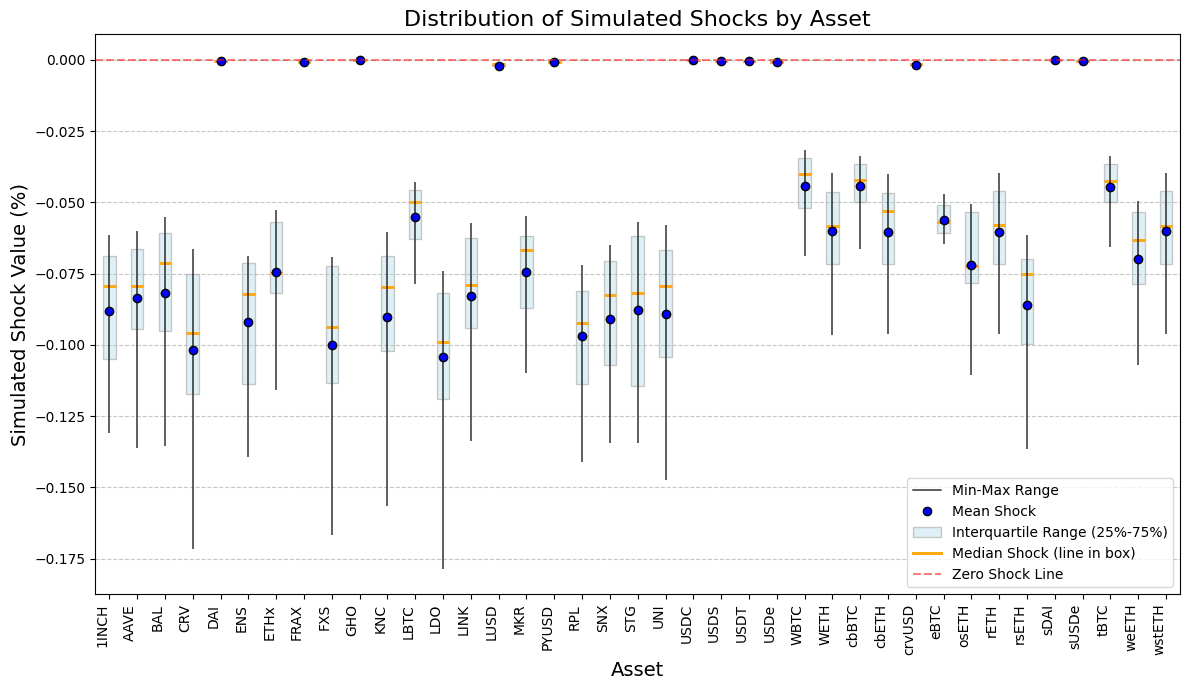

Source: LlamaRisk, May 15th, 2025

The resulting Shock Intensity multipliers differ based on the asset types, depending on asset price volatility and the collateral type distribution on Aave’s market. This leads to a large shock resilience for assets primarily used in E-Mode setups. In particular, WETH is largely resilient to market price shocks because most WETH borrows (90.3%) are used in ETH LST E-Mode. Consequently, in this simulation run, we omit the Shock Intensity evaluations for WETH, including USDT, USDC, and GHO stablecoins.

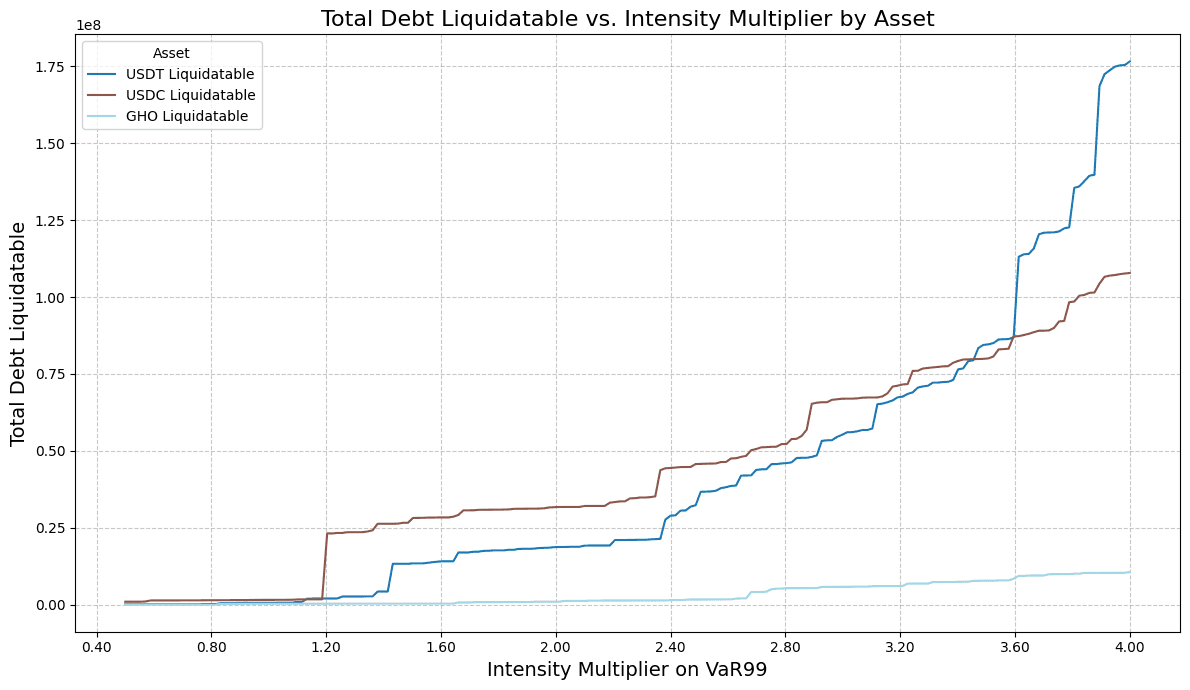

Source: LlamaRisk, May 15th, 2025

A key observation is an imbalance in the Shock Intensity resilience between USDC and USDT. With $85M projected Target Liquidity and ~$50.4M Liquidity Capacity, USDC demonstrated resilience up to a ~3.9x shock. Conversely, USDT, with an identical $85M projected Target Liquidity but only ~$12.2M Liquidity Capacity, showed resilience to a ~3.6x shock, at which point a large uptick in liquidatable debt is projected. This disparity suggests a potential inefficiency in the allocation of Umbrella funds relative to the underlying market’s inherent liquidation absorption capabilities.

#Proposed Optimizations

Adjusting the Umbrella fund allocations between USDC and USDT would lead to a more balanced coverage of their respective borrow caps and enhance the protocol’s resilience to price shocks. By increasing the Target Liquidity for USDT and slightly reducing it for USDC, both assets would have similar total debt coverage in dollar terms, and their coverage as a percentage of borrow cap is more closely aligned. This optimization would ensure that the protocol can withstand market volatility better, particularly for the largest stablecoins, without increasing the Umbrella budget.

| Asset | Target Liquidity | Total Debt Coverage | Coverage of Borrow Cap, % | Shock Intensity |

|---|---|---|---|---|

| USDC | $85,000,000 → $65,900,000 | $135,400,000 → $116,300,000 | 3.13% → 2.69% | 4.30 → 3.80 |

| USDT | $85,000,000 → $104,100,000 | $97,200,000 → $116,300,000 | 2.06% → 2.46% | 3.59 → 3.61 |

| WETH | $57,500,000 (unchanged) | $75,370,000 (unchanged) | 1.18% (unchanged) | >10x |

| GHO | $12,000,000 (unchanged) | $17,000,000 (unchanged) | 9.44% (unchanged) | 4.40 |

#Future Considerations

As the market landscape evolves and loan risk profiles shift, it will be essential to review Target Liquidity levels on an asset-by-asset basis regularly. Anticipated growth may also require more assertive risk parameters, so any such adjustments must be accompanied by a corresponding rebalancing of Umbrella’s Target Liquidity allocations.

The yield premium offered by Umbrella is expected to attract additional supply to Aave’s markets, thereby increasing liquidity available to borrowers. However, ensuring that the utilization rate never exceeds the supply of assets within Umbrella’s module remains critical so that assets remain available for slashing if necessary.

The Umbrella’s activation phase is expected to directly improve and optimize the risk profile of Aave’s Core market. In the subsequent stages, it will be crucial to further refine the parametrization and position Aave for sustainable growth. That will be a common effort and a priority of AFC’s members.

#Disclaimer

This analysis was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] Aave Umbrella - activation](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/ac84b15c-7671-40c4-892a-df906a404bfd.jpg)