An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

LlamaRisk supports onboarding USR to Aave v3 Core Instance contingent upon establishing a formal bug bounty program. We recommend introducing this asset similar to sUSDe, with lower general LTV/LT while enabling a wstUSR Stablecoins Liquid E-Mode for enhanced stablecoin borrowing. We propose including USDC, USDT, and GHO in this E-Mode. The wstUSR review builds on the USR report, which remains the reference for in-depth analysis of Resolv protocol.

#General Asset Features

Staked USR (stUSR) maintains the same value as USR, with amounts growing through staking rewards primarily allocated to stUSR and RLP holders. stUSR doesn’t absorb losses; RLP bears any losses. wstUSR is the non-rebasing ERC20 version of stUSR with accumulating value.

#Liquidity

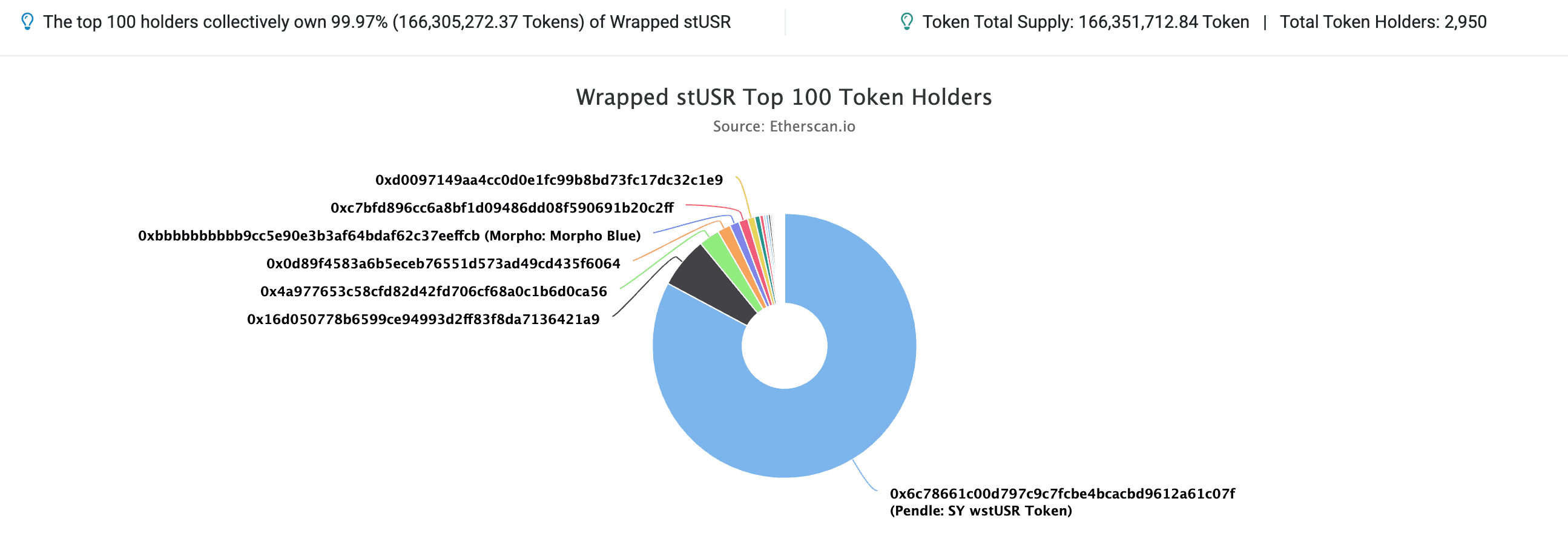

Over 80% of the token supply is concentrated on Pendle - SY wstUSR: 0x6c78661c00D797C9c7fCBE4BCacbD9612A61C07f.

Source: Etherscan, Date: March 12th, 2025

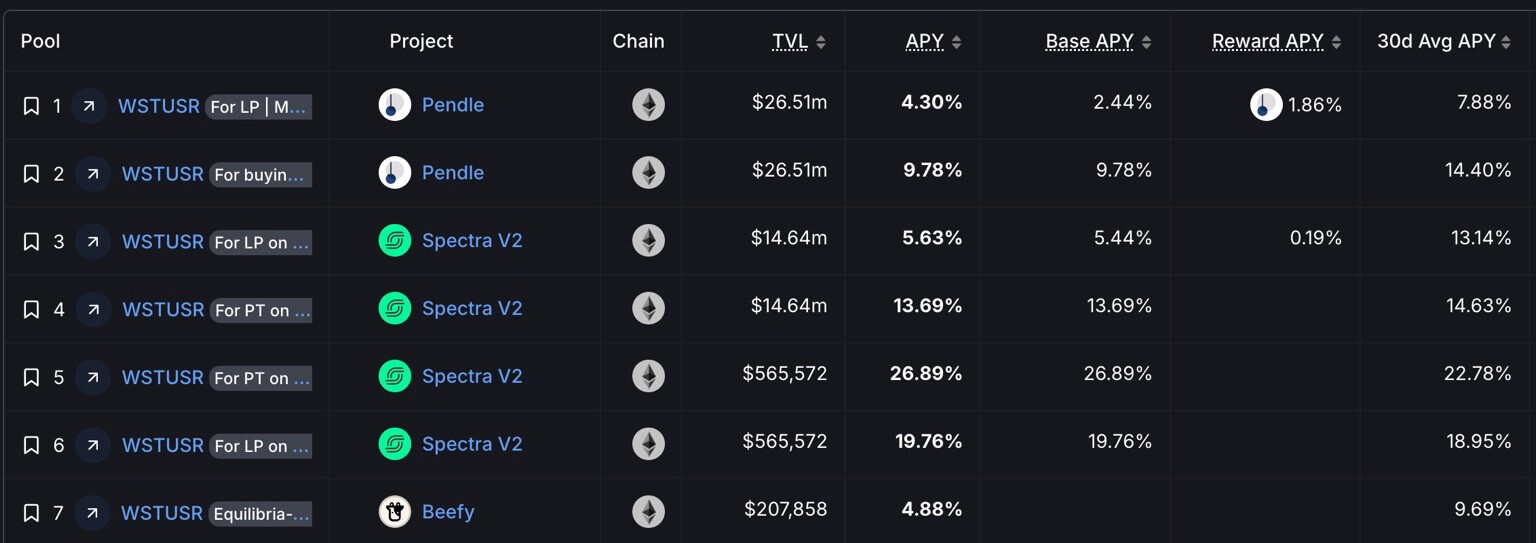

wstUSR distribution shows concentration in Pendle and Spectra V2:

-

Pendle: wstUSR (27 Mar 2025) - $34.1M TVL

-

Spectra: wstUSR (27 Mar 2025) - $507K TVL

-

Spectra: wstUSR (26 Jun 2025) - $14.9M TVL

stUSR can be unstaked to USR anytime without waiting periods, sharing their liquidity. With stUSR having limited direct liquidity pools, wstUSR parameters should align closely with USR.

#Stability

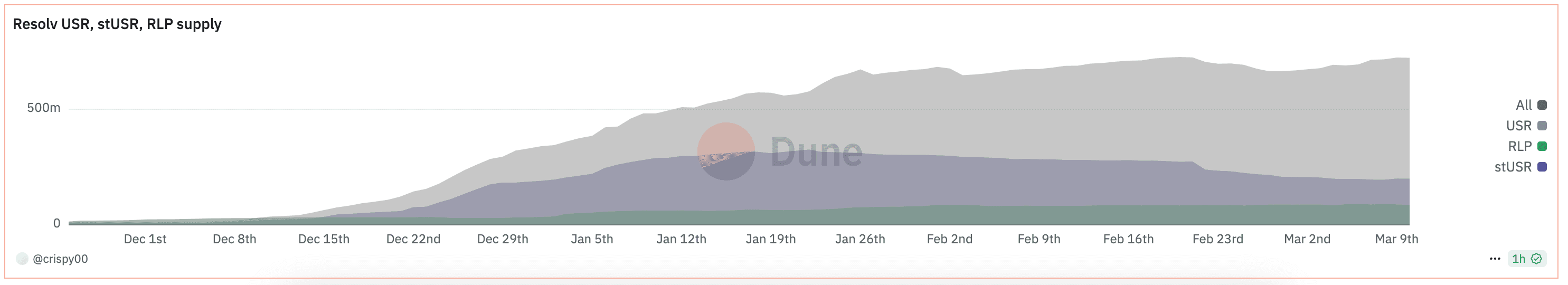

wstUSR is backed by RLP as an insurance layer against counterparty, market, and liquidity risks. The current USR collateralization ratio is approximately 118.30%. RLP supply has grown alongside USR/stUSR, maintaining consistent protection.

Source: Dune LLR, Date: March 10th, 2025

#Yield Venues

Primary venues for wstUSR are Pendle, Spectra V2, and Morpho, where the most liquid market offers $11.95M for USDC borrowing at 7.34% using PT-wstUSR-27MAR2025 collateral. Deploying wstUSR on Aave could enable yield-leveraging similar to sUSDe strategies, with existing stUSR supply and instant unstaking as a reference for overall liquidity and supply caps.

Source: DefiLlama, Date: March 17th, 2025

#Aave V3 Specific Parameters

Parameters are presented jointly with @ChaosLabs.

#Price feed Recommendation

Building on our recommendation for USR, which was for using the Proof-of-Reserves (PoR) oracle, we recommend employing wstUSR’s internal exchange rate in conjunction with CAPO, protecting against potential rate inflation risk.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] Add wstUSR to Aave v3 Core Instance](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/6eee3d5b-fbf4-4211-bc09-3657a68174d1.png)