An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

Update (March 26th, 2025): We’re endorsing parameters set forward by @ChaosLabs (750 supply cap, eBTC non-borrowable, and eMode params)

LlamaRisk recommends changing eBTC’s initial supply cap from 80 to 300 (and borrow cap to 30 from 12), given significant improvements in market liquidity. While good inroads have already been made, deeper liquidity and greater LP venue diversity and fragmentation enable us to recommend a higher supply / borrow cap.

#eBTC market update

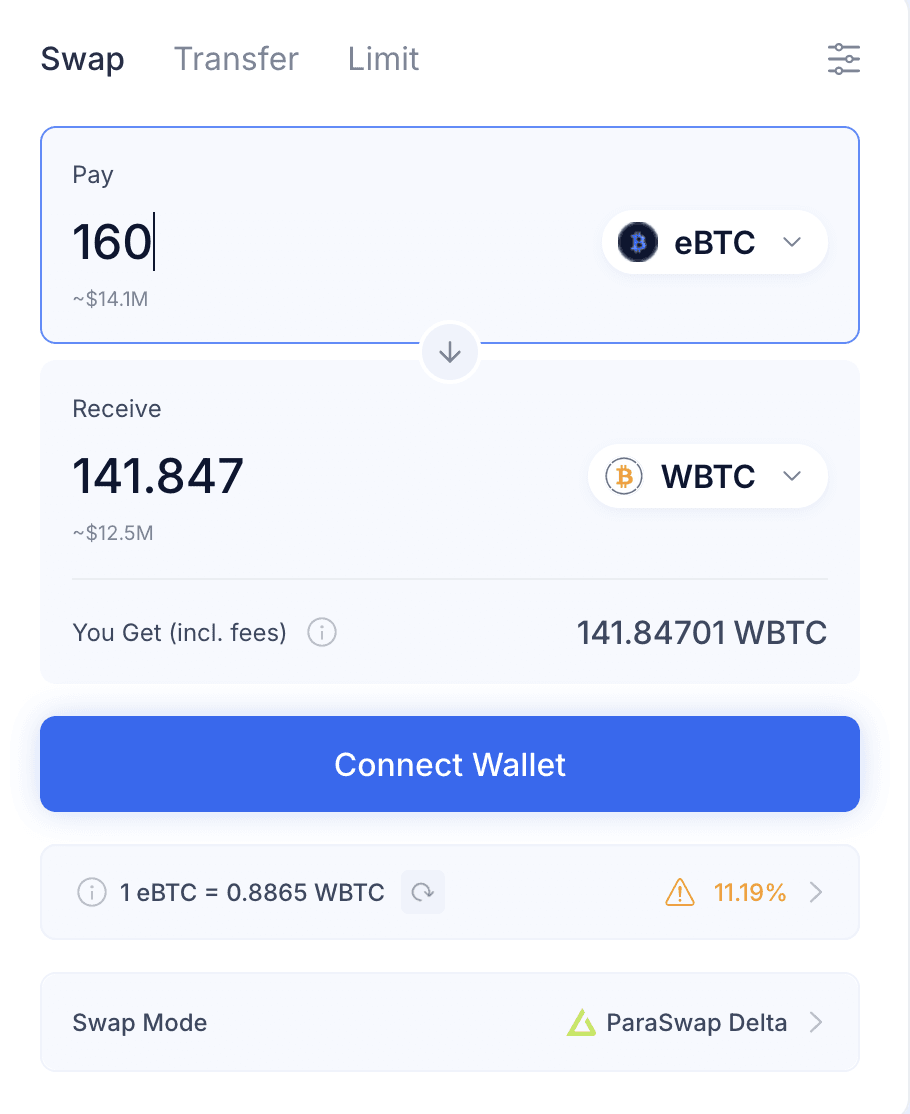

Source: eBTC/WBTC trade at ±10% price impact, Paraswap, March 25th 2025

The market capitalization of eBTC is significantly greater than at past review, with some 3,310 wrapped or staked BTC currently held in the vault. Liquidity for this asset is substantially improved, with a $14.5M trade resulting in ±10% price impact, the recommended liquidation bonus for this asset.

This liquidity is largely held in 4 liquidity pools:

-

32.5 eBTC in the Curve eBTC/WBTC pool ($5.38M TVL), of which, 99.9% of the liquidity is held by a 3/7 multisig.

-

26.5 eBTC in the Curve Tri BTC-Fi pool ($6.38M TVL), with 99.9% of the assets held by an EtherFi-deployed Lombard vault (LBTC BoringVault).

-

18.7 eBTC in the Uniswap eBTC/LBTC pool ($8.88M TVL). Of that, 100% is supplied by the same LBTC BoringVault.

-

11.8 eBTC in the Balancer eBTC/WBTC pool ($2.07M TVL):.

-

100% of Balancer Vault holds liquidity, which in turn is entirely supplied by this 2/5 multisig.

-

In short, all DEX liquidity is protocol-supplied and is controlled by a few entities. This increases the likelihood that DEX liquidity could dry up rapidly. Greater diversity in LP holders for this pool and a greater number of liquidity venues would drastically reduce this risk. It is important to note that all eBTC positions are paired with eBTC collateral, so should one of these assets suffer an incident, it may result in difficulty in liquidating distressed positions profitably.

#Aave V3 Specific Parameters

Endorsing parameters set forward by @ChaosLabs

![[ARFC] Enable eBTC/WBTC liquid E-Mode on Aave v3 Core Instance](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/b36036b2-b32a-478f-9537-45a198aacb80.png)