An archive of our post on Aave Governance forum, in the context of our scope of Risk service provider.

This is an archive of our post on Aave governance forum. Read the full thread here.

#Summary

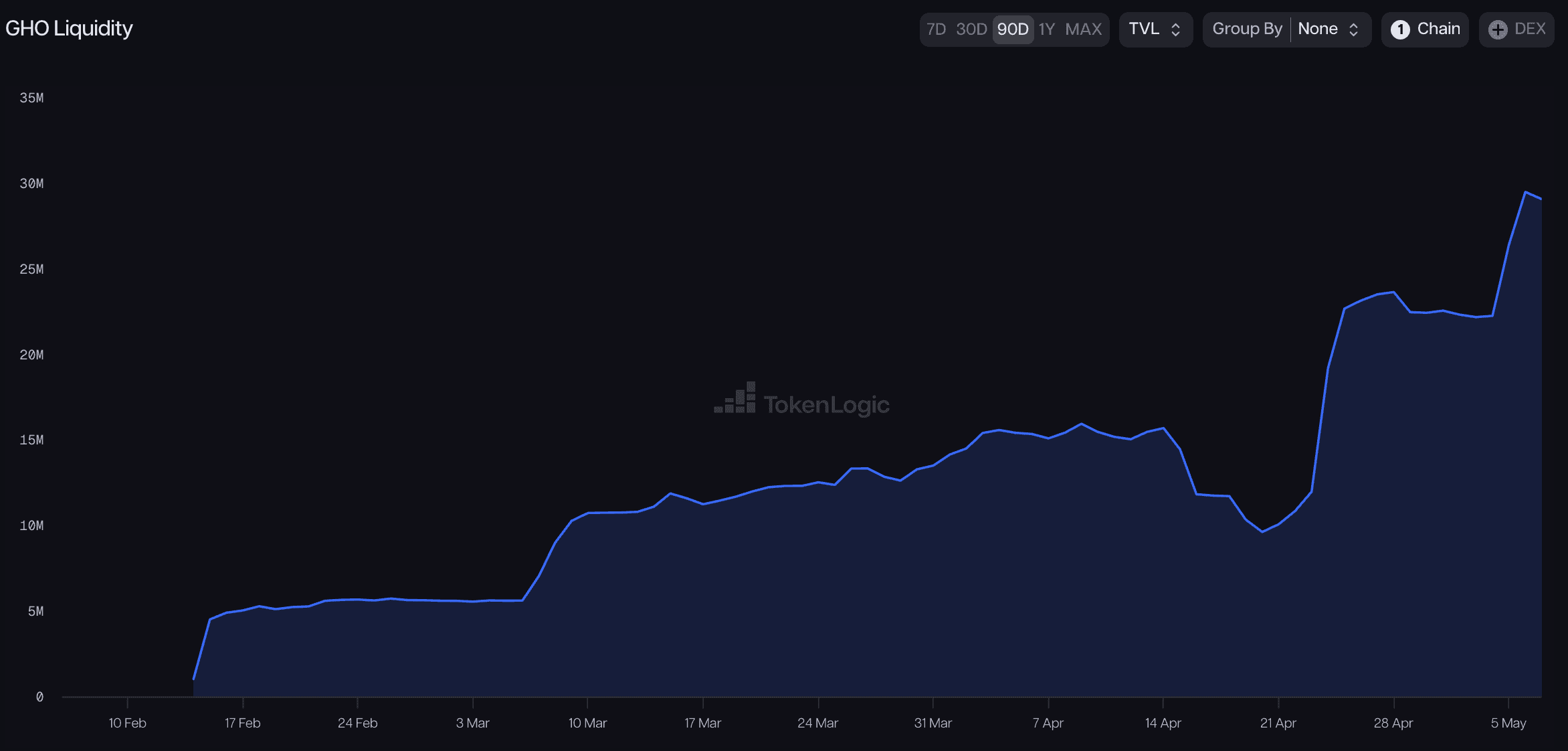

LlamaRisk supports this proposal and believes that increasing the CCIP rate limits for GHO bridging to Base is a timely adjustment. The initial conservative limits served as an important security measure during GHO’s nascent stages on Base, ensuring orderly market development. However, with the significant growth in GHO liquidity on Base, these initial parameters have become a bottleneck, hindering efficient capital deployment. Scaling the CCIP rate limits is a rational step that aligns with GHO’s expanding supply and cross-chain adoption.

Source: TokenLogic, May 7th, 2025

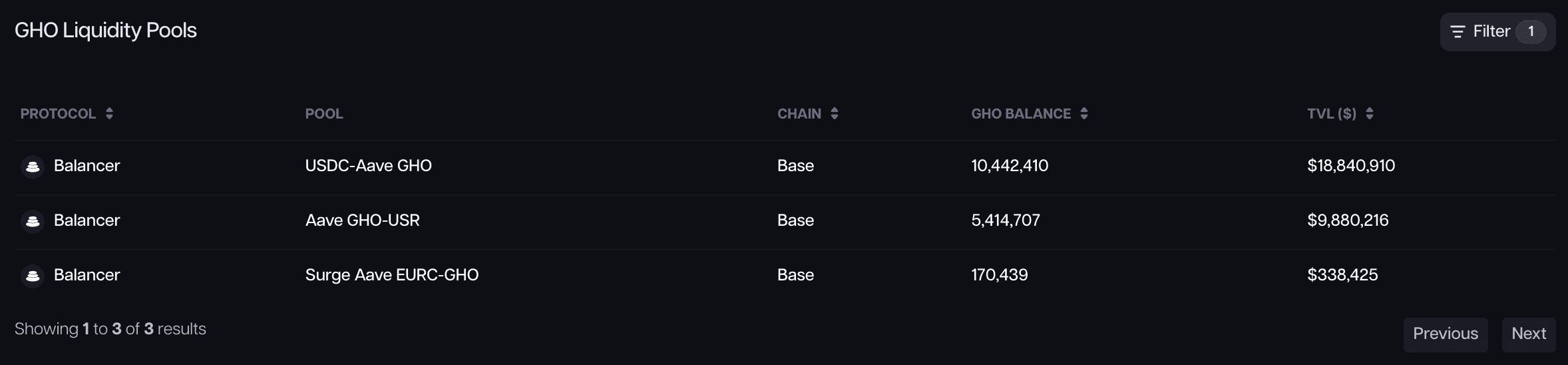

The proposed increase to a 1.5M GHO rate limit and a 300 GHO/second refill rate represents a five-fold enhancement. While substantially larger, this new capacity does not introduce immediate risks to GHO’s secondary market peg. The liquidity on Base is now sufficiently developed to absorb larger transfer volumes without significant price impact. The total GHO liquidity TVL on Base now stands at ~$28M, mainly concentrated on Balancer pools and paired with USDC, USR, and EURC.

Source: TokenLogic, May 7th, 2025

This new limit constitutes a relatively small fraction of GHO’s overall supply (approx. 0.6%). Notably, other risk mitigation layers, such as bridge facilitator caps, remain in effect, providing continued security.

#Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.

![[ARFC] GHO Cross-chain Parameter Adjustments](https://llamarisk-cms.nyc3.cdn.digitaloceanspaces.com/a8e9cec5-0cb1-4816-9b3d-53caffffd0ab.png)