A look at the market crash on October 10, 2025, and the future of risk-managed pricing strategies for pegged assets like Ethena USDe.

Useful Links:

#Introduction

This report examines how collateral pricing design determines system outcomes under stress, using USDe during the Oct 10, 2025 market crash as a case study. We compare Binance’s orderbook-driven collateral pricing with Aave’s pegged-pricing approach (USDe pegged to USDT). Aave’s choice proved prescient: by insulating collateral valuation from venue-specific dislocations, it avoided mass, wrongful liquidations while centralized venues that reflexively marked to their own stress events triggered pro-cyclical cascades. The episode validates pegged pricing as an effective user-protection tool amid acute system failures.

But pegged pricing alone does not cover tail risks—it fails to protect against genuine solvency problems if a peg is treated as truth in all scenarios. The core of this report outlines a path beyond static pegs: LlamaGuard risk-managed data feeds. Built to achieve the intent of pegged pricing (preventing wrongful liquidations) while preserving protocol solvency when danger is real, LlamaGuard fuses issuer/redemption state, proof-of-reserves, multi-source prices, and adaptive bounds to hold at $1 when conditions are verifiably safe and revert to market-reflective pricing when insolvency signals emerge.

We summarize the market dynamics of the crash, diagnose the oracle failures, show why Aave’s design succeeded, and present LlamaGuard as the principled, upgrade path from static pegs to risk-aware, verifiable, and automated pricing for DeFi.

#1. Summary of Market Crash: October 10, 2025

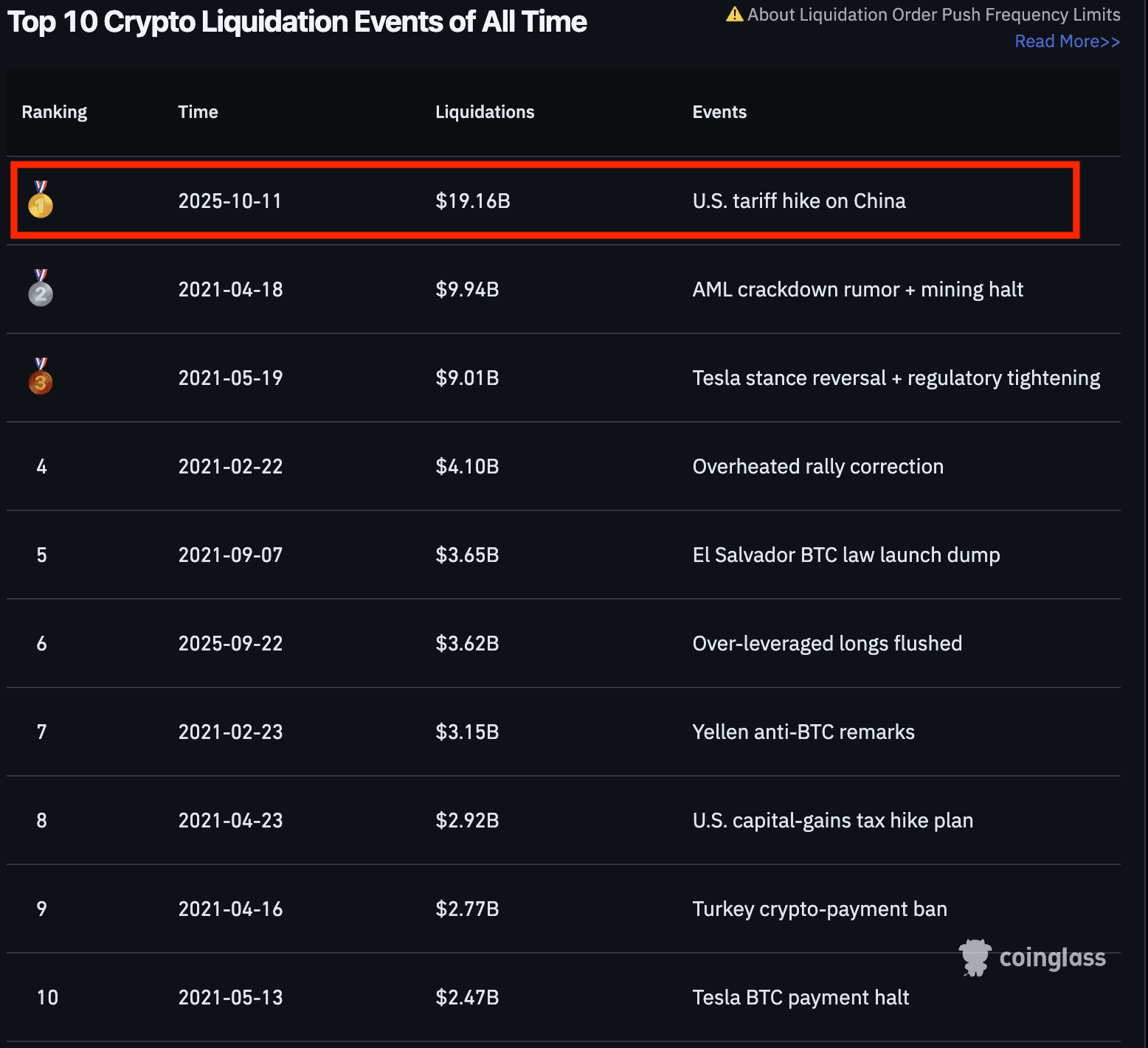

On 10th of October 2025, crypto markets experienced a crash. Even though ETH and BTC prices didn’t collapse as dramatically as in previous bear markets, this event has been the largest liquidation event in cryptocurrency history. Unlike the crashes in the past - usually triggered by a macro shift or a black-swan event followed by months of sell-offs - this crash was a rapid, system-wide cascade. Its speed and complexity exposed deep structural fragilities in the market’s foundations.

The importance of this crash and what led to it is worth discussing in detail, as it outlines several important insights into the nature of evolving crypto markets. The crash sparked heated online debates around the overlooked fragilities of the underlying market structures and hidden dependencies that lead to amplification of volatility effects during crashes. The incident forces us to do a hard evaluation of each layer of risk underlying the markets. The industry would benefit from understanding the factors leading to this systemic failure and taking measures to prevent similar events in the future.

Firstly, let’s look at some figures to understand the magnitude of what happened:

-

$19 billion evaporated from the markets: 19 times larger than the COVID-19 crash, 12 times bigger than the FTX collapse.

Source: coinglass.com

-

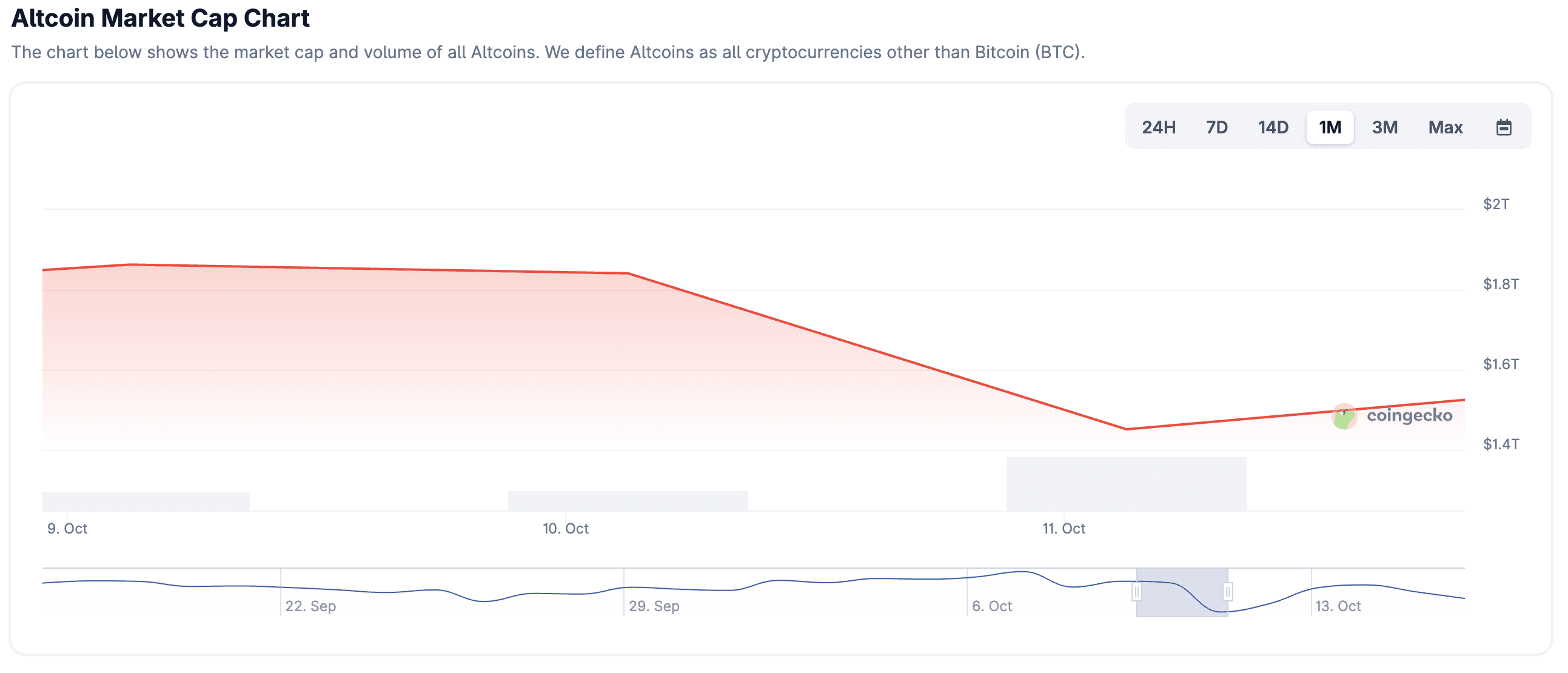

Altcoins suffer deep losses: SOL –40%, ATOM almost zero on Binance, Ethena’s USDe briefly quoted at $0.62

Source: Coingecko

-

Over 1.6 million traders were wiped out.

-

Exchange APIs and a lot of other services that are regarded as industry standard failed during peak volatility.

-

Some insiders walked away with an estimated $190–200 million in profits from perfectly timed short positions.

Some key observations:

-

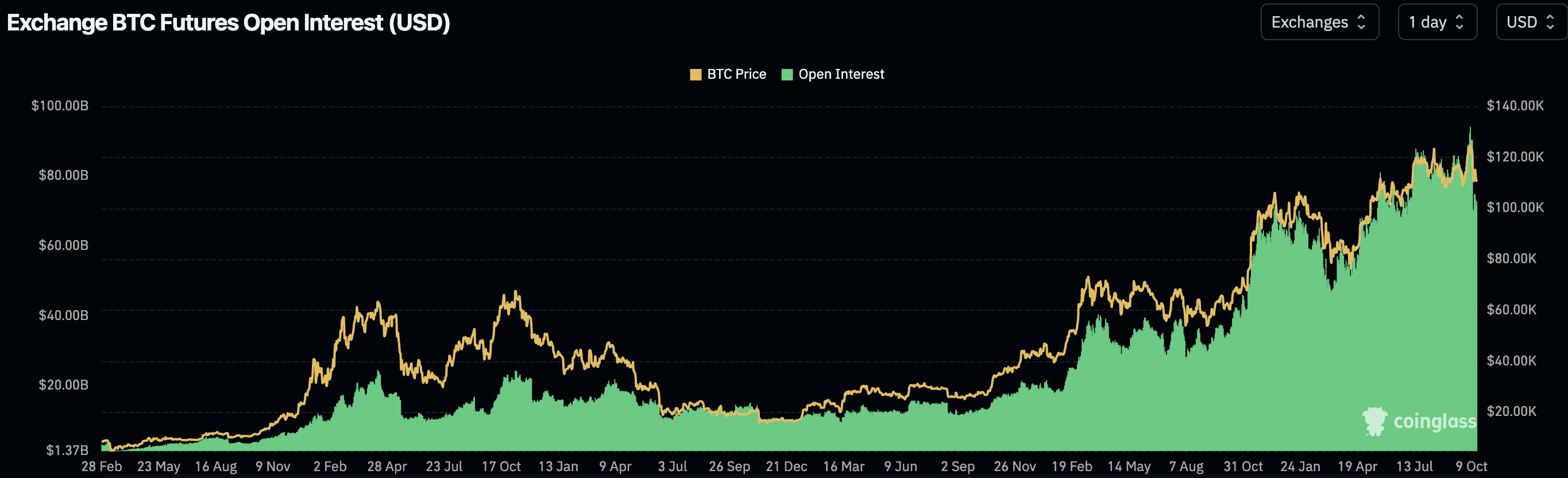

Markets were overleveraged. Fueled by the popularity of decentralized perpetuals (e.g., Hyperliquid), rising asset prices, and regulatory optimism, open interest had ballooned through 2025.

Source: coinglass.com

-

Oracles are the most critical piece in the design of any financial system. While Aave stood resilient during the crash, Binance suffered losses because it used its internal books to price collateral, which didn’t correctly represent the underlying asset’s value and caused temporary price deviations.

-

DeFi proved its maturity and resilience. The bluechip DeFi protocols remained operational with no downtime, bad debt or insolvency. Transparent risk management practices and open discussions indeed work.

-

Binance suffered the most. This has several structural, operational and systemic reasons to be discussed later in this report.

#2. Market Context: The Anatomy of the Crash

-

On 9 October 2025, 13:00 UTC, China announced export restrictions on rare-earth materials, a move that initially drew little market reaction.

-

The following day, 10 October, Bitcoin began to sell off gradually, a typical risk-off drift seen during macro uncertainty.

-

At 20:00 UTC, U.S. President Donald Trump announced a 100% tariff on Chinese goods in response to China.

This escalation accelerated the sell-off: BTC plunged from ~$124 K → ~$113 K, while ETH dropped from ~$3,600 → ~$3,050. At this stage, it still seemed like a regular and expected correction.

However, the high leverage across venues quickly turned the decline into a cascade of liquidations. As longs were liquidated, collateral was dumped onto spot markets. The speed and magnitude of these liquidations were too great for spot liquidity to absorb, resulting in a reflexive loop, liquidations leading to more liquidations.

Market makers responded defensively: first by widening spreads, which made further liquidations even costlier, and then by withdrawing quotes entirely once volatility became unmanageable. This withdrawal created a temporary liquidity vacuum. The order-book depth collapsed, and extreme prints appeared across pairs. That’s why several altcoins briefly traded near zero, simply because no buyers remained at any price.

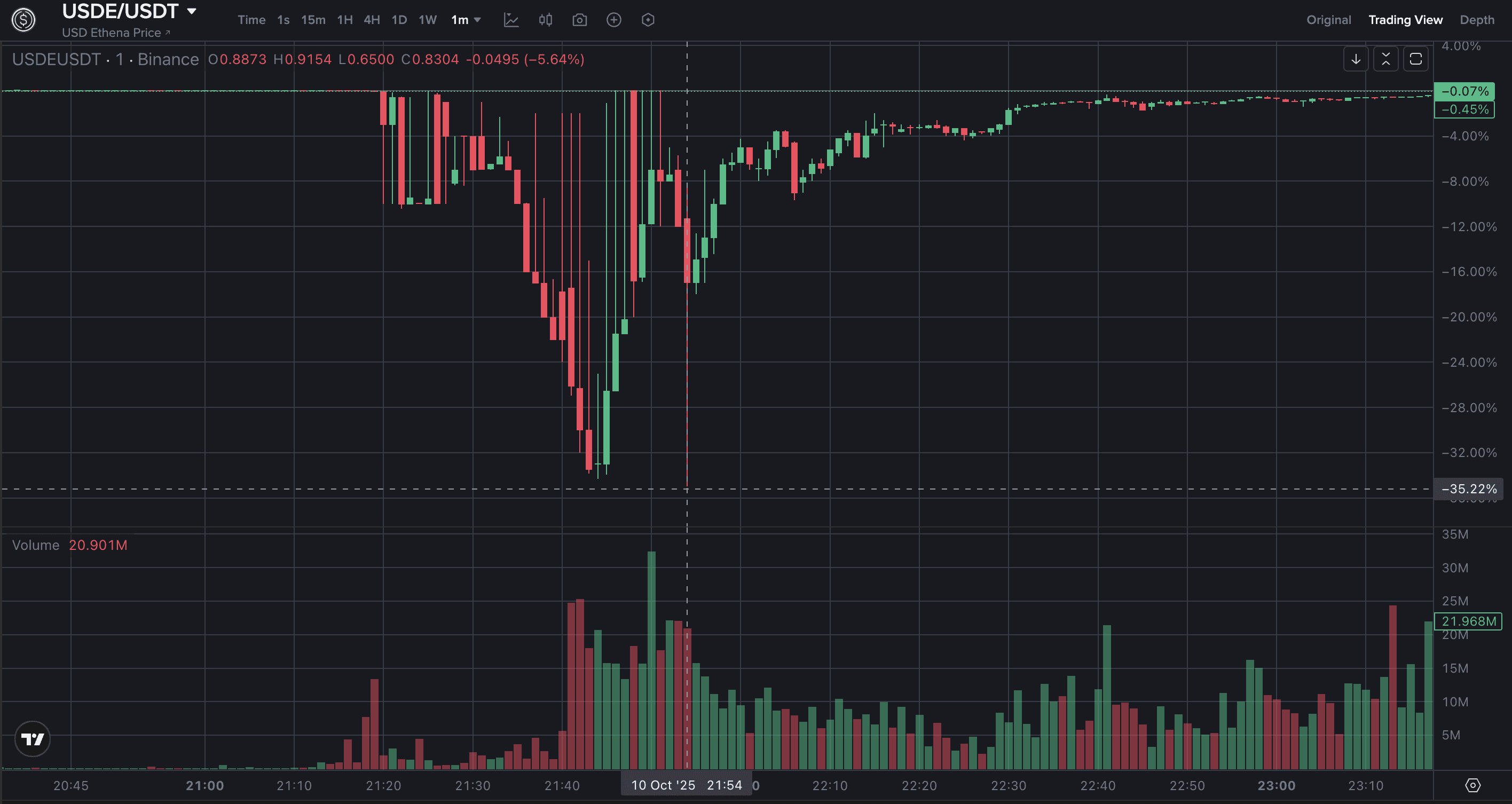

While all exchanges were under heavy load, the issue was most severe on Binance. Here, the liquidity vacuum turned a directional sell-off into a system-wide pricing failure. Collateral in cross-margin accounts was marked to these extreme prints, cascading liquidations even further. Key collateral assets such as WBETH traded 80–90 % below redemption value, USDe fell to around $0.60, and BNSOL collapsed to $0.13, each drop triggering new forced liquidations and further draining liquidity.

Binance later described this window as one of “abnormal pricing” and announced compensation for the affected users, effectively confirming an internal malfunction. As these distortions propagated, cross-exchange hedges unwound and contagion spread globally. Many venues had to tap into their insurance funds to meet the liquidations, realizing significant losses in the process.

Some suspiciously timed shorts that opened before the tariff announcement were already in deep profit. With liquidation engines overwhelmed, exchanges were left with no choice but to activate their last line of defense: Auto-Deleveraging (ADL) and started to close profitable short positions to restore balance. In this process, the system automatically closes profitable short positions to offset the losses of bankrupt longs. Positions are ranked by profitability, leverage, and size, with the most profitable traders closed first to rebalance exposure.

While painful for those affected, ADL acted as a circuit breaker that prevented a full-scale insolvency event. Perpetual futures markets are inherently zero-sum systems — every gain is offset by an equal loss elsewhere. When one side of the market is entirely wiped out and no new liquidity enters, ADL becomes the only viable method to restore equilibrium. It marks the point where the illusion of continuous, frictionless liquidity gives way to the underlying constraints of market structure.

The incident also exposed how differently platforms manage risk when market structure begins to break. On-chain perp DEXs like Hyperliquid operated through the chaos with full transparency and automated execution, while centralized venues like Binance, where internal pricing and collateral mechanisms remain opaque, became focal points of systemic stress. This contrast sets the stage for a closer look at Binance’s internal pricing model and its handling of USDe collateral, which together played a central role in amplifying the crash’s impact.

#3. The Binance Anomaly

The liquidation event of October 10-11 was not an asset-wide solvency crisis but a localized, systemic failure of market infrastructure. While primarily concentrated at Binance, pricing mismatches also occurred on Bybit and MEXC, though at a lesser level. The catastrophic price drops of key collateral assets were almost entirely isolated to CEX spot markets, while on-chain protocols remained largely stable. This incident must be analyzed not as an asset "depeg", but as a critical failure in market microstructure where an exchange's internal pricing mechanism became the primary vector for systemic risk.

#3.1 A Flawed Oracle Design

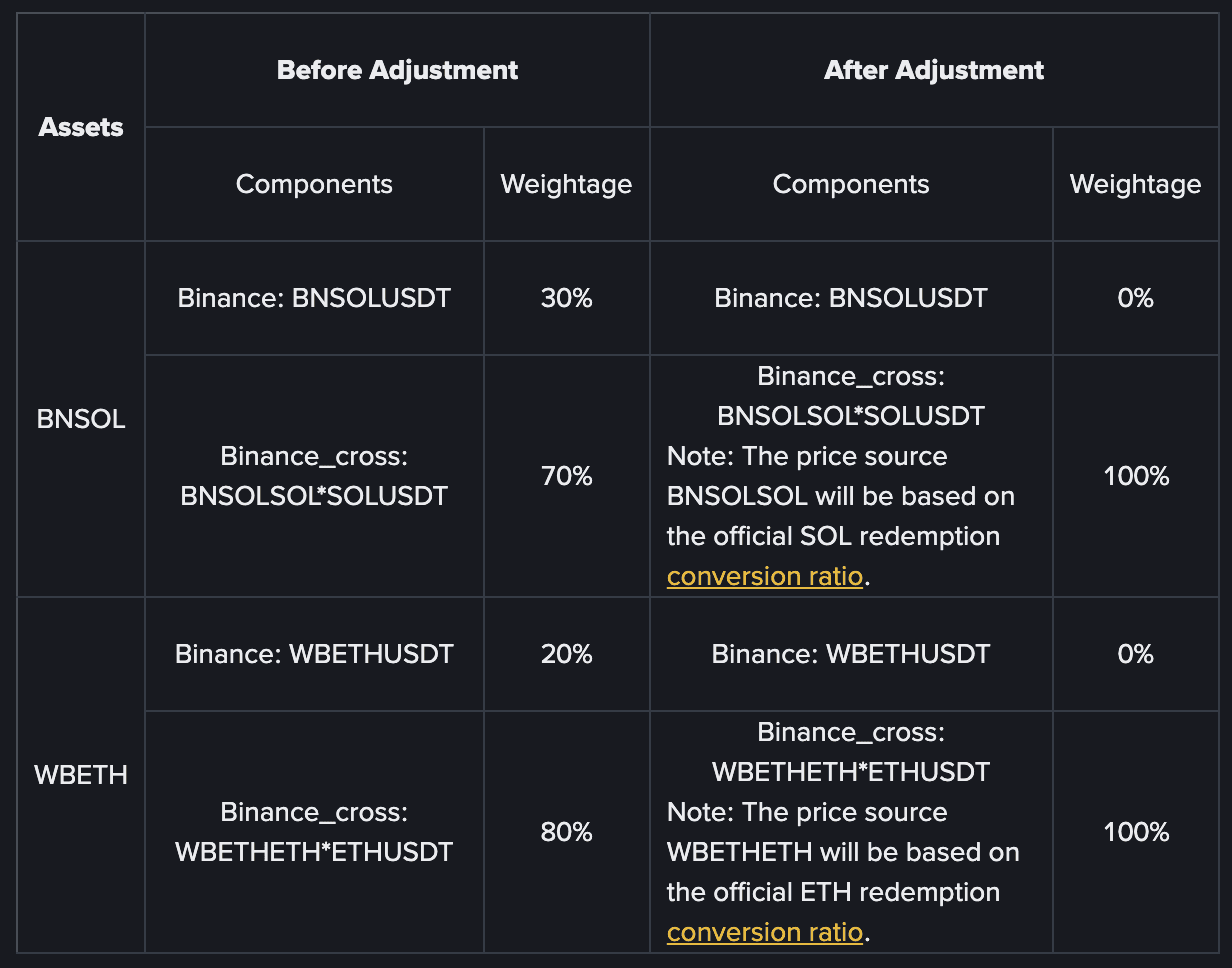

The anomaly's root cause was Binance's margin system architecture, which utilized its own spot order book as the primary price source for its collateral oracle. The “Before Adjustment” column in Binance's own post-mortem announcement confirms this design, showing the price index for BNSOL and WBETH was weighted 30% and 20%, respectively, to their USDT spot pairs. Although USDe was not explicitly mentioned in the announcement, strong evidence from the index price composition on Binance suggests that its pricing was also heavily reliant on its own spot market.

Source: Binance

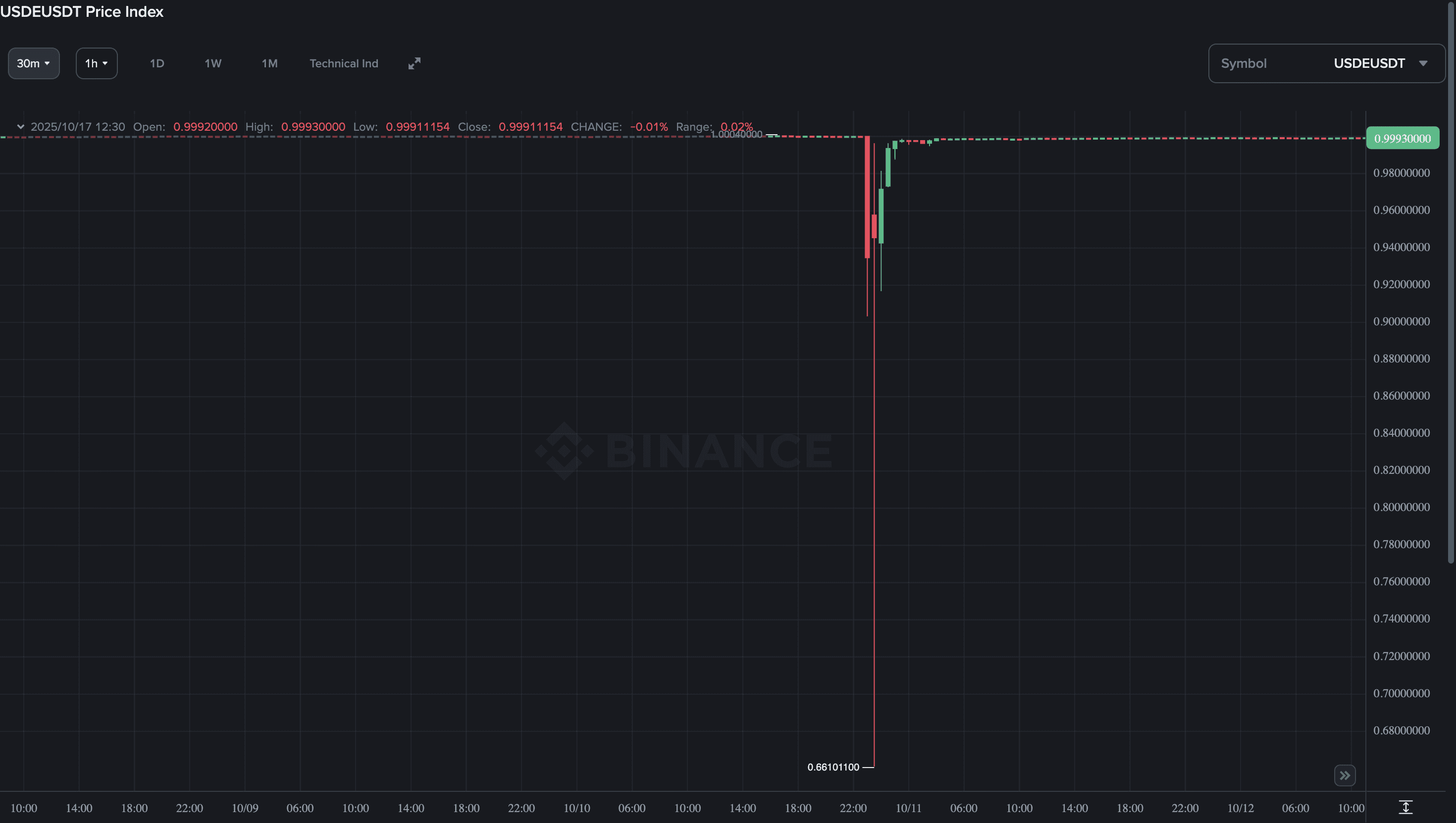

Source: Binance, Price Index

Source: Binance, Price Index

This design is inherently fragile, creating a self-referential loop where the system's actions (liquidations) directly influence the data it uses for subsequent decisions. This vulnerability was explicitly communicated to the public in an announcement on October 6, which detailed a plan to shift the pricing mechanism to a more robust conversion ratio model.

#3.2 Anatomy of the Cascade

The collapse followed a clear pattern, demonstrating a breakdown across multiple layers of the venue's infrastructure:

-

Price Discovery Failure: An initial shock met a thin order book, creating a localized, artificial price completely detached from the market consensus.

-

Risk Management Failure: The oracle reported these internal prices as valid, feeding the panic-driven spot price back into the liquidation engine.

-

Safety Mechanism Failure: The liquidation engine, acting on this faulty data, became a procyclical accelerant, amplifying the crash with each forced sale. This contagion also affected other venues like Bybit and MEXC, which utilized Binance's spot price in their own internal oracles.

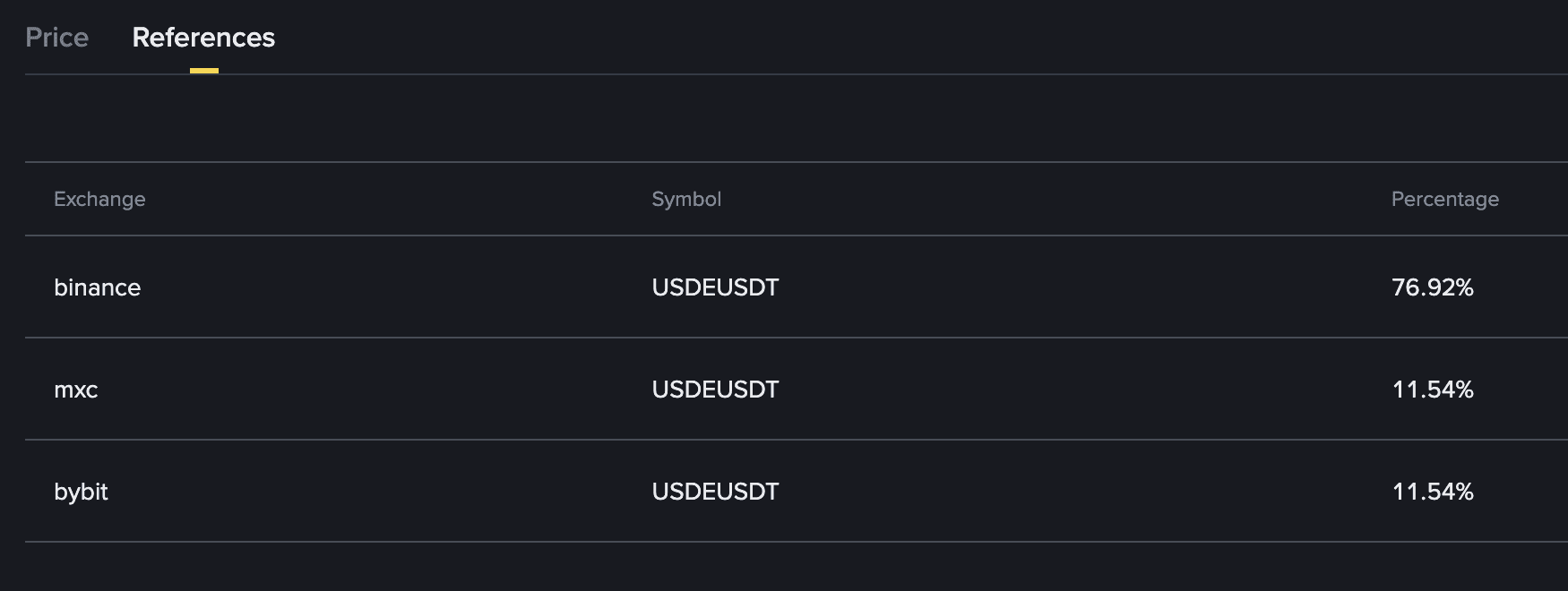

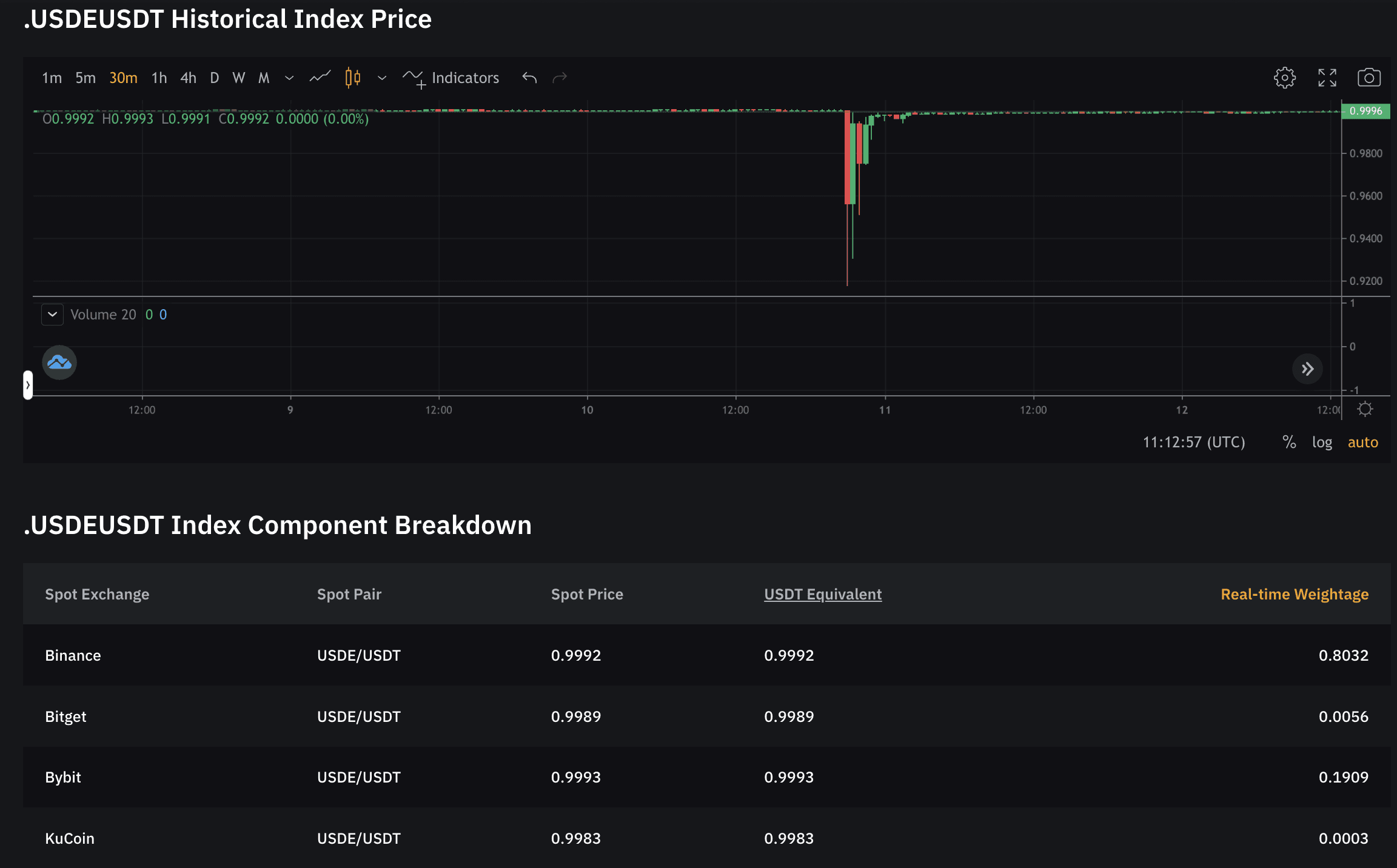

Source: Bybit USDEUSDT Historical Index Price and Component Breakdown

#3.3 Official Acknowledgment and Resolution

In the aftermath, Binance effectively confirmed this analysis in its official communication titled, "Resolution of USDE, BNSOL, and WBETH Price Depeg and Risk Control Enhancements." The exchange acknowledged "platform-related issues" and announced it would "compensate all impacted Futures, Margin and Loan users within 72 hours."

Crucially, the announced remediation plan directly addresses the root cause identified in our analysis. Their new parameters confirm that the "redemption price will be added to the...USDE price index weights" and that the "USDE index rule will include a minimum price threshold to improve price stability."

Source: Binance

This change represents a fundamental shift away from a self-referential oracle to one grounded in the asset's primary, redemption value. While commendable, this reactive fix underscores the initial design flaw. The compensation plan, while necessary for affected users, serves as a financial admission of a critical failure in the platform's risk infrastructure.

#3.4 Empirical Evidence

The definitive proof of a localized infrastructure failure lies in the massive, rational flow of capital away from Binance's compromised market and directly into the Ethena protocol's functioning redemption mechanism.

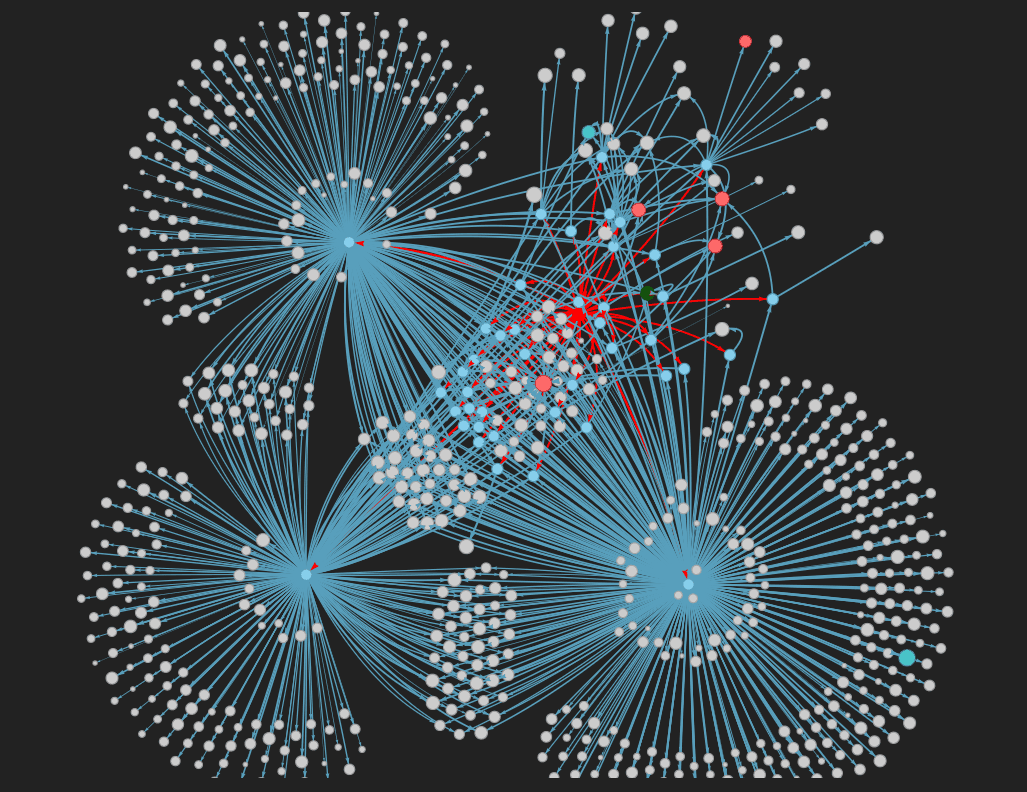

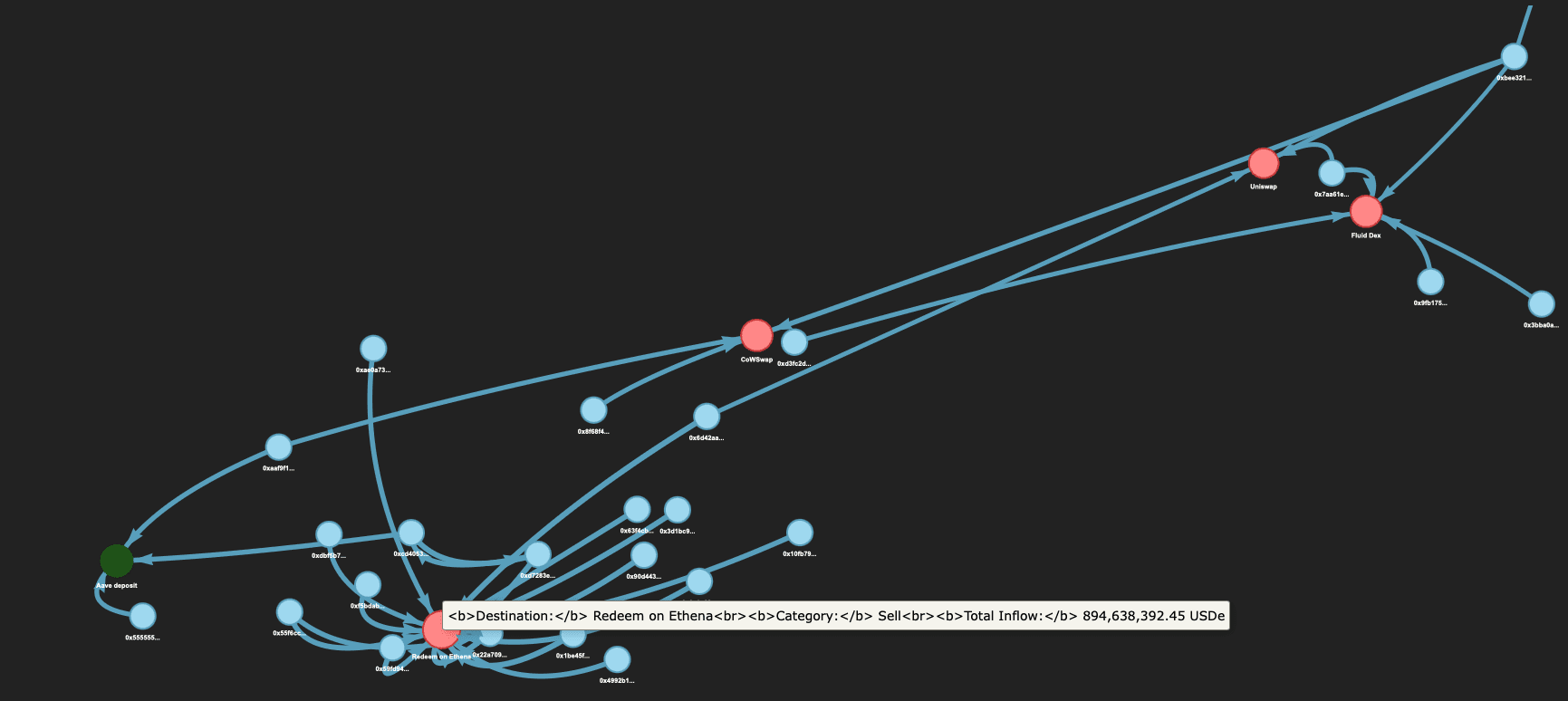

On-chain analysis reveals that in the 7-hour window after the crash, $1.24 billion of USDe was withdrawn from Binance and most of it subsequently redeemed via the Ethena protocol in exchange for stablecoins. The flow of this capital was clear, with approximately $894 million funneled directly to the Ethena redemption facility to be exchanged for underlying collateral at par value.

Source: LlamaRisk

This network graph illustrates the flow of capital post-crash. Binance's wallets (major bright red/blue hubs) are the source for significant redemptions on Ethena (central light red node) and deposits into Aave (green node), the rest of the light red nodes are DEXs.

Source: LlamaRisk

In this graph we only show the addresses that withdrawn from Binance and then redeemed on Ethena, which processed nearly $900 million in redemptions, deposited into Aave (~$20M) or sold on various DEXs (~$40M).

#4. Aave's Design Choice

In stark contrast to the failure at Binance, the Aave protocol demonstrated remarkable resilience. This stability was not accidental but the result of a deliberate and conservative risk management decision in its oracle design. By choosing to peg the value of USDe to USDT, Aave's framework prioritized systemic stability over acute sensitivity to secondary market price feeds, a choice that was validated by the events of October 11.

#4.1 A Strategic Choice for Stability

Aave's risk framework correctly identified that a synthetic dollar like USDe is susceptible to temporary secondary market dislocations, which could cause billions of dollars in unwarranted liquidations. To mitigate this specific risk vector, the protocol opted to hard-code USDe's price to USDT for collateral valuation. This decision insulated the protocol from short-term, venue-specific volatility and manipulation by anchoring its risk calculations to a more liquid and stable benchmark.

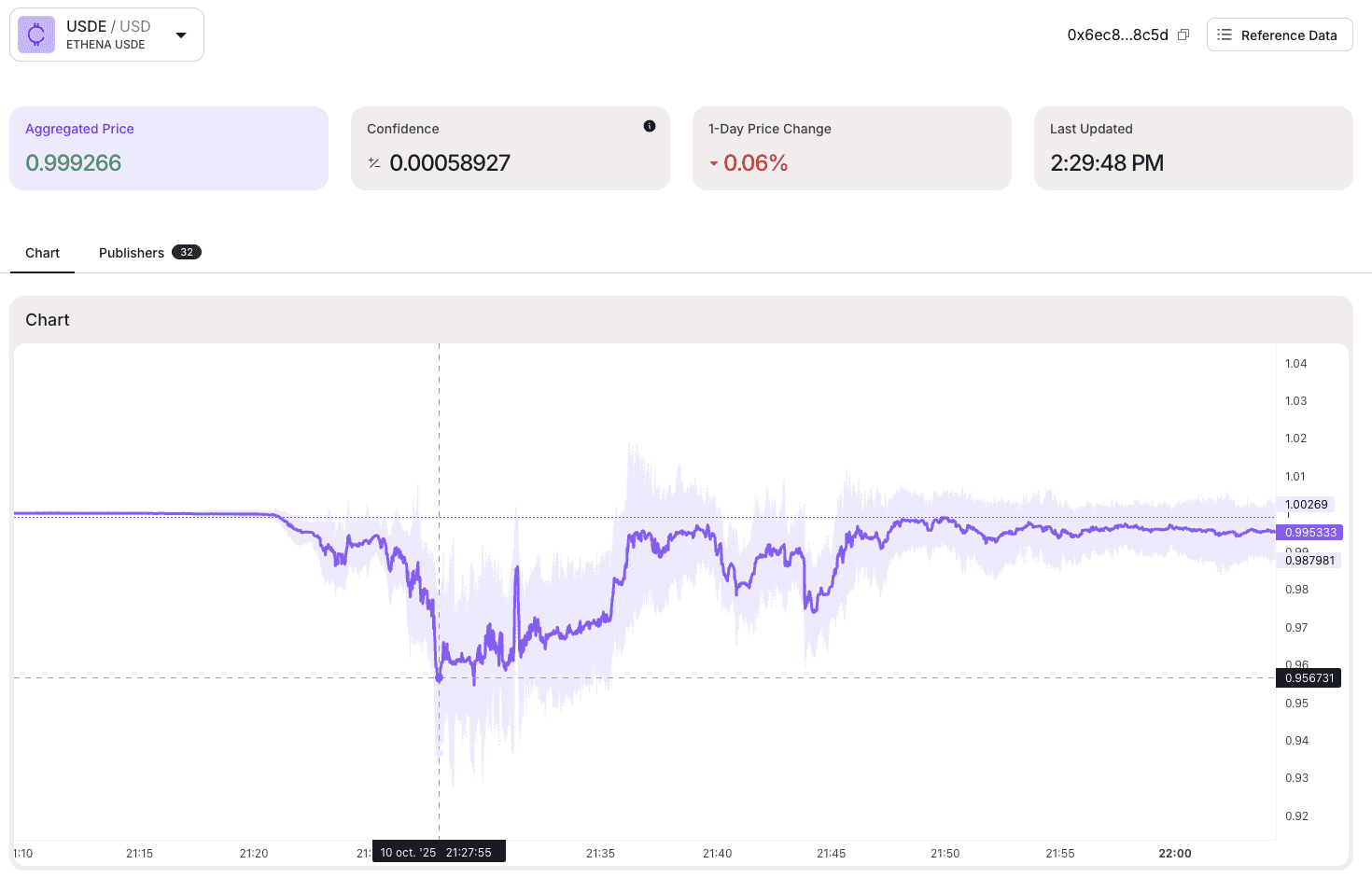

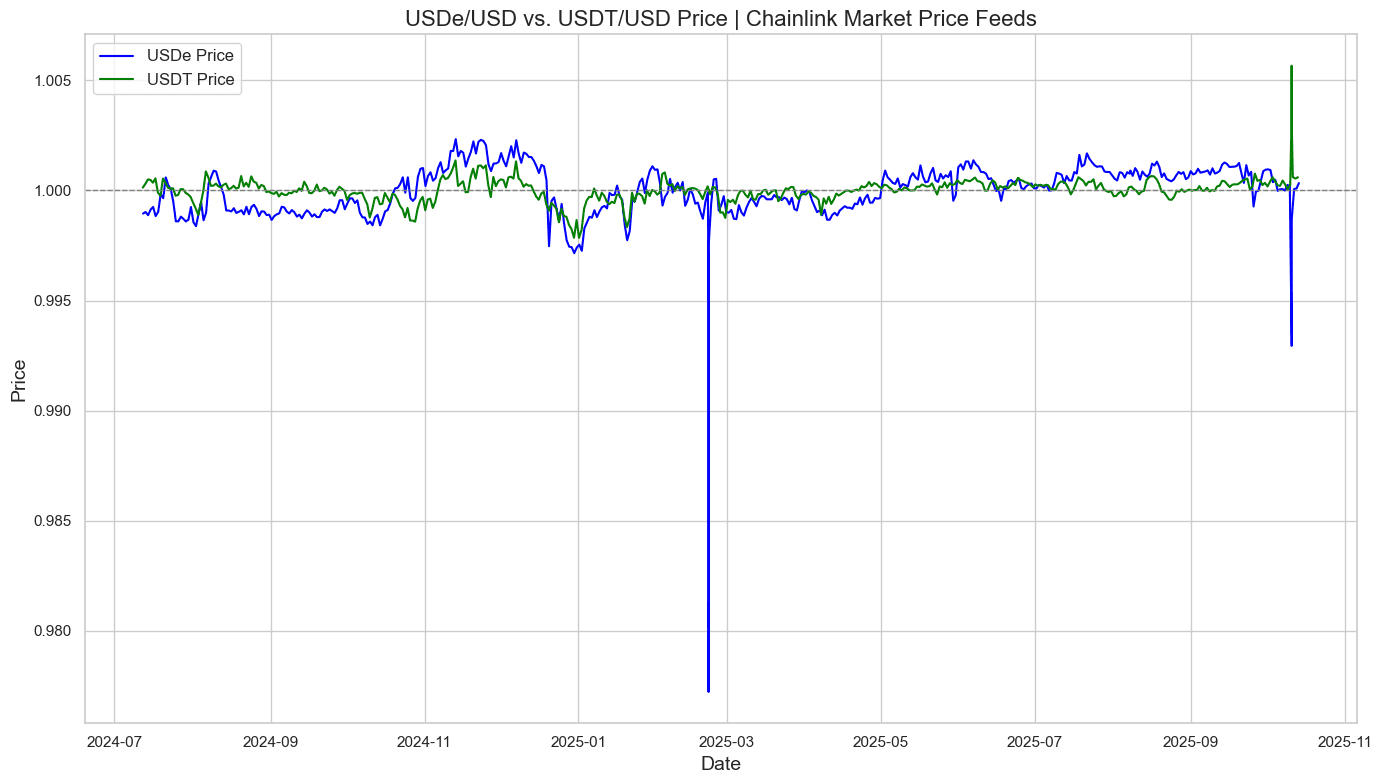

It is important to note that even if Aave had used the Chainlink oracle, it most likely would have remained safe. A review of available price feeds shows:

-

The Chainlink oracle deviated by a maximum of 65 bps.

-

The Pyth oracle deviated by a maximum of 430 bps(4.3%).

-

The Binance Spot Price deviated by over 3,500 bps (35%).

A deviation of 65 bps is well within the safety parameters of a well-configured lending protocol. The hard peg chosen by Aave represents a more conservative posture, presenting a critical tradeoff: accepting a controlled, temporary divergence from market prices in order to prevent catastrophic, oracle-driven contagion. The event proves this was the correct posture, as it prevented the potential for billions in liquidations on Aave alone.

Source: Pyth, USDE/USD

Source: LlamaRisk

Source: Binance

#4.2 Visualizing the Divergent Outcomes

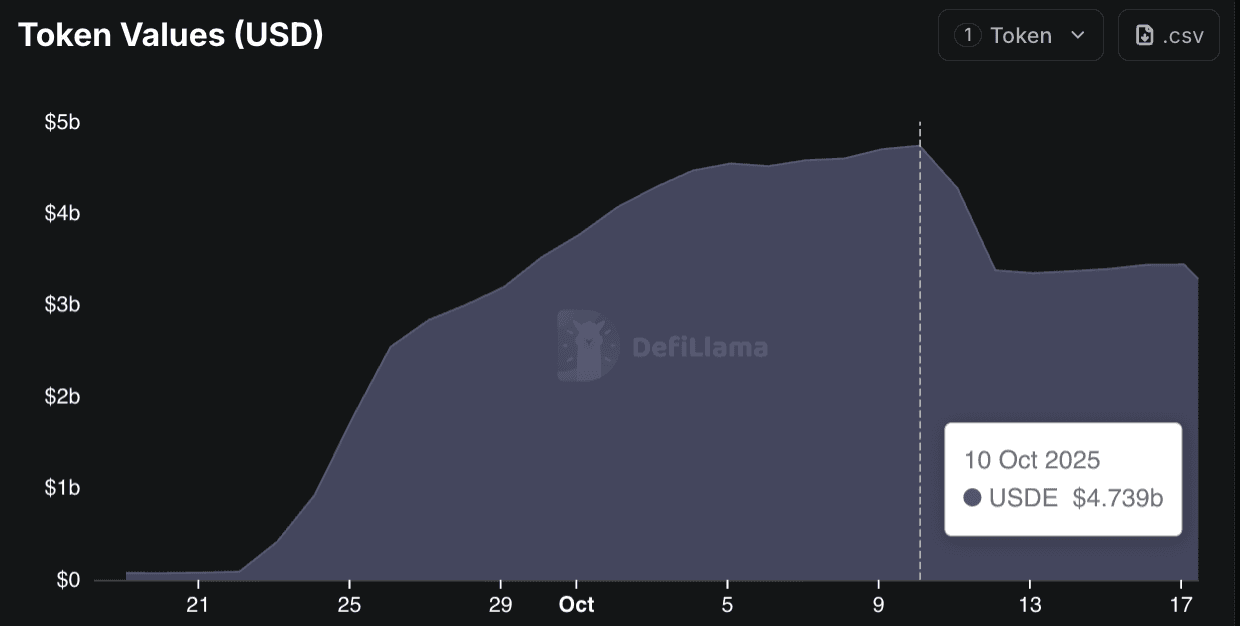

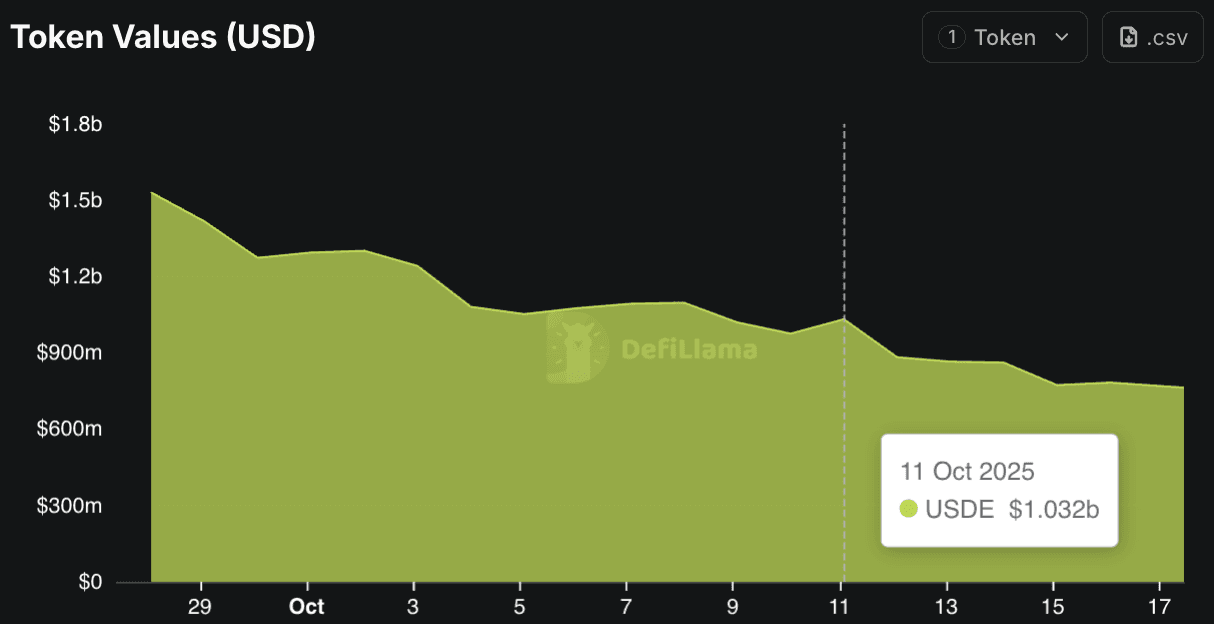

The theoretical differences in oracle design manifested as dramatically different real-world outcomes for the collateral pools on Binance and Aave.

On Binance, the total USDe deposited peaked at $4.73 billion before the event. This massive pool became the fuel for the fire sale as the broken oracle began marking down its value, triggering the collapse.

Source: Defillama

Conversely, Aave's USDe deposits, of $1.03 billion USDe, remained remarkably stable. Because its oracle was designed to ignore such transient dislocations, it did not mark down the price, preserving the value of its users' positions and preventing a contagion event. The chart also shows a moderate influx of USDe during the crash, some of which originated from addresses that had withdrawn from Binance.

Source: Defillama

#4.3 Implication: The Primacy of Oracle Design in Risk Management

The divergent outcomes between Binance and Aave offer an unequivocal lesson: the design of a system's price oracle is as critical as the inherent peg stability quality of its listed collateral. A fundamentally sound asset became toxic within Binance's ecosystem due to a self-referential oracle. Conversely, Aave's model successfully defended its users and the protocol from systemic collapse.

#5. Toward Safer Pricing: The LlamaGuard Framework

#5.1 Market vs. Pegged Pricing

As resilient as DeFi proved during this event, it still gave us an opportunity to re-evaluate our understanding of systemic risk. We can all celebrate that liquidations were successfully executed where appropriate and no bad debt was accrued, protocols stayed solvent, and the system remained stable in general.

A key consideration for why this didn’t spill over to onchain markets is that the recovery was fast, primarily thanks to Ethena’s ample supply of liquid reserves to process redemptions and stabilize the USDe peg. Had the prices remained deviated from the external markets long enough, it could have been a catalyst for illiquidity in lending markets as suppliers flee and the threat of lending markets becoming an exit venue loom. In the worst case, the threat of USDe insolvency could mean a permanent depeg that would have potentially severe consequences for lending platforms that use pegged pricing strategies for USDe.

It should also be emphasized that pegged pricing is not a long-term sustainable solution, and should DeFi actually start to be used in a meaningful way by global institutions, we need better guardrails than what is currently available. A static oracle solution simply neglects tail risks. What we should build instead are intelligent systems — aware of multiple risk layers, capable of reacting dynamically to emerging threats, and able to contain damage autonomously before contagion spreads.

#5.2 LlamaGuard for Risk-Aware Pricing

At LlamaRisk, we specialize in identifying and mitigating exactly these kinds of multi-layered structural vulnerabilities — the invisible dependencies that only surface under stress. Our work spans from oracle architecture and parameter calibration to liquidation dynamics, collateral modeling, and systemic risk mapping across integrated DeFi protocols. We engage directly with DAOs, lending markets, and liquidity providers to help them design safer pricing mechanisms, tune monetary policies, and establish data-driven guardrails for extreme conditions.

Through this experience, we have learned that risk cannot be eliminated by a single-layer fix alone - it requires a coordinated framework between protocols, risk providers, and governance systems. The next step is to translate that coordination into rule-based systems capable of enforcing collective risk principles automatically on-chain, while preserving the qualities that make LlamaRisk a trusted name in DeFi risk. We have recently introduced our LlamaGuard NAV Oracle as a first step in this direction.

LlamaGuard is not a singular product but a framework that will encompass customizable solutions for a wide range of use cases involving risk management. We envision LlamaGuard to be a crucial part of the DeFi infrastructure moving forward, used to dynamically react to risk conditions on-chain in predetermined ways, preventing or limiting the downside risk as much as possible. A significant amount of ongoing effort is dedicated to calibrating the underlying models — fine-tuning their parameters, conditions, and bounds — to ensure accurate and responsive behavior under a wide range of market scenarios.

#5.3 USDe Pricing Through LlamaGuard

One immediate use case is to build a LlamaGuard USDe feed, which can be abstracted and generalized for similar assets. A dual feed design would return 1$ if USDe is solvent according to the on-chain Proof of Reserves and redemptions open instead of posting the spot price directly, which would lead to unnecessary liquidations due to supply and demand imbalances in the secondary markets. The feed would fallback to spot price only when a possibility for insolvency was detected through reserves and redemptions. This approach allows markets to respond appropriately to genuine systemic risks while shielding users from short-term dislocations by maintaining a stable reference price whenever conditions are verified as safe.

Beyond this, several additional use cases highlight the flexibility of the LlamaGuard framework:

-

Lending Protocol Risk Triggers: LlamaGuard can act as an automated risk governor for lending markets, monitoring collateral health, oracle deviation, and liquidity depth. When risk thresholds are breached, it can dynamically adjust LTV ratios, pause new borrows, or trigger higher liquidation incentives until conditions normalize.

-

Parameter Calibration & Governance Automation: LlamaGuard can provide real-time risk metrics—such as volatility, utilization, and collateral concentration—to automatically inform or guide governance parameter updates like debt ceilings, reserve factors, or interest rate slopes, shifting governance from reactive decision-making to continuous, data-driven calibration.

-

Oracle and Pricing Layer Protection: Serving as a meta-oracle, LlamaGuard can verify primary oracle data against secondary sources and trigger fallback logic in case of significant deviation, preventing mispricing from cascading through interconnected protocols.

-

Institutional Risk Monitoring Layer: For custodians and tokenized funds, LlamaGuard can provide compliance-grade analytics combining on-chain metrics with off-chain attestations to track exposure and solvency across counterparties—bridging DeFi transparency with institutional risk standards.

The LlamaGuard framework is a move from reactive crisis management to proactive risk prevention. Yet, the broader lessons of the October crash remind us that no matter how advanced our systems become, resilience is a moving target - one that demands continuous adaptation and collaboration across the ecosystem.