Introducing LlamaGuard NAV Powered by Chainlink Infrastructure: A Dynamic Risk-Adjusted Oracle Solution for Tokenized RWAs

#A Dynamic Risk-Adjusted Oracle Solution for Tokenized RWAs

We’re excited to announce that LlamaRisk, Chainlink, and Aave Labs have collaborated to implement best-in-class NAV feeds on the Aave Horizon lending platform. LlamaGuard NAV powered by Chainlink is a next-generation oracle solution purpose-built for pricing tokenized real-world assets (RWAs) with sophisticated risk controls. Underpinned by Chainlink’s proven decentralized oracle network infrastructure and backed by LlamaRisk’s risk management expertise, LlamaGuard NAV enhances the robustness of delivering Net Asset Value (NAV) data onchain by incorporating smart dynamic price bounds based on real-time market signals.

Aave Horizon is a leader in DeFi lending, bringing utility to RWAs by allowing institutions and other qualified users to borrow stablecoins against RWA collateral. It is now also establishing industry standards with the phased rollout of LlamaGuard NAV security enhancements. The upcoming release will introduce dynamic price bounds to Chainlink NAVLink feeds configured via an onchain registry. The subsequent implementation will leverage the Chainlink Runtime Environment for enhanced modularity and extensibility, enabling LlamaRisk to incorporate additional market signals and automate protocol parameter management.

To provide additional risk protections, LlamaGuard NAV enables two core operations:

-

Proactive Validation Layer — A Chainlink Decentralized Oracle Network (DON) enforces dynamic price bounds offchain, rejecting invalid price updates before they are published. This is controlled by an onchain parameter registry managed by Aave Horizon.

-

Automated Response Layer — This circuit breaker protects the protocol while the source of the price discrepancy can be reviewed.

We chose to build on Chainlink as it is the industry-standard oracle platform, having secured Aave’s markets since day one, and providing reliable access to high-quality market data even during extreme volatility and blockchain network congestion. Chainlink infrastructure has been integrated by over 2,400 projects and has enabled tens of trillions of dollars in transaction value, while actively securing nearly $100B in DeFi TVL.

Furthermore, building LlamaGuard NAV on Chainlink’s decentralized oracle network infrastructure cleanly separates responsibilities: neutral oracle operators validate and deliver NAV data, while LlamaRisk transparently implements bounds logic and protocol risk controls. This separation of duties supports DeFi’s decentralization ethos, mitigates conflicts of interest, and gives users verifiable assurance over how NAV data is produced and acted upon.

With the market for tokenized RWAs now totaling over $30B and expected to grow rapidly in the years to come, the need for mission-critical infrastructure to safely price and manage the risk around RWA markets is ever increasing. By combining the proven reliability and neutrality of Chainlink infrastructure for onchain data delivery with LlamaRisk’s deep expertise on protocol risk management, LlamaGuard provides Aave Horizon with a robust, automated risk management solution based on macroeconomic data that can safely scale the adoption of tokenized assets across DeFi.

#How LlamaGuard NAV Provides Robust, Multi-Layered Safeguard for RWA NAV Oracles

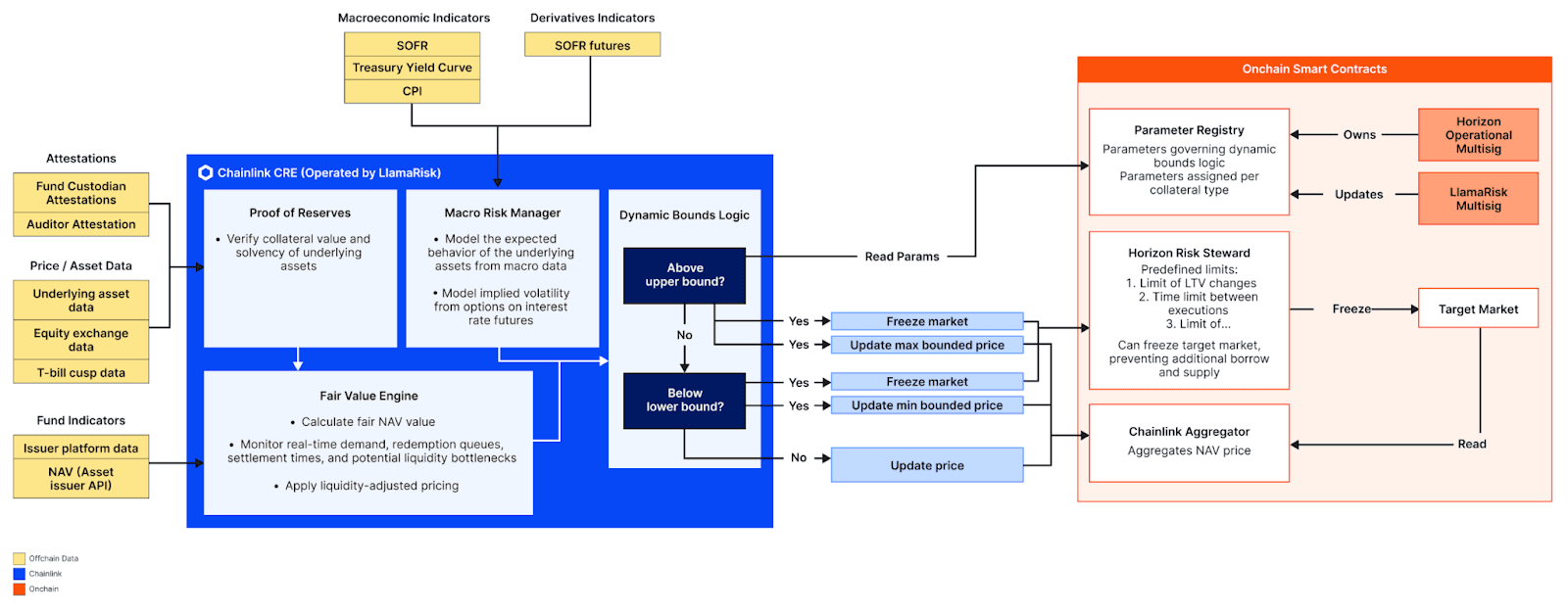

At its core, LlamaGuard NAV brings together three critical layers of functionality into a unified, opinionated oracle framework. This includes data ingestion, risk modeling, and automated safeguards.

The Chainlink Runtime Environment (CRE) offers a modular framework, allowing LlamaGuard NAV to aggregate the diverse macroeconomic information needed to establish NAV integrity. This will allow us to introduce granular details about the composition of underlying assets verified through Proof of Reserve, redemption and settlement data that reflect real-time liquidity and credit health, official macroeconomic indicators delivered onchain through Chainlink’s work with the U.S. Department of Commerce, and even derivatives market signals such as implied volatility from interest rate options. Taken together, these inputs provide a multi-dimensional view of risk that goes well beyond traditional issuer-reported NAVs.

Architectural overview of LlamaGuard NAV operating on the Chainlink Runtime Environment (CRE)

Building on this foundation, LlamaGuard applies a risk modeling approach that transforms raw data into actionable risk parameters. Instead of relying on static heuristics, the system dynamically calculates upper and lower NAV bounds that reflect the market’s own pricing of risk. By incorporating techniques such as delta–gamma approximations of rate volatility, LlamaGuard can generate mathematically rigorous confidence bands that evolve in step with changing market conditions.

If an issuer-reported NAV falls outside these dynamic bounds, LlamaGuard’s automated safeguards are triggered. Depending on the severity of the anomaly, the system can raise warning signals, temporarily freeze the feed at the last known good value, or execute protective circuit breakers (e.g, preventing additional supply/borrow actions in the target market). These automated responses ensure that invalid NAV pricing does not flow downstream, protecting users and maintaining market integrity.

A defining feature of this design implementation is that the complex logic of the risk-managed oracle network is abstracted away from the end user (e.g., the Aave Horizon protocol) without sacrificing transparency or introducing additional intermediaries. The onchain Parameter Registry ensures public verifiability of the values used in offchain computation and grants ultimate authority to the integrating protocol. These dual priorities to offer convenience while preserving trust serve to strengthen user assurances and boost protocol performance without compromise.

Through this architecture, LlamaGuard applies the same quantitative safeguards relied on by institutional risk managers, but now fully automated, transparent, and enforced directly onchain.

#Scaling the Tokenized Asset Economy With Industry-Leading Security and Risk Management

By helping secure NAV integrity and providing automated onchain defenses, LlamaGuard NAV creates a foundation for safely scaling the adoption of tokenized assets in DeFi. With Chainlink providing the trusted oracle infrastructure and LlamaRisk delivering institutional-grade risk expertise, this collaboration establishes a new standard for RWA oracle design, ensuring that tokenized asset markets can grow with the resilience, transparency, and automation demanded by global institutions.

“LlamaGuard NAV shows how DeFi infrastructure is maturing to meet the scale of global finance. By pairing Chainlink’s battle-tested oracle networks with LlamaRisk’s dynamic risk modeling, we’re building on Aave Horizon’s resilient foundation to support the next wave of tokenized real-world assets,” said Stani Kulechov, Founder, Aave Labs.

“LlamaGuard represents a major step forward in how tokenized real-world assets can be secured onchain within the DeFi economy. By combining Chainlink’s proven oracle networks with LlamaRisk’s expertise in risk management, Aave Horizon can now access NAV safeguards that adjust dynamically to real-world market conditions. It’s a prime example of how the DeFi ecosystem is moving toward more resilient and institution-ready RWA infrastructure.” — Johann Eid, Chief Business Officer at Chainlink Labs.

“The integrity of NAV data is critical to the growth of tokenized asset markets. With LlamaGuard, we’ve built an oracle that not only validates NAVs but also provides automated protections when anomalies occur. Working with Chainlink to deploy this on Aave Horizon shows how tokenized RWA protocols can be equipped with the same kind of risk controls that institutions expect in traditional finance.” — Adam Sadowski, CEO at LlamaRisk.

About Aave Labs

Aave Labs is shaping the next generation of global onchain finance. The company builds leading products that individuals, public companies, and institutions rely upon, processing billions of transactions, reliably, and quickly – 24/7. Founded by Stani Kulechov, the original author of ETHLend in 2017 and Aave Protocol in 2020, Aave Labs continues to contribute major protocol upgrades, including the upcoming Aave V4, and is a recognized innovator in decentralized finance. In 2023, the team introduced Aave’s overcollateralized stablecoin GHO, and Horizon, in August 2025, the fast-growing institutional platform for borrowing against tokenized real-world assets. Aave.com

About Chainlink

Chainlink is the industry-standard oracle platform bringing the capital markets onchain and powering the majority of decentralized finance (DeFi). The Chainlink stack provides the essential data, interoperability, compliance, and privacy standards needed to power advanced blockchain use cases for institutional tokenized assets, lending, payments, stablecoins, and more. Since inventing decentralized oracle networks, Chainlink has enabled tens of trillions in transaction value and now secures the vast majority of DeFi.

Many of the world’s largest financial services institutions have also adopted Chainlink’s standards and infrastructure, including Swift, Euroclear, Mastercard, Fidelity International, UBS, ANZ, and top protocols such as Aave, GMX, Lido, and many others. Chainlink leverages a novel fee model where offchain and onchain revenue from enterprise adoption is converted to LINK tokens and stored in a strategic Chainlink Reserve. Learn more at chain.link.

About LlamaRisk

LlamaRisk is a leading DeFi risk manager trusted by top-tier protocols like Aave, Aave Horizon, Curve, and Ethena. We work alongside our partners to protect users and drive sustainable growth. LlamaRisk delivers transparent, verifiable risk engineering that accelerates institutional onchain adoption.

We blend rigorous protocol research with real-time market monitoring and quantitative tooling to safeguard lending markets, stablecoins, and tokenized assets. Our risk engines optimize parameters and trigger proactive protections, helping protocols ship faster with guardrails that benefit the whole ecosystem.

Learn more at llamarisk.com.